The question why is crypto down today has a growing list of answers. In the past 24 hours, the total cryptocurrency market cap fell by 2.4%, dropping to $3.1 trillion. At the same time, 92 of the top 100 coins posted losses.

The Bitcoin price prediction slid below $90,000, while Ethereum dipped under $3,000. Behind the red numbers are tightening macro conditions, sharp ETF outflows, a spike in leveraged liquidations, and a policy shock from Davos.

Traders are shifting toward risk-off positioning as both retail and institutional sentiment deteriorates. While volatility remains muted, options data shows a strong downside skew – signaling more turbulence ahead.

BTC and ETH Face Selling Pressure as Fear Returns to the Market

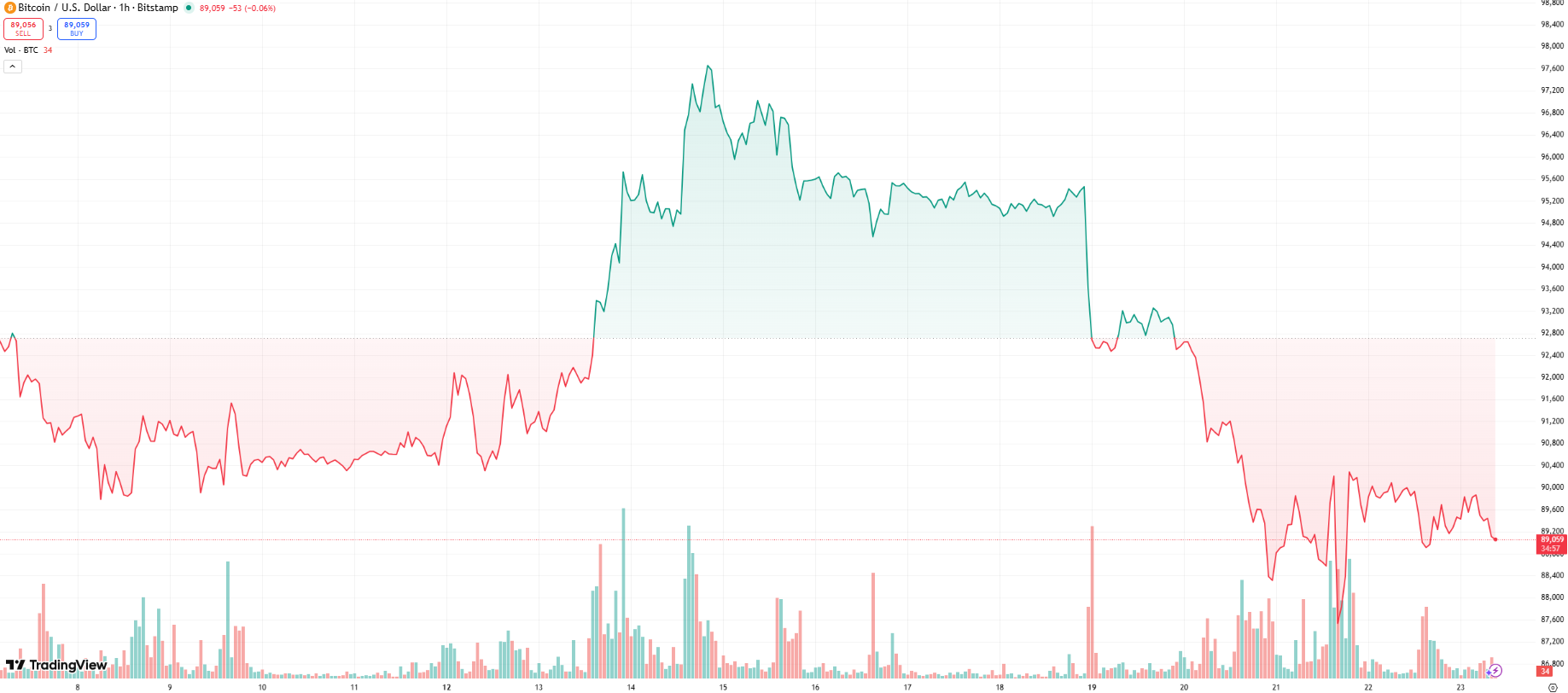

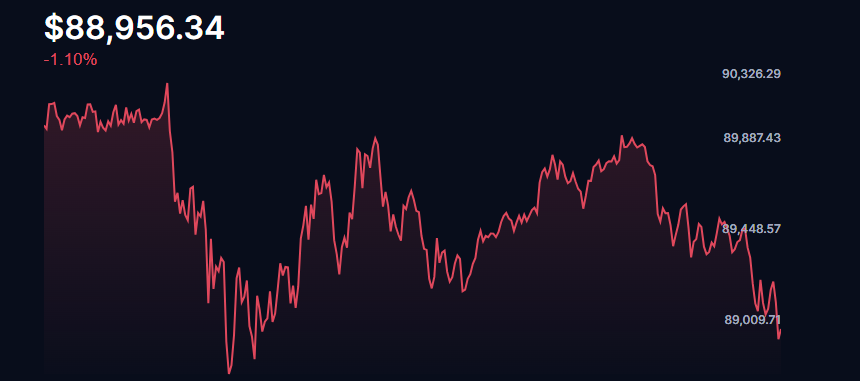

Bitcoin is currently trading at $89,183, with a market cap of $1.78 trillion. Its 24-hour trading volume collapsed by 28%, falling to $36.1 billion. Ethereum, sitting at $2,929, has also lost traction, with volume down 33% to $21.9 billion.

Both coins have now re-entered their high-beta behavior patterns, amplifying broader market moves. Analysts from Derive.xyz report a sharp deterioration in BTC 25-delta skew, falling from +5% last year to -3% today.

This indicates that traders are paying a premium for downside protection – effectively hedging against mid-term losses. With 92 of the top 100 coins in the red, the broader sentiment index is now firmly back in the fear zone.

Trump’s Davos Speech and the “Greenland Crisis” Rattle Global Risk Markets

Volatility returned to global markets after President Trump’s speech at the WEF in Davos, where he announced sweeping tariffs aimed at European nations as part of his revived effort to acquire Greenland.

The proposed tariffs range from +10% to +25%, igniting fears of a renewed trade war. European leaders responded with a €93 billion retaliation package. As investors fled risky assets, crypto was among the first to feel the shock.

Solana and high-growth meme coins posted double-digit losses, while Bitcoin dipped further below $90,000. The timing of the announcement – paired with existing macro stress – added to the already growing selling pressure across digital assets.

ETF Outflows Signal Institutional Retreat as Liquidity Tightens

After a record-setting 2025, spot Bitcoin ETFs are now seeing over $800M in redemptions in just 48 hours. According to SosoValue, there were no inflows during this period, underscoring a broader retreat from institutional investors.

Analysts suggest that large players are locking in gains after BTC’s run to $126,000 last year. The absence of new buyers, paired with this exit activity, has triggered a liquidity crunch. This sell-side imbalance is particularly visible in leveraged markets.

Just yesterday, over $371M in BTC long positions were liquidated, according to Coinglass. This created a cascading effect, dragging down Ethereum, Solana, and other altcoins in tandem.

Liquidity Gaps and Collateral Selling Add Fuel to the Drop

The recent Martin Luther King Jr. holiday in the U.S. created a short-lived liquidity gap, amplifying institutional sell orders at a critical moment. Analysts say this gap intensified selling during the ETF redemption wave.

At the same time, long liquidations are forcing additional spot selling of crypto collateral, worsening the sell-off. Ethereum has struggled to stay above $3,100, and Solana – known for its high beta – has dropped 11% over the past week.

With the momentum breaking, traders are moving funds into traditional safe havens like gold, which is trading near $4,600, a new all-time high. Bitcoin, meanwhile, has failed to act as a “digital gold” hedge in this environment.