XRP price forecast is once again under heated discussion after the token plunged below the $2 support level amid a $53.32 million outflow from its spot ETFs. XRP is trading around $1.95, down 7.09% over the past week, with 24-hour trading volume at $4.34 billion.

The average daily total inflow for spot XRP ETFs in the last two weeks was around $10 million, and an outflow of this scale put heavy pressure on the price. However, last week’s decline was mainly due to rising geopolitical tensions and heightened trade-war speculation between the US and Europe.

But on Wednesday, President Donald Trump unveiled a “Greenland Framework,” a preliminary agreement. After the news broke, US equities jumped higher, and the total crypto market cap recovered above $3 trillion. The framework effectively de-escalated geopolitical and trade tensions, restoring “risk-on” appetite, which typically benefits speculative assets like cryptos.

XRP price is still trading below the $2 psycholigical mark, and the price action is still favoring sellers. Analysts are now focusing on the deal’s further development and whether XRP could reclaim $2 for a bullish bounce or fail to hold $1.90 support.

XRP ETF Flows and Market Impact

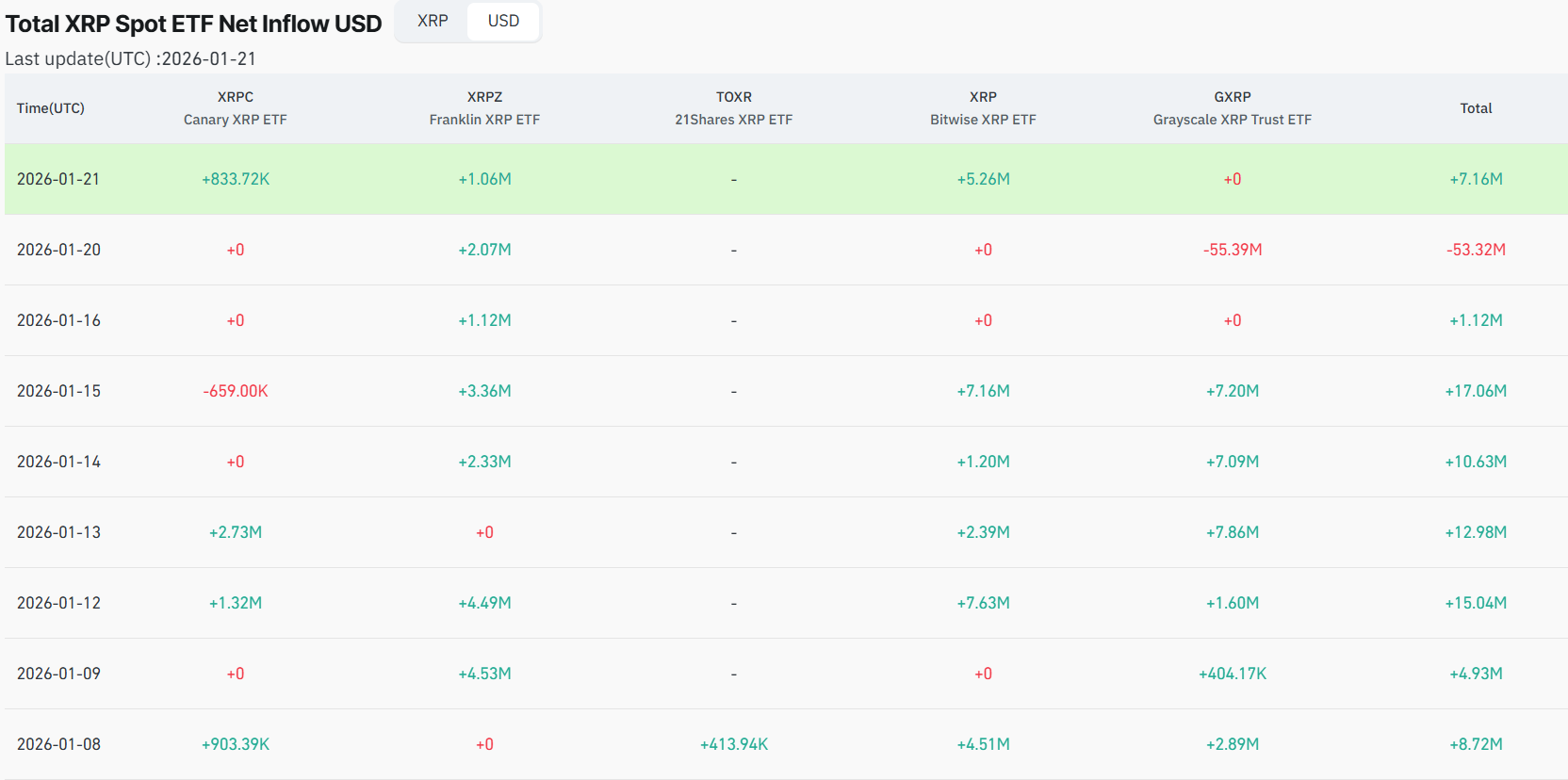

Tuesday’s heavy outflows from spot XRP ETFs have amplified downside pressure on the XRP price forecast. After seven days of continuous inflows in ETFs, Tuesday’s $53.32 million losses have nearly erased the prior streak of inflows. This marks the largest single-day outflow so far.

Source: Coinglass

In this outflow, the majority of losses came from Grayscale’s GXRP product, which alone recorded roughly $55.39 million in losses in a single session. Franklin’s XRPZ ETF was the only ETF to see a slight inflow of $2.07 million. Meanwhile, other issuers such as Canary, Bitwise, and 21Shares posted flat flow readings.

However, on Wednesday, inflows were restored, as XRP US spot ETFs recorded $7.16 million in inflows. Despite the inflow, the XRP price is yet to recover and is facing resistance around the $1.95.

Macro and Geopolitical Factors Driving XRP Volatility

Yesterday, US President Donald Trump took the stage at the World Economic Forum (WEF) and reportedly laid out a “framework” for future cooperation with NATO Secretary General Mark Rutte regarding Greenland.

In his social media platform, Truth Social, Trump said, “We have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region. Based upon this understanding, I will not be imposing the Tariffs that were scheduled to go into effect on February 1st.”

"Based upon a very productive meeting that I have had with the Secretary General of NATO, Mark Rutte, we have formed the framework of a future deal with respect to Greenland and, in fact, the entire Arctic Region. This solution, if consummated, will be a great one for the United… pic.twitter.com/24b99begbb

— The White House (@WhiteHouse) January 21, 2026

Investor interest in the crypto market renewed after Trump paused tariffs on European Union goods, easing trade-war tensions. Bitcoin sharply recovered from its day’s low and is currently trading near $90,000. While the broader crypto market has recovered slightly, short-term bearish dominance remains intact.

XRP Price Forecast Eyes $2 Local Target

XRP price continues to face bearish pressure amid broader market sentiment. In the recent correction, the altcoin has dropped by more than 20%, erasing gains from the start of the month. On January 6, it made a new two-month high of $2.4 but has again dropped below the $2 support level and is trying to regain it.

Technical indicators also indicate short-term weakness as the token consolidates on lower time frames. On the daily chart, the RSI (Relative Strength Index) is at 43.8, suggesting a neutral balance between buyers and sellers. However, MACD has dipped below the middle line with the histogram printing negative signals.

XRP price chart. Image courtesy: TradingView

Coinciding with the $2 psychological resistance, the key 50-day moving average will also act as a crucial barrier. A strong move above $2 would push the XRP price out of the current bear dominance, while a breakout above $2.42 would confirm the reversal and a potential bull swing.

However, a decisive break of the immediate support level near $1.90 would likely push the price into the lower territory. The action would confirm the bear cycle and could lead to previous correction levels, around $1.55 and $1.40. For now, $1.9 is a decisive pivot; if XRP holds it, bulls may regain control, while losing it would hand control back to bears.