Ethereum price forecast takes a cautious turn as ETH drops 4.66% in 24 hours to trade at $2,964, slipping below the key $3,000 level.

Despite this pullback, network data points to increasing long-term strength. Ethereum’s staking participation has reached an all-time high, tightening circulating supply and signaling institutional confidence.

Meanwhile, address activity has surged in early 2026, with over 160,000 new ETH wallets added daily. The divergence between short-term price weakness and rising ecosystem engagement is prompting analysts to reassess immediate trading ranges.

Ethereum Falls Below $3,000 as Daily Volume Spikes Over 44%

Ethereum lost critical ground this week, with price action dipping below $3,000 for the first time since mid-January. As of writing, ETH is trading at $2,964.50, reflecting a 4.66% drop in the past 24 hours and a market cap of $357.8B.

Yet, this decline has been accompanied by a notable 44.46% surge in trading volume, which now sits at $31.31 billion. This volume spike suggests growing trader interest at these lower levels, potentially setting up a short-term bounce if support holds. ETH’s current circulating supply is 120.69 million, with no fixed max cap.

The elevated volume-to-market cap ratio (8.73%) further highlights increased activity, even as prices consolidate. For now, $2,900–$3,000 remains a crucial support band, with resistance likely forming near $3,150.

Record Ethereum Staking Levels Signal Long-Term Strength

Despite short-term volatility, Ethereum staking has reached a record high. On-chain data shows over 36 million ETH staked, representing 30% of the total circulating supply. According to Beacon Chain metrics, ETH’s Proof-of-Stake network has seen inflows grow steadily, with 2.3 million ETH still queued for entry.

This locks up significant liquidity, tightening the available supply on the open market. Market analyst Naga Avan-Nomayo confirmed this trend, stating that institutional holders like Bitmine and Grayscale are leading the surge.

If you think ETH staking is slowing, the data says otherwise.

Ethereum staking just hit an all-time high, and institutions are leading the charge.

More than 36M ETH is now staked, with some 2.3M still in the entry queue.

It means large holders like Bitmine and Grayscale are… pic.twitter.com/0vCCjIeyo8

— Naga Avan-Nomayo (@JeSuisNaga) January 14, 2026

This staking concentration reduces liquid ETH and suggests growing investor confidence in the protocol’s security. As ETH prepares for further scaling upgrades, the sustained rise in validator participation supports a bullish outlook, despite near-term corrections.

Network Growth Accelerates with Surge in New Ethereum Addresses

Ethereum’s user base continues to expand rapidly. The seven-day average for new ETH addresses has surged past 160,000 per day, reaching the highest levels since early 2022. In the first weeks of January 2026, address creation even approached 400,000 per day, signaling renewed adoption. Analysts typically associate this level of activity with early stages of major market cycles.

While network growth doesn’t always correlate with immediate price spikes, it reflects deepening ecosystem usage and organic traction. Ethereum’s Layer 2 activity, NFT transactions, and DeFi adoption continue to support this trend.

The rise in address creation aligns with broader confidence in the best crypto to buy, particularly as staking and developer activity both remain elevated.

Updated 2026 Ethereum Price Forecast: Can ETH Still Hit $5,000?

Based on current metrics, the updated Ethereum price forecast for 2026 remains cautiously optimistic. After reaching $3,107.99 on January 21, ETH began climbing sharply, peaking at $3,751.53 on February 3 – a 21.26% gain in just under two weeks.

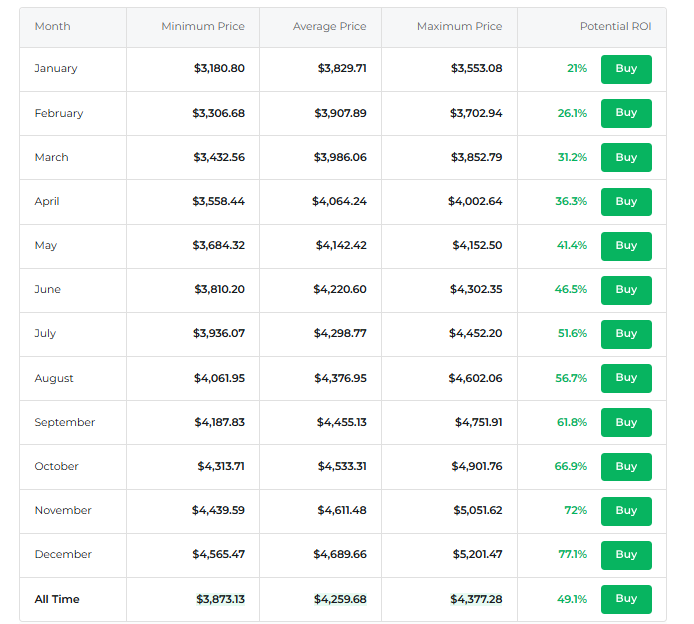

Current consolidation near $2,960 breaks that momentum, but longer-term projections still see potential. Forecast models now estimate ETH’s average trading range for 2026 between $3,800 and $4,900, with possible highs reaching $5,200 by Q4.

These targets assume continued staking inflows, steady network growth, and broader crypto market recovery. Should Bitcoin ETF inflows stabilize and risk appetite return, ETH may attempt another leg higher. However, any sustained move below $2,900 would invalidate this outlook and suggest deeper downside risk.