DASH price forecast is back in the spotlight after the privacy-focused token surged past $87, marking a 17.5% daily gain and over 100% weekly rise.

Fueled by major payment integrations and a resurgence in market interest for financial anonymity, Dash is outperforming nearly all altcoins and the next 1000x crypto to invest in, including Monero and Zcash.

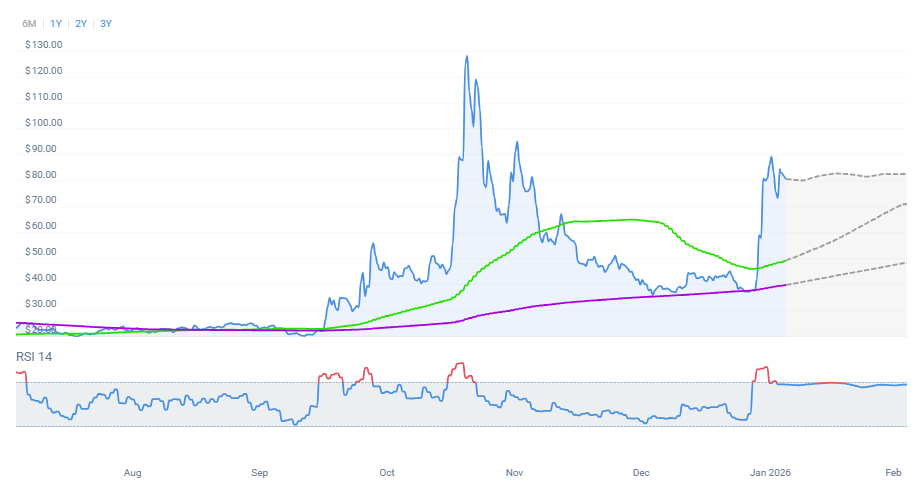

Over $1 billion in daily volume, a sharp RSI spike above 90, and a wave of institutional inflows are pushing DASH into new territory. But can the rally hold – or will overbought signals trigger a pullback?

DASH Surges Past $87 as Trading Volume Skyrockets

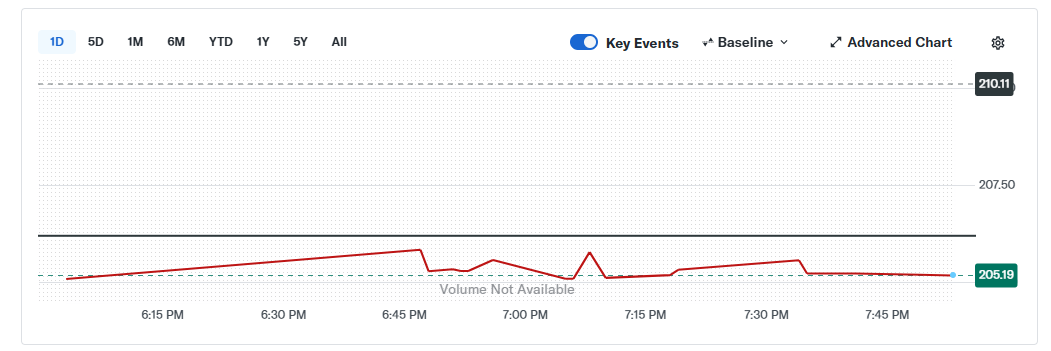

Dash’s price explosion began with a sharp $4.9 million short squeeze on January 13, pushing the token from $71 to over $92 within 48 hours.

Daily volume soared by more than 800%, reaching $932 million, and market cap crossed $1.05 billion. Technical charts showed bullish alignment across key moving averages – MA(7) at 87.98, MA(25) at 83.73, and MA(99) at 77.49 – signaling strong momentum.

The rally intensified when Dash broke out of a multi-month descending channel, moving from $35 to over $90 in less than two weeks. Resistance between $60–$70 flipped to support, confirming a structural shift in trend. The move drew fresh attention from traders seeking privacy-aligned assets, particularly as regulatory concerns mounted for Zcash.

Despite hitting a Relative Strength Index range of 83–92 (typically overbought), DASH maintained its price strength above the $83–85 band. Analysts view this as a potential setup for a further climb, assuming the token consolidates without slipping below its new support level.

Privacy Narrative and Payment Integration Fuel Demand

Dash’s rally wasn’t purely technical. A series of major partnerships pushed real-world adoption into the spotlight. On January 13, Alchemy Pay enabled fiat-to-DASH purchases in 173 countries, unlocking credit card, Apple Pay, and regional gateway support for non-crypto users. This milestone dramatically reduced onboarding friction and boosted merchant accessibility.

Just two days later, AEON Pay brought Dash crypto payments to over 50 million merchants across Southeast Asia, Africa, and Latin America.

These integrations gave Dash a visibility edge in emerging markets, where cash alternatives and decentralized payment rails are in high demand. Together, these developments aligned Dash with a broader narrative of accessible, private, and borderless finance.

Risks Remain as Regulatory Pressure Intensifies

Still, the bullish narrative is not without risk, even for the new cryptocurrencies. The EU’s proposed regulatory framework could target anonymous crypto transactions, potentially restricting Dash access on centralized exchanges.

Although Dash offers an optional privacy feature – unlike mandatory obfuscation in Monero – regulatory interpretation varies by jurisdiction, which may lead to delistings or restrictions regardless of opt-in design.

Overbought indicators also remain a concern. With RSI above 90 and recent green candle dominance on the 15-minute chart, short-term traders could begin taking profits near the $95–$100 psychological barrier. A failure to hold $83 support could result in a pullback toward $75–78 to reset momentum.

However, the upcoming Evolution platform upgrade in Q1 2026 may renew investor interest. Features such as memo-free atomic swaps, enhanced metadata backups, and smoother cross-chain communication are expected to strengthen Dash’s infrastructure and expand its appeal to dApp developers and payment processors.

DASH Price Forecast: Near-Term Targets and 2026 Outlook

Short-term forecasts remain cautiously optimistic. For January 20, models project a stable price of $83.95, while longer-range predictions point to gradual growth. February forecasts suggest an average of $83.15, followed by $87.41 in March and $97.59 in October – a nearly 30% jump from current levels.

November and December 2026 outlooks are even more bullish, with average prices climbing to $119.08 and $125.18, respectively. If macro tailwinds persist – including capital flight from surveillance-based networks and stable merchant expansion – these targets appear feasible.

Still, the volatility of privacy coin narratives means Dash could experience sharp retracements if regulation bites or if adoption stalls. The balance between privacy and compliance will play a defining role in whether Dash breaks into a new long-term range above $100 or falls back into its historic $60–$70 channel.