As of 2026, the ongoing geopolitical dispute between the United States and Venezuela continues to send shockwaves through the global oil market. With sanctions, supply chain disruptions, and escalating tensions, oil prices have become more volatile than ever, leaving investors and everyday consumers looking for alternative ways to hedge against instability. In this dynamic landscape, United States Oil Reserve (USOR) crypto has emerged as a unique digital asset that bridges traditional oil reserves with the innovation of blockchain technology.

In this article, you’ll discover the essentials of the United States Oil Reserve (USOR) token—how it works, what makes it unique, its potential benefits and risks, and key considerations before investing.

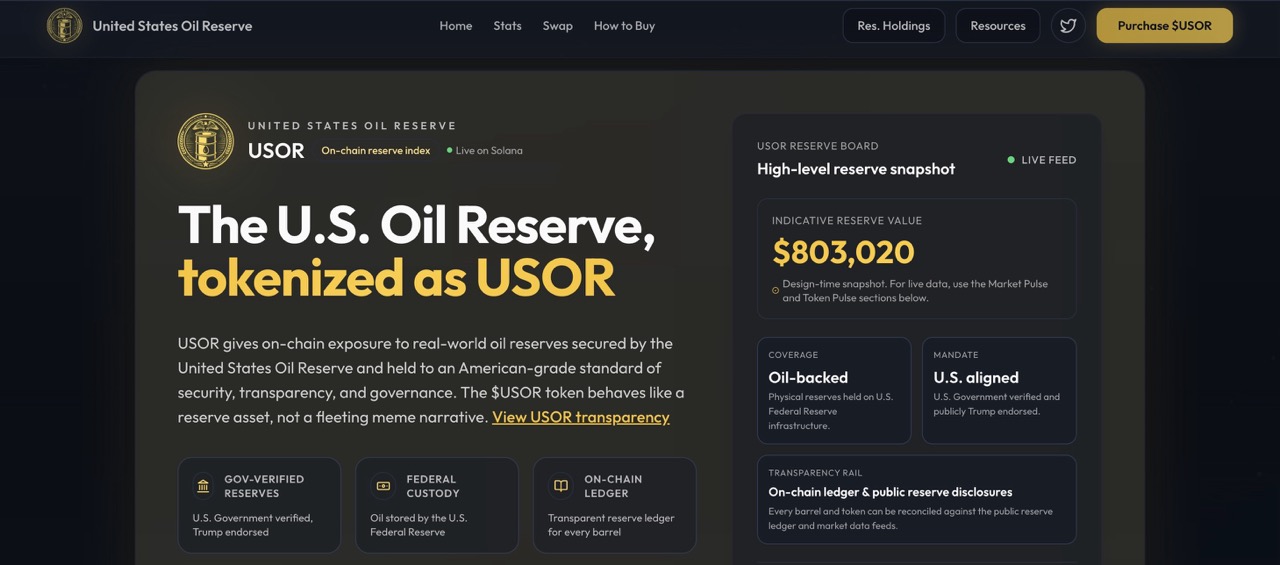

What Is USOR Crypto?

USOR (United States Oil Reserve) is a Solana-based (SPL) token designed to tokenize and bring transparency to the concept of the US oil reserve. Developed by the USOR team, the project allows users to buy, sell, and trade digital tokens that represent US oil assets, all on the fast, cost-efficient Solana blockchain. Unlike traditional oil investments or ETFs, USOR crypto opens the door to borderless, 24/7 trading, enhanced liquidity, and decentralized market participation.

According to its official website, the project aims to put the verification of oil reserves “on-chain,” meaning all reserve operations, token allocations, and transactions are recorded transparently and are verifiable by anyone at any time.

Key Features of USOR

Solana Native: USOR is built on the Solana blockchain, offering rapid transactions and negligible fees—key advantages over legacy systems and Ethereum-based tokens.

Fully Transparent: The status and movements of reserves, token supply, and key statistics are published on-chain and accessible via SolScan and the USOR official dashboard .

Fixed Supply: Only 1 billion USOR tokens were minted at creation; no further tokens will be added, supporting scarcity and anti-inflationary tokenomics .

Oil Reserve Pegged: The project’s vision is to represent the United States’ oil reserves via blockchain, offering what the team calls “digital proof of reserves.”

Community-Driven & Auditable: USOR’s open, blockchain-based structure allows community members and outside auditors to verify reserves and key project data at any time.

How Does USOR Crypto Work?

Tokenization and Proof of Reserves

Rather than holding barrels of oil on your behalf, USOR puts reserve transparency on-chain:

All USOR token issuance and reserve audits are visible via Solana’s public ledger.

Regular proof-of-reserve updates are provided on the official site for added credibility.

Transparency & Data

As of January 2026, the USOR dashboard provides the following metrics to ensure transparent monitoring of the United States Oil Reserve (USOR) token ecosystem:

Current Token Supply:

1,000,000,000 USOR (total fixed supply minted on Solana)Circulating Supply:

701,573,391 USOR in circulation, actively held and traded by the communityReserve Wallet Balance:

298,426,609 USOR held in the official reserve wallet, backing the project and providing reserve transparencyLiquidity:

$99,900 USDT in current liquidity, supporting USOR trading pairs on decentralized exchangesMarket Capitalization:

$340,000 USD (calculated using circulating supply and latest USOR market price)24h Trading Volume:

$9,960 USD traded in the past 24 hoursNumber of Holders:

3,949 unique wallet addresses hold USOR tokens, indicating a growing and engaged communityRecent Transactions:

Over 120 transactions processed in the last 24 hours—including wallet-to-wallet transfers, DEX swaps, and liquidity pool activityTop Holders:

The largest individual wallet holds about 53,000,000 USOR (5.3% of total supply), with the ten largest wallets collectively owning roughly 25% of all USOR in existence

All statistics are publicly available and updated in real time on USOR official website.

USOR Tokenomics

Total Supply: 1,000,000,000 USOR tokens.

Chain: Solana (SPL token)

Token Utility: Designed for trading, oil market exposure, and possible participation in future governance or utility features.

Reserve Auditing: Community and independent audits are core to the project’s transparency mission.

How to Buy USOR Crypto

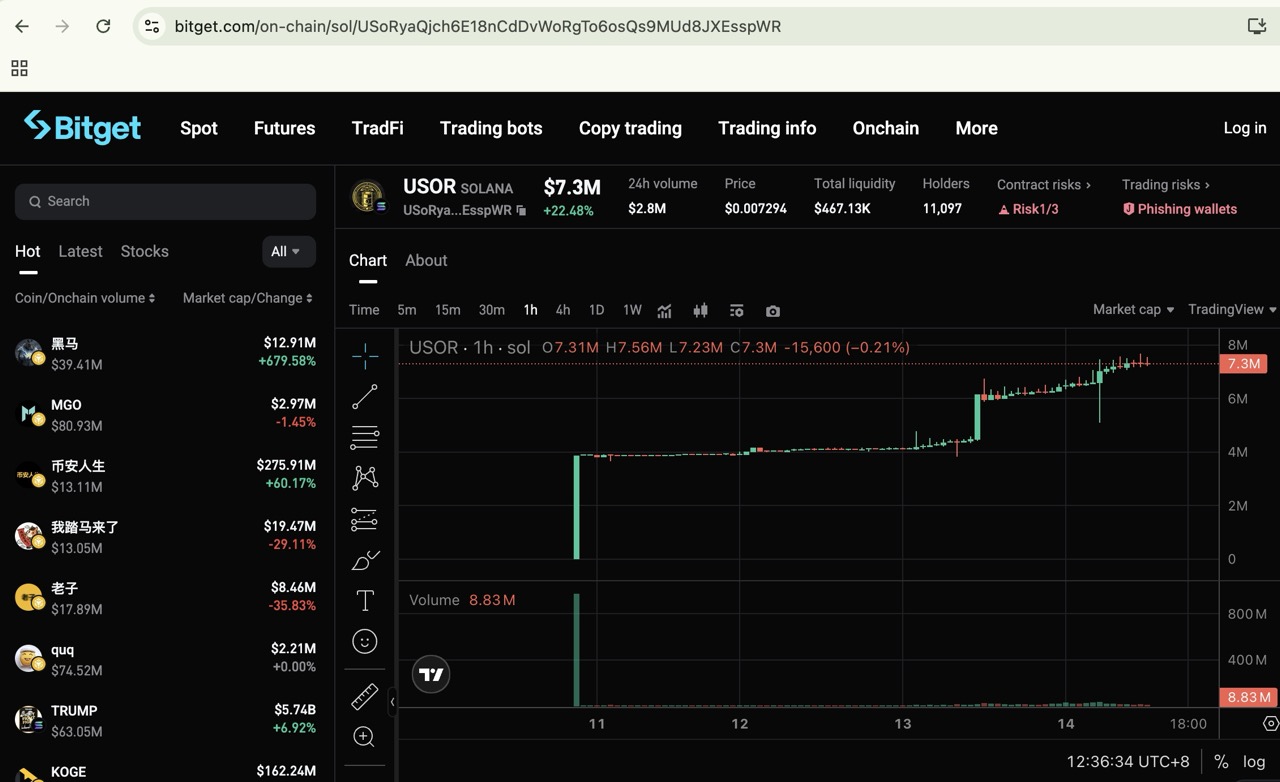

Go to the Bitget On-chain USOR Page

Visit the official Bitget On-chain USOR purchase page .Buy the USOR coin

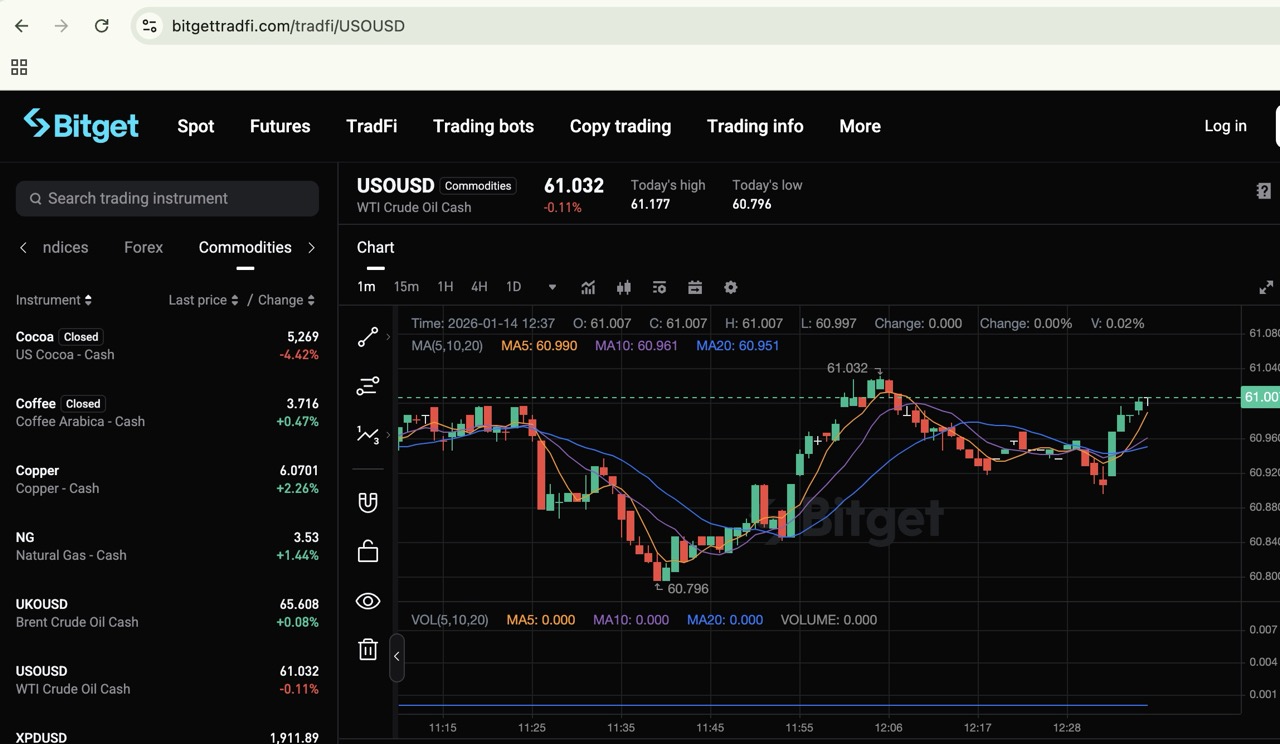

Alternatively, If you prefer traditional financial products, you can invest in U.S. oil by trading the USO/USD pair directly on Bitget Tradfi.

Log in to Your Bitget Tradefi Account

Go to the official Bitget Tradfi website .

Search for USO/USD

Trade Instantly

Buy or sell USO/USD like any regular spot or derivatives product

Advantages and Potential Use Cases

Decentralized Exposure to Oil Markets: Easily gain oil market exposure with no need for futures contracts or ETFs.

On-Chain Transparency: Full verifiability of all reserves and transactions, improved market trust.

DeFi Integration: As a Solana token, USOR could be used in emerging DeFi applications for lending, collateral, or yield.

Global 24/7 Access: Buy, sell, and transfer USOR at any time or place, without traditional oil market barriers.

Is USOR Legit?

Not US Government-Managed: USOR is not affiliated with the U.S. government or the Strategic Petroleum Reserve; it is an independent crypto project .

Market Volatility: USOR’s price is influenced by crypto market dynamics and oil sentiment, which are highly volatile, especially in times of geopolitical uncertainty.

Auditing Reliance: Claims of oil reserve backing and on-chain audibility depend on the project’s integrity and the quality of community/third-party audits.

Regulatory Changes: The evolving crypto and commodities landscape may impact USOR’s usability and compliance status.

Conclusion

The United States Oil Reserve (USOR) token is pioneering new ground in oil market access and transparency, utilizing Solana’s blockchain for fast, low-cost, and publicly verifiable oil-linked digital assets. Whether you’re seeking hedged exposure to energy, in-depth reserve visibility, or simply want a practical way to speculate on oil price movements, USOR opens the door with a modern, auditable, and decentralized approach.

However, as with any crypto investment, due diligence, skepticism, and ongoing monitoring of the project and reserve proofs are essential.