Institutional crypto ETF flows on January 16, 2026 revealed a clear divergence in positioning, with investors sharply reducing exposure to Bitcoin while selectively allocating capital to Ethereum and XRP.

Solana-linked products saw mild pressure, underscoring a broader shift toward cautious, asset-specific allocation rather than broad market exposure.

Key takeaways:

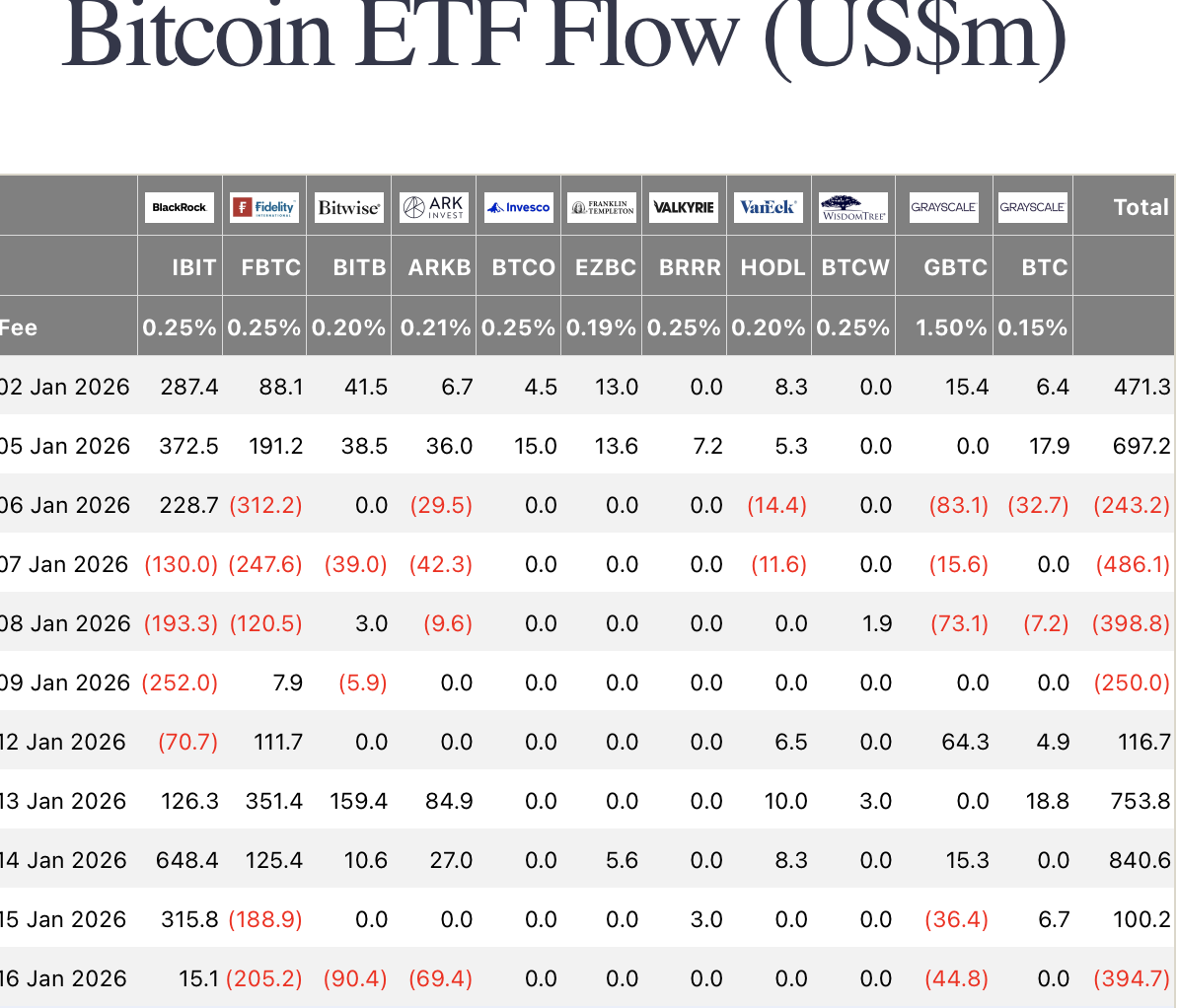

Bitcoin ETFs recorded heavy net outflows of about $394.7 million.

Ethereum ETFs remained marginally positive with around $4.7 million in inflows.

Solana ETFs saw small net outflows of roughly $2.2 million.

Bitcoin ETFs: Heavy outflows as BTC consolidates near $91K

Bitcoin spot ETFs experienced the most pronounced move of the day, with combined net outflows of roughly $394.7 million. Selling pressure was spread across multiple issuers, signaling broad-based risk reduction rather than isolated fund-specific activity.

With Bitcoin trading around $91,100, institutions appear to be trimming exposure following recent volatility and a failure to reclaim higher resistance levels. The magnitude of the outflows suggests portfolio rebalancing and leverage reduction rather than panic-driven exits, but it nonetheless weighed heavily on overall market sentiment.

Ethereum ETFs: Relative stability as ETH holds above $3,000

Ethereum ETFs stood out for their resilience. Despite volatile conditions across the broader market, ETH products recorded net inflows of about $4.7 million on the day.

With Ethereum trading near $3,099, the modest inflows suggest that institutions remain comfortable maintaining exposure, potentially reflecting confidence in Ethereum’s staking-driven supply dynamics and its role as core infrastructure within the crypto ecosystem.

Solana ETFs: Mild outflows as momentum cools

Solana-linked ETFs posted net outflows of approximately $2.2 million, marking a modest pullback rather than a decisive shift in sentiment.

SOL was trading around $129, down sharply on a weekly basis, and the ETF flows suggest investors are becoming more cautious after Solana’s strong performance earlier in the cycle. The relatively small size of the outflows points to hesitation rather than outright bearishness.

XRP ETFs: Net inflows as XRP draws selective interest

XRP was the clear outlier on January 16. Spot XRP ETFs recorded net inflows of roughly 538,960 XRP, driven primarily by activity in Franklin’s XRP ETF.

With XRP trading near $1.92, the inflows are notable given the broader risk-off environment. While the absolute dollar value remains smaller than Bitcoin and Ethereum flows, the positive direction highlights growing selective interest in XRP-related products.

What the ETF split signals

The January 16 ETF data paints a picture of rotation rather than wholesale exit from crypto markets. Institutions aggressively reduced Bitcoin exposure, remained selectively invested in Ethereum, cautiously stepped back from Solana, and added incremental XRP exposure.

This pattern suggests investors are becoming more discerning, favoring targeted allocations over broad market beta as volatility remains elevated and price discovery continues across major digital assets.