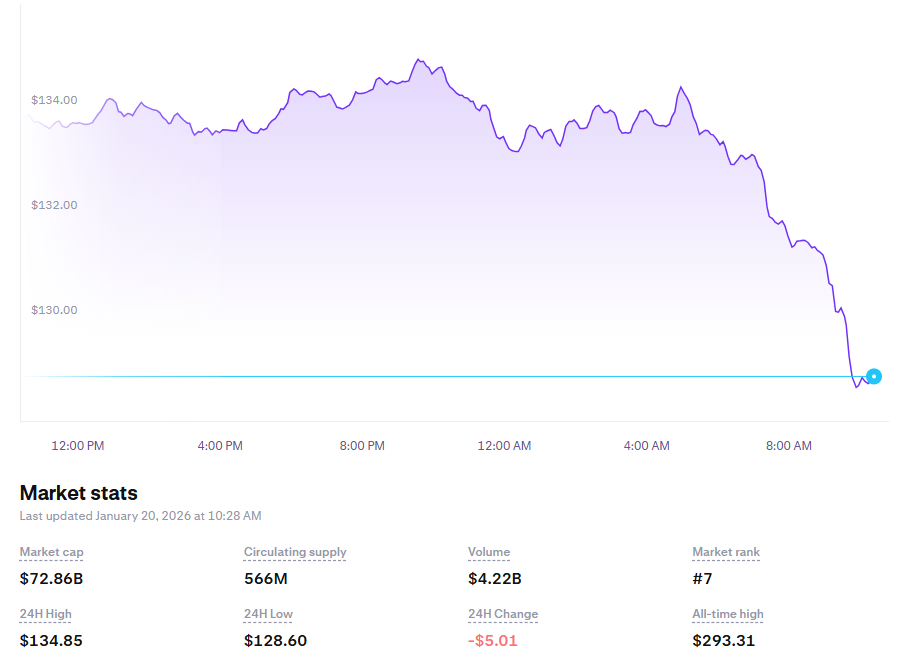

Solana price prediction turns sharply divided after the token plunged below a key support zone at $130, triggering concerns over a larger correction. SOL is currently priced at $128.81, marking a 3.74% drop in 24 hours, with volume falling 24.66% to $3.91 billion.

This move comes after an 8% weekly decline and a failure to hold above the $142–$145 resistance band, placing the asset at a precarious technical juncture.

Despite signs of institutional buying and rising network activity, market structure now favors bears unless Solana can quickly reclaim lost levels. Analysts are watching the $136–$140 zone closely to determine whether a bullish bounce or deeper breakdown is next.

Solana Price Forecast: RSI, MACD Signal Weak Momentum Below $135

According to Bit Guru, the Solana price forecast shows short-term weakness as the token attempts to bounce off the $130 demand zone. On the 1-day chart, RSI sits at 47, suggesting neutral momentum but leaning weak.

Meanwhile, MACD has dipped below its signal line, with the histogram turning negative. This setup confirms that the recent bullish trend is losing steam.

Futures metrics also paint a bearish picture. Open interest dropped 7% to $8.19B, and $59M in long positions were liquidated, compared to just $1.38M in shorts. Funding rates remain negative at -0.0004%, favoring sellers.

Resistance sits at $135, then $140, followed by the key barrier at $144. A break above these levels would reset the short-term Solana price forecast to bullish. But failure to do so could expose $122, with $115 as the final support before a possible freefall.

Pattern Breakdown? Solana Bears Highlight Head and Shoulders at $120 Neckline

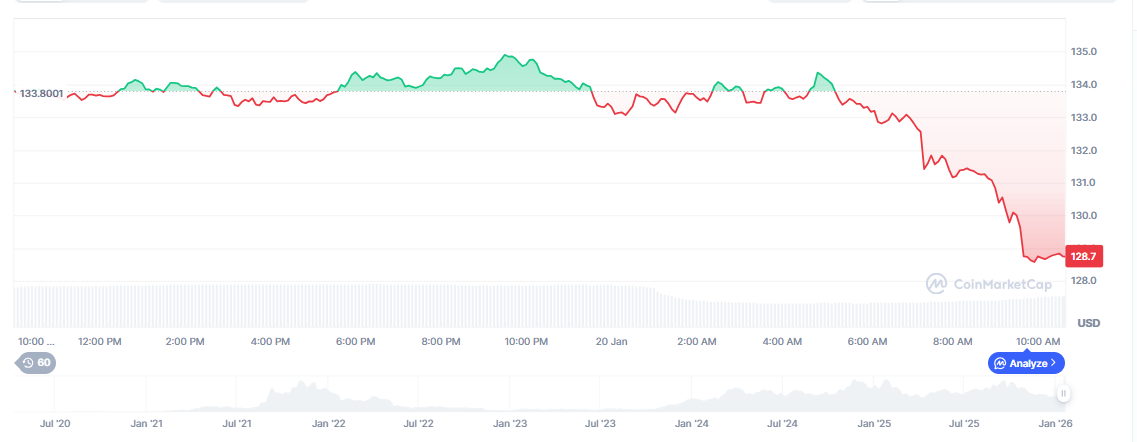

Traders tracking Solana’s macro structure point to a two-year Head and Shoulders pattern that could signal an extended decline.

According to analyst Slashology, this bearish formation has been building since Q1 2024, with the neckline sitting near $120 for the best long-term crypto. If that level breaks, the Solana price prediction dips to $75–$80, implying a 35–40% correction from current levels.

The pattern’s “head” formed during SOL’s run to its $293 ATH in early 2025, while the right shoulder developed after the Q3 2025 rally and Q4 correction. Slashology warned that investors should “prepare for the worst” as SOL approaches the neckline with growing downside pressure.

However, other analysts remain cautiously optimistic. One compared this setup to the S&P 500’s 2009–2011 price action, which invalidated a similar pattern and rebounded to new highs. For now, $120 is the pivot: hold it, and bulls may regain control – lose it, and bears take full charge.

Institutional Inflows Support Solana, But Technicals Limit Upside

Despite near-term bearishness, some underlying fundamentals remain strong. Solana ETFs recorded $46.88 million in inflows last week, marking the ninth straight week of institutional accumulation. According to on-chain data, wallets holding SOL jumped from 3.13M to 5.18M in two weeks, showing renewed network confidence.

Meanwhile, stablecoin supply on Solana rose 12.37%, hitting $14.85 billion, per DeFiLlama. That metric typically reflects network usage and on-chain velocity, both of which support a bullish medium-term Solana price prediction.

Still, bulls must overcome key technical barriers. SOL trades below both its 100-day SMA ($149) and 200-day SMA ($172). The 200-day now sits above the 100-day – a bearish crossover that shifts medium-term trend outlook to negative.

Technical analysts also highlight immediate resistance at $135 and $136, with price consolidating below both levels after bouncing from $130. Any recovery depends on closing above $140, which would confirm reversal strength. If not, Solana could revisit last month’s low near $122 or even challenge the $100 zone, representing a 25% drop.

Supreme Court Ruling & Macro Risk Stir Volatility in Solana Price Prediction

Adding to the mix is a potential shock from outside crypto markets: a pending U.S. Supreme Court decision on Trump-era tariffs. If the court supports the tariffs, analysts expect increased inflation concerns and a stronger dollar, both of which pressure high-beta assets like SOL. Solana’s historical 80% volatility makes it especially vulnerable to such macro shifts.

Still, bullish analysts argue that if SOL can reclaim $135, rising ETF inflows and continued developer engagement – like the recent privacy hackathon offering $75,000 in rewards – could push price back to $145.

Beyond that, $160 and $300 remain longer-term targets, but only if macro winds calm and bulls can reclaim control above both moving averages. For now, the Solana price prediction remains at a fork: regain $136 and rally toward resistance, or slide below $130 and retest multi-month lows.