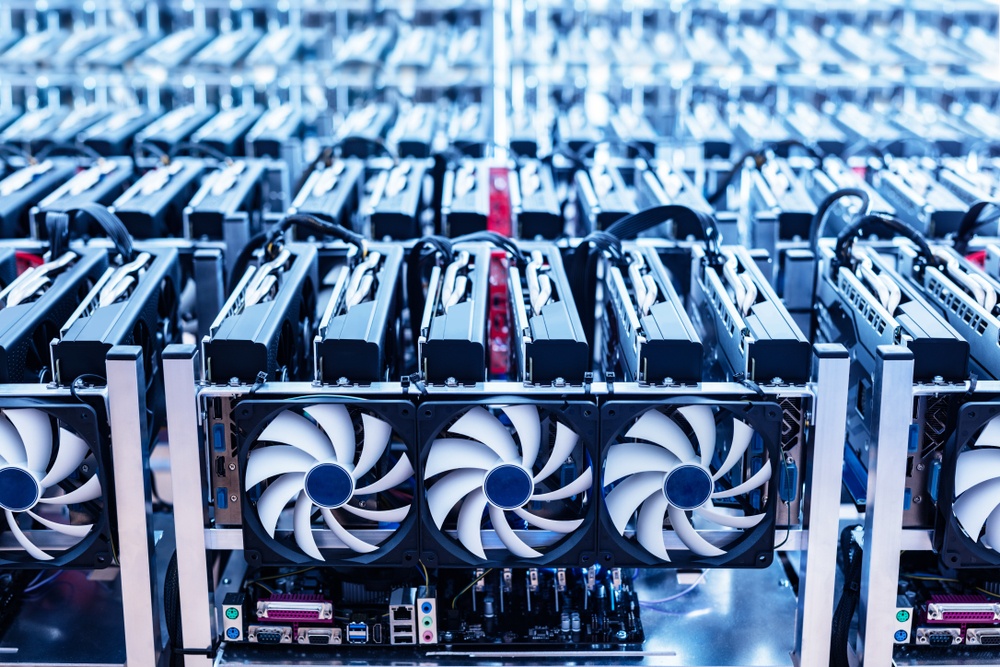

Georgia’s cryptocurrency mining sector is expanding at a pace that is beginning to reshape the country’s energy landscape.

Driven by low electricity prices and a relatively permissive regulatory framework, mining operations now consume roughly five percent of all electricity produced nationwide, according to the information.

Key takeaways:

Crypto mining now accounts for about 5% of Georgia’s total electricity consumption

Power usage by mining-related data centers rose sharply in 2025, nearly 80% year-on-year

Growth is concentrated in free economic zones around Tbilisi and Kutaisi

Rising crypto prices and regulatory clarity have boosted industrial-scale mining

Electricity usage by large data centers linked to crypto mining surged throughout 2025, with total consumption reaching about 675 million kilowatt-hours between January and November. That figure represents nearly an eighty percent increase compared with the previous year and reflects a rapid scaling-up of industrial mining activity. Local business media report that output from companies operating in the sector roughly tripled over the same period, underscoring how quickly capacity has expanded.

Who Is Using the Power?

A small number of operators account for most of the electricity consumed by Georgia’s mining industry. AITEC Solution, which runs a large data center in the Gldani district of Tbilisi, is the biggest consumer, having used more than 400 million kilowatt-hours.

Texprint Corporation, based in the Kutaisi Free Economic Zone, follows with around 135 million kilowatt-hours, while TFZ Service supplies power to miners operating in the Tbilisi Free Industrial Zone. Additional consumption comes from firms such as ITLab and Data Hub, which together make up the remainder of the top electricity users.

Several forces are driving the expansion. Higher crypto prices in 2025 improved mining profitability, while Georgia’s electricity remains relatively cheap by regional standards. The country’s regulatory approach has also played a role. Bitcoin, the largest digital asset by market capitalization, surged to a record above $126,000 in October, strengthening incentives for industrial mining. Georgia’s business-friendly environment has already attracted international players, including Bitfury, which previously operated major facilities in the country.

The rapid rise in power usage is prompting wider debate across the region. Georgia generates up to eighty percent of its electricity from hydropower, a system that can struggle during periods of high demand. While mining remains legal for both companies and individuals and benefits from a favorable tax regime introduced in 2019, legislation adopted in 2023 increased oversight of the sector.

Other countries in the former Soviet space have taken a more restrictive path. Russia has banned mining in several regions after legalizing it nationwide, while Tajikistan and Kyrgyzstan have imposed harsh penalties amid electricity shortages. Kazakhstan, demonstrating a different approach, has relied on higher electricity tariffs and tighter regulations to curb excess demand.

Georgia’s mining boom illustrates the balancing act facing energy-rich economies. Low-cost power and regulatory clarity can attract investment and activity, but sustaining that growth without straining the grid may ultimately require tougher policy choices.