Bittime - In the ever-evolving crypto world, the tokenization of real world assets (RWA) has become one of the biggest narratives in 2025.

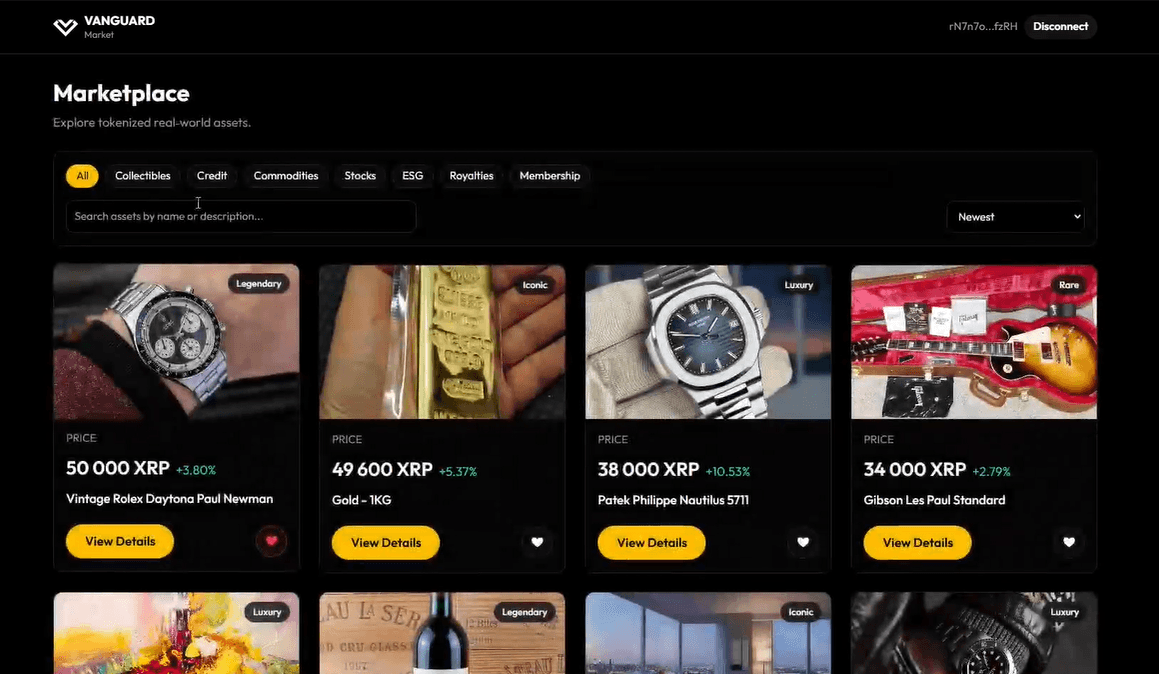

This concept allows physical assets such as gold, gemstones, and luxury goods to be converted into digital tokens on the blockchain.

One project claiming to be at the forefront of this trend is Vanguard (VWA), also referred to as Vanguard Coin or Vanguard RWA.

However, while it claims innovation in the RWA sector, the project has also sparked debate over its legitimacy and transparency.

What Is Vanguard (VWA)?

Vanguard (VWA) is a crypto project operating within the Solana ecosystem, aiming to bring valuable real-world assets like gold and gemstones onto the blockchain.

According to its official site, VWA aims to “Transforming precious physical assets into accessible digital investments”.

The project blends the RWA narrative with a lighter, viral meme-coin style approach.

Some aggregators even categorize VWA as a meme coin themed around asset tokenization due to its flashy branding and limited documentation.

Market Data (October 2025):

Current price: $0.00831

Market capitalization: $8.31M

All-Time High (ATH): $0.00838

24h volume: >$1.7M

The token can be traded on Solana DEXs like Jupiter and managed via Phantom Wallet.

Vanguard (VWA) Vision & Mechanism

Main Vision

VWA seeks to bridge traditional finance and blockchain technology by tokenizing high-value physical assets.

According to the official website vwa.to:

Global gold market value: $22.8 trillion

Luxury watch market: $75 billion

Total potential RWA market: $23+ trillion

VWA claims tokenization will increase global liquidity and investment access, allowing anyone to own fractions of high-value assets without buying the physical items.

How It Works (Project Claims)

Tokenization: physical assets are converted into digital tokens

Liquidity: tokens can be traded globally via blockchain

Accessibility: ownership available to anyone with a digital wallet

Integration: leveraging the Solana ecosystem such as Jupiter DEX & Phantom Wallet

Popularity Surge & Hype Issues

VWA first went viral in October 2025 after videos and memes claiming a “Simpsons prediction” circulated on social media, alleging that The Simpsons had “predicted” the token — which later proved to be a hoax.

Nevertheless, the viral effect was real:

Market cap surged up to $7.5M within days

Trading volume exceeded $1.7M daily

VWA community on X (Twitter) and Telegram grew rapidly

Unfortunately, on-chain analysis tools like BubbleMaps indicate about 90% of the token supply is concentrated in roughly 50 wallets, mostly linked to the project deployer. This raises concerns about centralization and price manipulation risk.

VWA Correlation with Crypto Markets

Generally, VWA has weak correlation with major crypto assets like BTC or ETH.

VWA’s price is more influenced by:

Community sentiment & social media

Tokenization trend (RWA narrative)

Seasonal hype in the Solana ecosystem

However, VWA benefits from growing interest in the RWA crypto sector, especially after notable projects like Ondo Finance and BlackRock BUIDL Fund gained attention in 2025.

If VWA can demonstrate real evidence of asset tokenization, the project could expand Solana liquidity and strengthen the RWA trend. Conversely, without proof, it may remain a short-lived meme coin.

Major Risks

High centralization: the majority of supply is held by a handful of wallets.

Lack of transparency: no public audit or whitepaper.

Dual identity: RWA + meme coin causes market confusion.

Potential price manipulation: trading activity still depends heavily on the internal community.

Unverified rumors and claims: such as alleged associations with Ripple or BlackRock that are unproven.

Conclusion

Vanguard (VWA) exemplifies how the asset tokenization (RWA) narrative and meme crypto culture can mix to create viral phenomena.

With claims of bringing gold, silver, and gemstones onto the blockchain, VWA leverages a major trending theme — but without clear technical evidence and audits, the validity of those claims remains doubtful.

For investors, VWA is interesting as a social experiment and community trend, but highly risky if treated as a serious RWA project.

Until more transparency is provided, VWA should be viewed as a speculative token rather than a long-term value asset.

The RWA trend itself remains promising — however, its success will depend more on projects with credibility, audits, and real reserves, not just social media popularity.