TRON’s growing role in the global stablecoin economy is drawing renewed attention after optimistic comments from Justin Sun and a detailed year-in-review analysis published by Messari.

Together, the statements and data paint a picture of a network that is increasingly defined by real-world usage rather than speculation.

Key Takeaways

TRON ended 2025 as one of the largest stablecoin networks, with over $81 billion in supply dominated by USDT.

Messari’s data shows rising daily transfer volumes and strong growth in addresses and transactions, pointing to real usage.

Justin Sun’s bullish outlook for 2026 aligns with fundamentals, even as TRX price action remains in a consolidation phase.

Justin Sun signals confidence in TRON’s direction

Justin Sun recently stated that 2026 is shaping up to be a strong year for TRON, suggesting that momentum built over the past year could accelerate further. While the message itself was short, it followed months of expanding network activity and growing relevance in stablecoin transfers. Sun’s framing positions TRON less as a hype-driven blockchain and more as foundational infrastructure for crypto payments.

This confidence appears to be rooted in usage trends rather than price action alone. TRON has quietly become one of the most important rails for dollar-pegged transactions, especially in regions where low fees and fast settlement are critical.

Messari highlights stablecoins as TRON’s core strength

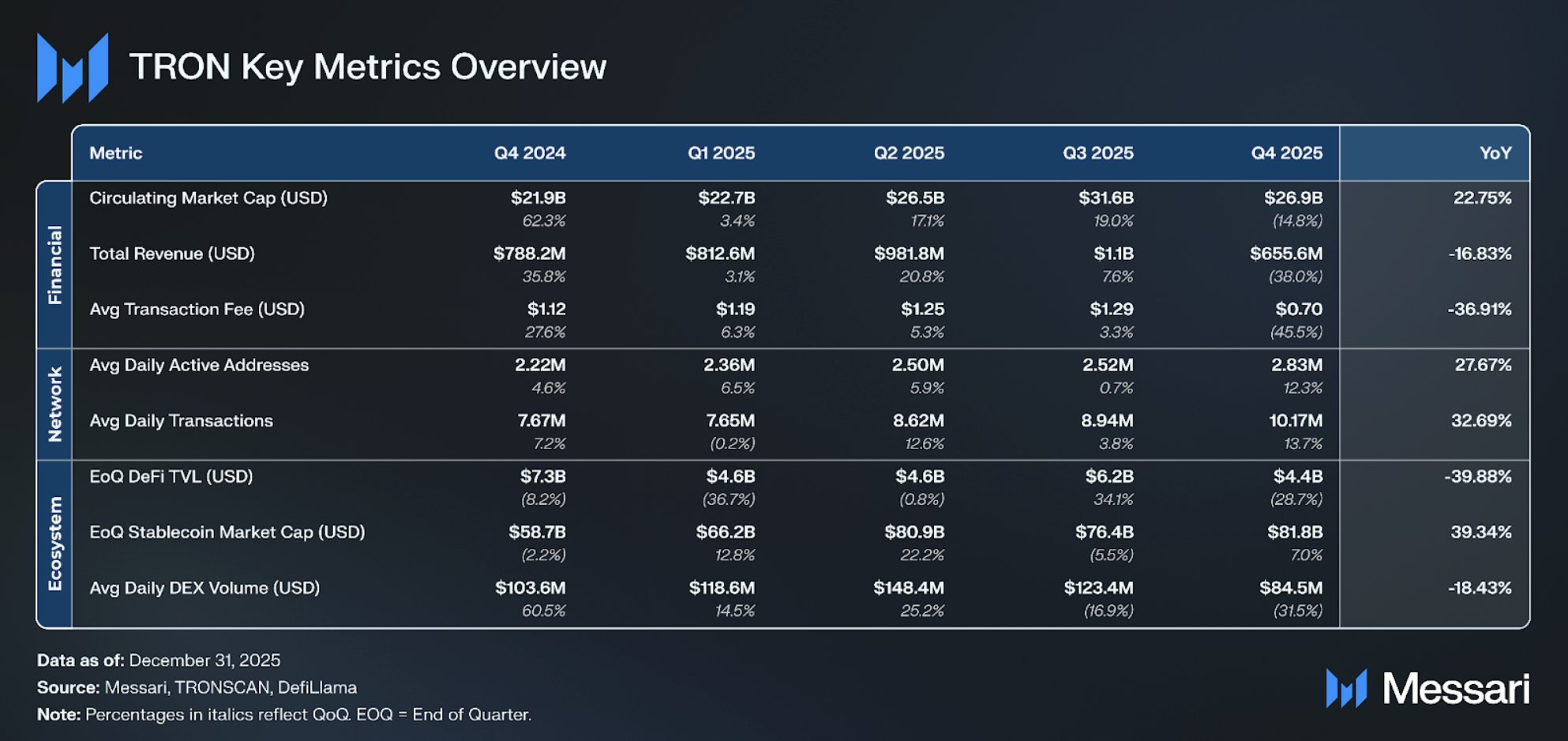

Messari’s review of TRON’s 2025 performance reinforces Sun’s optimism with hard data. By the end of Q4, the total stablecoin supply on TRON reached about $81.8 billion, with USDT making up roughly $80.9 billion of that figure. This dominance underlines TRON’s status as one of the primary networks for USDT circulation globally.

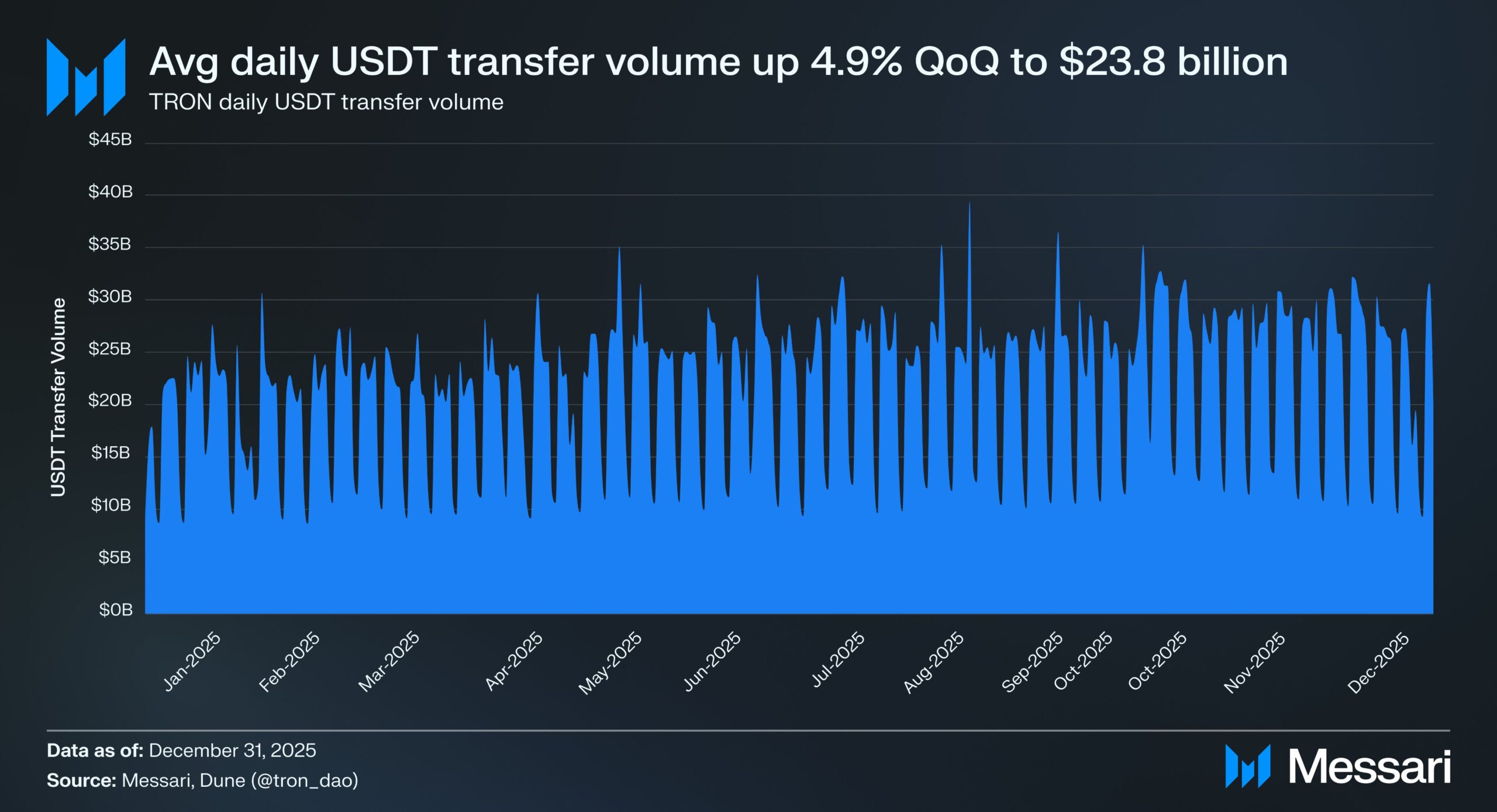

Average daily USDT transfer volume also continued to rise, reaching approximately $23.8 billion toward the end of the year. Rather than showing sporadic spikes, the data points to consistent, repeat usage. According to Messari, this reflects TRON’s growing role as a settlement and payment layer, not just a trading venue.

Network growth outpaces DeFi activity

Beyond stablecoins, Messari notes solid growth in core network metrics. Average daily active addresses and transaction counts both increased significantly on a year-on-year basis, signaling broader participation and higher throughput. TRON also surpassed $1 billion in revenue during a single quarter, highlighting the economic impact of sustained transaction demand.

At the same time, some ecosystem segments cooled. DeFi total value locked and decentralized exchange volumes declined compared with earlier periods. This divergence suggests that TRON’s current cycle is being driven more by payments and transfers than by speculative DeFi activity, a distinction that sets it apart from many other layer-one networks.

Price action remains a secondary story

TRX price movement has been more subdued compared with the strength of on-chain fundamentals. After reaching local highs, the token has pulled back toward the $0.30 area. Short-term technical indicators show weaker momentum, with RSI trending lower and MACD remaining in negative territory.

For now, this price consolidation appears disconnected from the broader usage narrative emphasized by both Justin Sun and Messari. Market participants seem to be digesting gains while the network continues to process large volumes of real economic activity.

Why this matters for 2026

The combined messaging from Justin Sun and Messari suggests that TRON is entering 2026 with a clear identity. Instead of competing head-on in every DeFi category, the network is leaning into its role as a global stablecoin settlement layer. If this trend continues, TRON’s relevance may increasingly be measured by transaction flow and revenue rather than short-term price volatility.