Based on our research, the best short-term cryptocurrencies to buy have deep liquidity, high volatility, and sustained positive market sentiment and attention, which is why Bitcoin sits at the top of our shortlist.

Other top short-term crypto to buy in 2026 that we’ve identified include BNB and Render. We chose BNB because it benefits from ongoing buybacks and burns, as well as its continued relevance in the Binance ecosystem. We selected RENDER for its relevance and sensitivity to AI narratives.

In this guide, we’ll share our top picks and our reasoning, along with our methodology and a framework for you to assess what the top short-term crypto is for you to buy. We’ll also go into the risks and considerations of short-term cryptocurrency trading.

Best Short-Term Cryptocurrencies: Our Top Picks

As the market trades sideways, but with subdued optimism, here are our strongest contenders for the best short-term cryptocurrencies right now.

Best for Fast Breakouts (High Momentum)

Solana (SOL) – L1 with Proof of History mechanism for speed and staking rewards

BNB (BNB) – The coin underpinning Binance, the CEX, and the Binance Smart Chain

Render (RNDR) – Established AI-related coin with high liquidity

Bittensor (TAO) – Bluechip AI project with high funding and institutional support

Best for Safer Short-Term Rotations

Bitcoin (BTC) – The original coin has always been worth more in every bull run

Ethereum (ETH) – Gas token of the Ethereum blockchain and various L2s on the EVM

XRP (XRP) – One of the first cryptocurrencies designed for institutional use

Best for Meme Pumps

Pepe (PEPE) – Meme coin based on the famous Pepe the frog character

Dogecoin (DOGE) – Original memecoin with its own blockchain

Shiba Inu (SHIB) – Large cap well known dog meme coin

Best for Early-Stage High-Risk Projects

Bitcoin Hyper (HYPER) – Bitcoin L2, enabling smart contracts and cheap transactions

Maxi Doge (MAXI) – New meme coin aimed at degen humor and perps traders

Best Short-Term Crypto in 2026 Review & Analysis

Here are our reviews of the best short-term crypto, along with our reasoning and analysis, as well as upcoming catalysts and other relevant information.

Solana (SOL) – L1 Blockchain with High Institutional and Retail Support

SOL is the gas token for Solana, which, according to CoinGecko, is the fastest functional blockchain. Solana also has low fees and high staking rewards, in part thanks to MEV rewards rather than simple inflation. It has several staking ETFs, with more on the way.

As one of the top cryptocurrencies by market cap, with institutional and retail support, liquidity is high, and price changes are frequent. Solana’s price is down with the overall market, but history has shown that SOL often rebounds well from lows, as in the case of the FTX crash, which brought Solana below $10.

Solana’s 7 Day net inflows exceeded BTC and ETH on December 16, 2025. Source: Lookonchain on X

SOL Details

Why Solana is a Top Short-Term Crypto:

Solana’s Firedancer mainnet rollout on December 15, 2025 offers better scalability and security and could generate momentum as validators adopt it.

Franklin Templeton is the latest to launch a Solana ETF. December saw SOL’s largest yet ETF inflows, with total inflows at $655M.

Solana is listed on all major CEXes and DEXs, and has a high amount of liquidity.

The Alpenglow upgrade received consensus in September, Alpenglow is set to go live in Q1 2026, aiming to reduce transaction finality from 12.8 seconds to 150 milliseconds.

Market Position: Solana is the fifth-largest crypto by market cap and one of the most active blockchains, with $80.2B (Snapshot from CoinGecko, January 13, 2026). SOL’s price is currently at the lower range of levels seen in 2025, which could position it for a rally in the coming weeks and months.

Key Risks to Consider:

Firedancer and Alpenglow may be successful but fail to raise the price significantly.

If the overall market continues to trend down, SOL holders may need to keep holding until there is a reversal.

Where to Buy Solana (SOL): You can purchase SOL on any major centralized exchange, including Binance, Kraken, and Coinbase, and on decentralized exchanges like OrcaSwap, Uniswap, Jupiter, and Raydium.

Solana Summary

| Category | Layer 1 |

| Blockchain | Solana |

| Launch Status | Launched |

| Current Price | |

| Market Cap | $80.2B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | Record-breaking SOL ETF inflows and the Firedancer and Alpenglow upgrades provide a potential catalyst for short-term growth |

| Tokenomics Highlights | Disinflationary with MEV rewards for stakers and 50% fee-burn to support price action |

BNB (BNB) – Binance Coin and Gas for the Binance Smart Chain

BNB is used within the Binance CEX and also as the gas token of BSC, Binance’s blockchain. BNB pays for trading fees and gas fees. Binance does regular buybacks and burns, and over the years, BNB is one of the few coins to consistently reach new all-time highs in bull markets.

Also, BNB’s cofounder, CZ, remains, for many, a highly regarded figure in crypto, which lends support to the coin and ecosystem, despite the fact that he was forced to step back due to legal issues.

Top dApps on the BNB Chain ecosystem showing the most active dApps and their user growth (Snapshot January 13, 2026). Source: BNB Chain Website

BNB Details

Why BNB is a Top Short-Term Crypto:

Binance is attempting to recapture its share of the US crypto market, down from 35% to close to nothing.

Binance is expanding into other markets, such as Abu Dhabi.

BNB reacts to the market but tends to perform well in bull markets.

Data from DeFiLlama shows the BNB chain holds ever-increasing numbers of active addresses.

Market Position:

BNB tends to be in the top 10 cryptos by market cap, currently the largest after Bitcoin and Ethereum.

Key Risks to Consider:

Binance is facing a new round of legal issues, and this could affect CEX licences and BNB’s price.

BNB is more centralized than many competing blockchains, raising potential concerns around governance, validators, and blockchain safety, and transparency.

Where to Buy BNB: Through Binance and most centralized cryptocurrency exchanges and decentralized exchanges, for example, 1inch or Pancakeswap.

BNB Summary

| Category | CEX and blockchain gas token |

| Blockchain | Binance Smart Chain |

| Launch Status | Launched |

| Current Price | |

| Market Cap | $125.0B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | BNB’s long-term resilience means that even if the market crashes, it will likely recover, making it safer for short-term trades in uncertain conditions |

| Tokenomics Highlights | Buy back/burns of CEX fees paid with BNB. Reduced trading fees for holders |

Render (RENDER) – Marketplace for Idle Graphics Cards’ Power

Render is a blue-chip AI project launched in 2020. Since AI is currently a trillion-dollar industry, Render’s GPU marketplace and network fit well with the short-term and longer-term metas of AI and decentralized processing power.

Unlike many older projects like Filecoin or Chainlink, which are still very relevant but whose tokens are underperforming, RENDER (formerly RNDR) reached a new all-time high in 2024. The coin dropped substantially in 2025, but may be in a good place for a recovery when the overall market recovers.

Opentensor Foundation posted that the first TAO halving cycle happened. Source: X

TAO Details

Why TAO is a Top Short-Term Crypto:

Bittensor halving event in December 2025, which could increase price through scarcity.

TAO is a high volatility coin with good trading momentum.

The project continues to receive investment and attention. Investors include Polychain Capital, Digital Currency Group (DCG), and crypto billionaire Barry Silbert.

Market Position: Bittensor is the 49th crypto by market cap, with a market cap of $2.7B (Snapshot from CoinGecko, January 13, 2026), and is down by approximately 29% on the yearly charts (Snapshot from CoinGecko, January 13, 2026).

Key Risks to Consider:

Reliant on the continuation of the AI sector, in competition with many AI giants.

Price has been trending down in line with the broader market.

Where to Buy TAO: Most major CEXs and DEXs, including Coinbase, Bybit, and Uniswap.

TAO Summary

| Category | AI / DePIN |

| Blockchain | Subtensor (proprietary, built with Polkadot) |

| Launch Status | Launched |

| Current Price | |

| Market Cap | $2.7B (Snapshot from CoinGecko, January 13, 2026) |

| Short-Term Strengths | Demand for AI learning, high volatility, and high trading volume |

| Tokenomics Highlights | TAO’s max supply is 21 million tokens, with a halvening cycle |

Bitcoin (BTC) – Crypto’s First and Most Widely Adopted Coin

Bitcoin was launched in 2008 as the original (successful) digital and decentralized currency. Since then, newer coins and blockchains have been created, with faster speeds and smart contract abilities. This has led to a narrative of Bitcoin as the best crypto to represent digital gold.

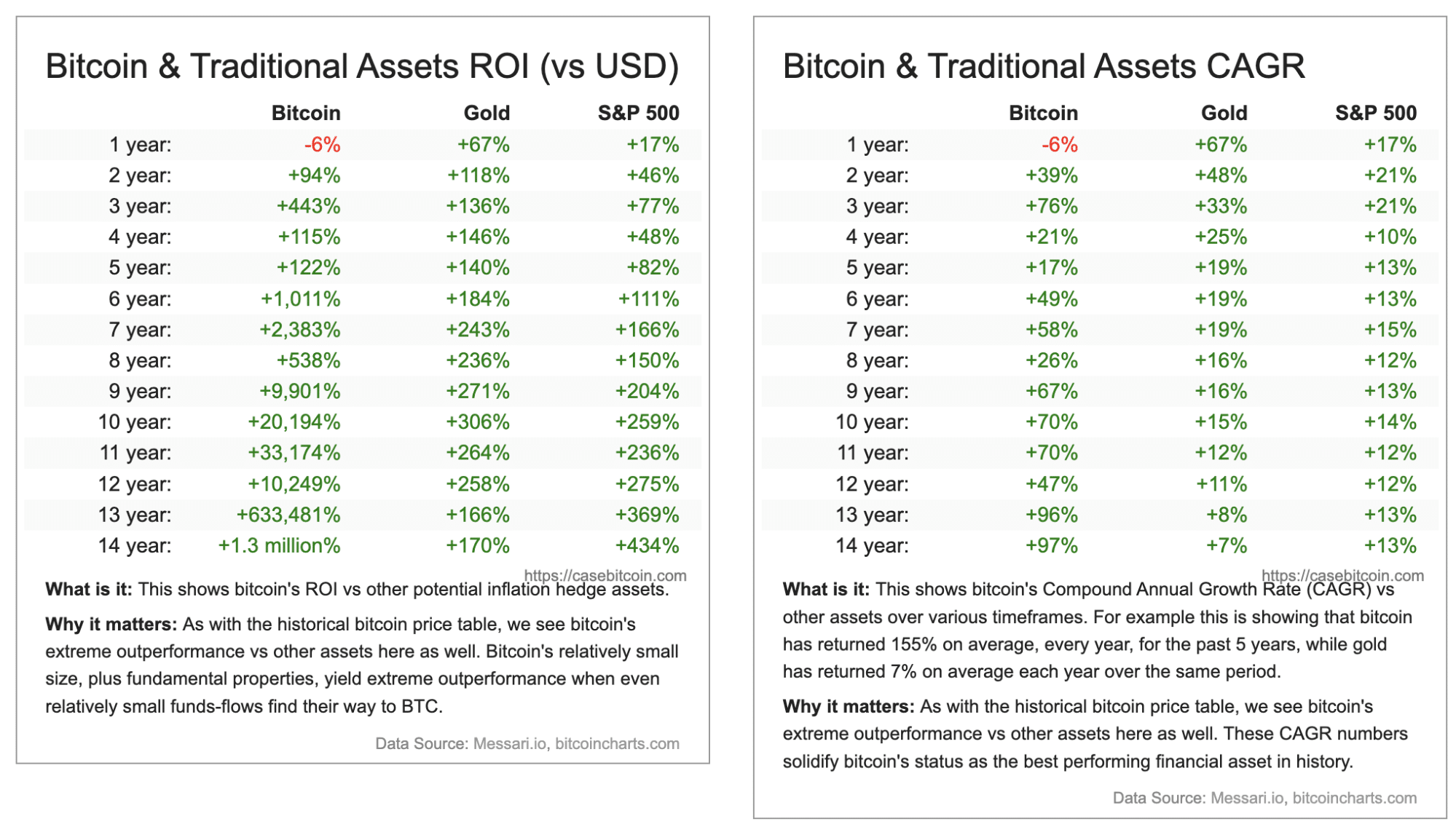

Bitcoin’s ROI and CAGR vs other assets. Source CaseBitcoin.com

While BTC currently performs more like a risk-on asset than gold, its high CAGR relative to other assets, deep liquidity, institutional investment via ETFs (exchange traded funds), and persistent achievement of new all-time highs in every bull cycle, make Bitcoin potentially the best crypto for short-term trades. And it is also most likely to rebound eventually, if caught in a bear market.

BTC Details

Why BTC is a Top Short-Term Crypto:

Although BTC’s price is down since October all time highs, on-chain data shows that most of the sell pressure is coming from long-term holders, and is being absorbed by ETF buyers.

While the market has retraced amid macro uncertainty, ETF adoption continues.

BTC has the deepest liquidity of all cryptocurrencies.

Market Position: Bitcoin continues to be the largest coin by market cap and adoption, but has faced several weeks of bearish pressure since its all-time high in October.

Key Risks to Consider:

Although BTC has historically gone on to exceed prior highs in each market cycle, some analysts say the cycle is broken, and past performance doesn’t guarantee future results.

Theoretical quantum threats to the network or Satoshi’s wallet.

Where to Buy BTC: Centralized crypto exchanges, such as Coinbase and Kraken. Directly on chain using the Electrum wallet or Exodus, or peer-to-peer for pseudonymity. MetaMask now also supports BTC.

BTC Summary

| Project | Bitcoin |

| Type | Store of value / biggest decentralized currency |

| Blockchain | Bitcoin |

| Launch status | Launched (2009) |

| Current price | |

| Market cap | $1.83T (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Institutional ETF adoption, improving regulatory clarity, Governments holdings |

Ethereum (ETH) – First Programmable Chain and EVM Tech Stack

While Bitcoin is often called the digital gold, Ethereum is famous for being the first decentralized computer, thanks to its smart contracts and programmability. In line with co-founder Vitalik Buterin’s vision, Ethereum serves as the base for many faster Layer 2s such as Optimism and Arbitrum.

Ethereum’s performance hasn’t been quite as strong or consistent as Bitcoin’s, but its lower market cap, institutional adoption, and high liquidity and volatility make it a good short-term crypto, particularly if you understand the ranges it tends to trade in.

Reasons for developers to build on the XRP Ledger. Source. XRP Ledger

XRP Details

Why XRP is a Top Short-Term Crypto:

XRP ETFs were approved in the latter half of 2025, with more on the way, potentially increasing institutional demand.

New XRPL dApps will add utility to the coin, potentially supporting price action.

Market Position: Down from its all-time highs in 2025, but still the third-biggest crypto, having been freed from most of the legal cases by the SEC.

Key Risks to Consider:

Another system or token may become the de facto payment coin.

Ripple may be pulled back into further regulatory battles.

Where to Buy XRP: Most CEXs and DEXs, including MEXC, Coinbase, Kraken, Uniswap, and Raydium.

XRP Summary

| Project | XRP |

| Type | Banking and payment rails |

| Blockchain | XRP Ledger |

| Launch status | Launched |

| Current price | |

| Market cap | $124.9B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Institutional ETF adoption, large retail following, high liquidity |

PEPE (PEPE) – Cult Meme Coin with High Liquidity

Pepe the frog was launched as a meme coin in 2023, although there was an initial pump, holders who kept their bags until 2024 and beyond saw huge price spikes, making millionaires of many. While initial liquidity issues stopped some from cashing out, the coin has now matured and has high liquidity on a wide range of exchanges. Since then, PEPE, unlike many other meme coins, has continued to experience large spikes and dips, making it suitable for short-term trades, when considering timing.

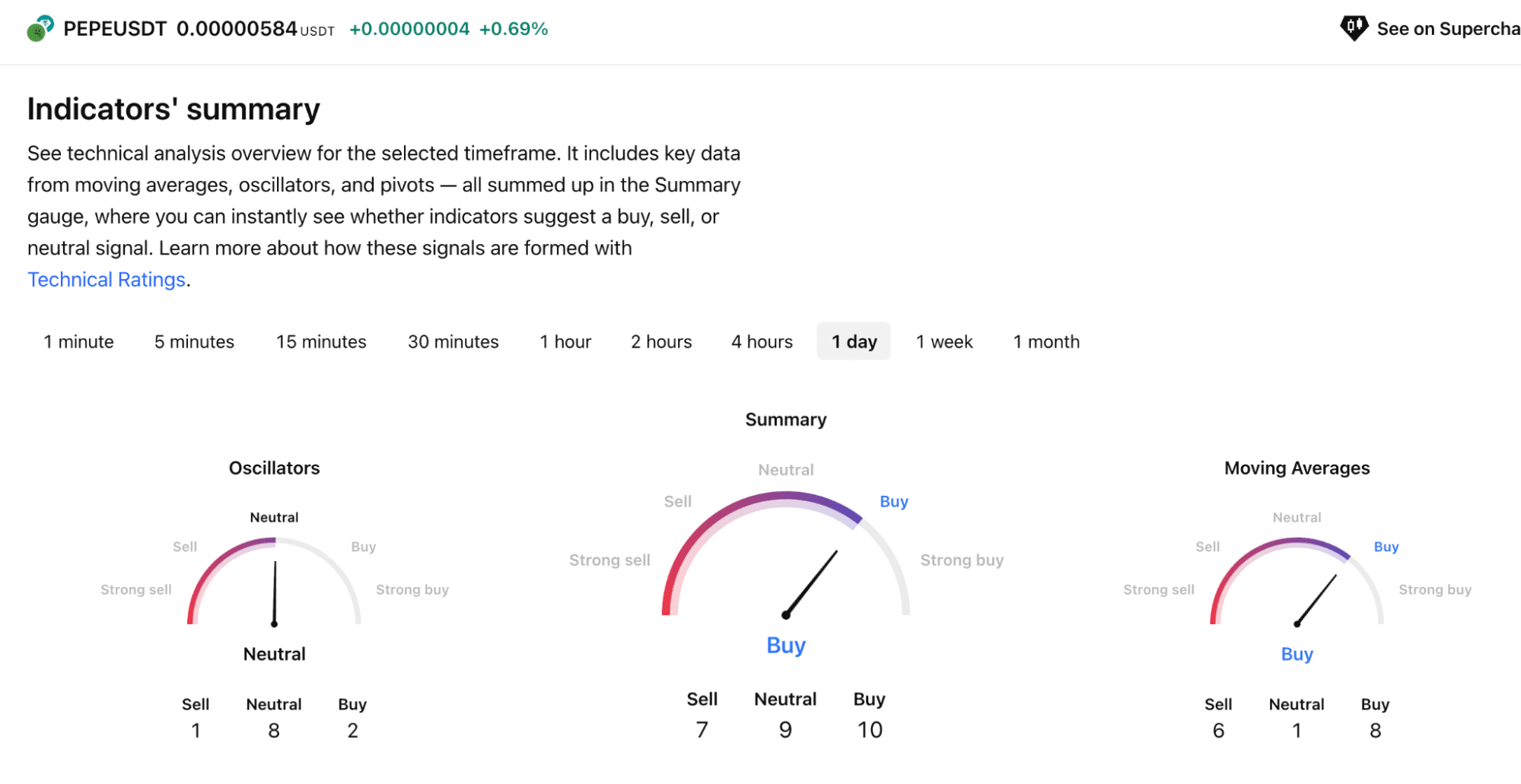

Technical analysis based on indicators such as moving averages, pivots, and oscillators for Pepe on the 1-day charts (Snapshot, January 12, 2025). Source: TradingView

PEPE Details

Why PEPE is a Top Short-Term Crypto:

Bloomberg ETF analyst Eric Balchunas predicts that in 2026, there will be a ‘slew of memecoin ETFs’. If he’s correct, PEPE is almost certain to get one as a popular meme.

PEPE’s highs and lows tend to mirror BTC, but with bigger swings.

Market Position: Like most coins, PEPE is down from its all-time high. It’s the 61st biggest coin by market cap with a 24-hour trading volume of $520M (snapshot from CoinGecko, January 13, 2026).

Key Risks to Consider:

Pepecoin’s December 2024 high may not be reached again.

Memecoin ETFs may fail to attract significant attention.

Where to Buy PEPE: Most CEXs and DEXs, including Binance, Crypto.com, and Kraken, and in Web3, Uniswap, and 1inch, and in wallets like MetaMask and Best Wallet.

PEPE Summary

| Project | PEPE |

| Type | Meme coin |

| Blockchain | Ethereum |

| Launch status | Launched |

| Current price | |

| Market cap | $2.4B (Snapshot from CoinGecko, January 13, 2026) |

| Short-term strengths | Release of ETFs and potential adoption, cult following, and high liquidity |

Dogecoin (DOGE) – Original Dog Meme Coin

Dogecoin was famously created as a joke in 2013 to mock the proliferation of new cryptocurrencies. Fast forward to 2026, and it’s one of the biggest coins and top memecoins, with a high trading volume, and reasonably high volatility.

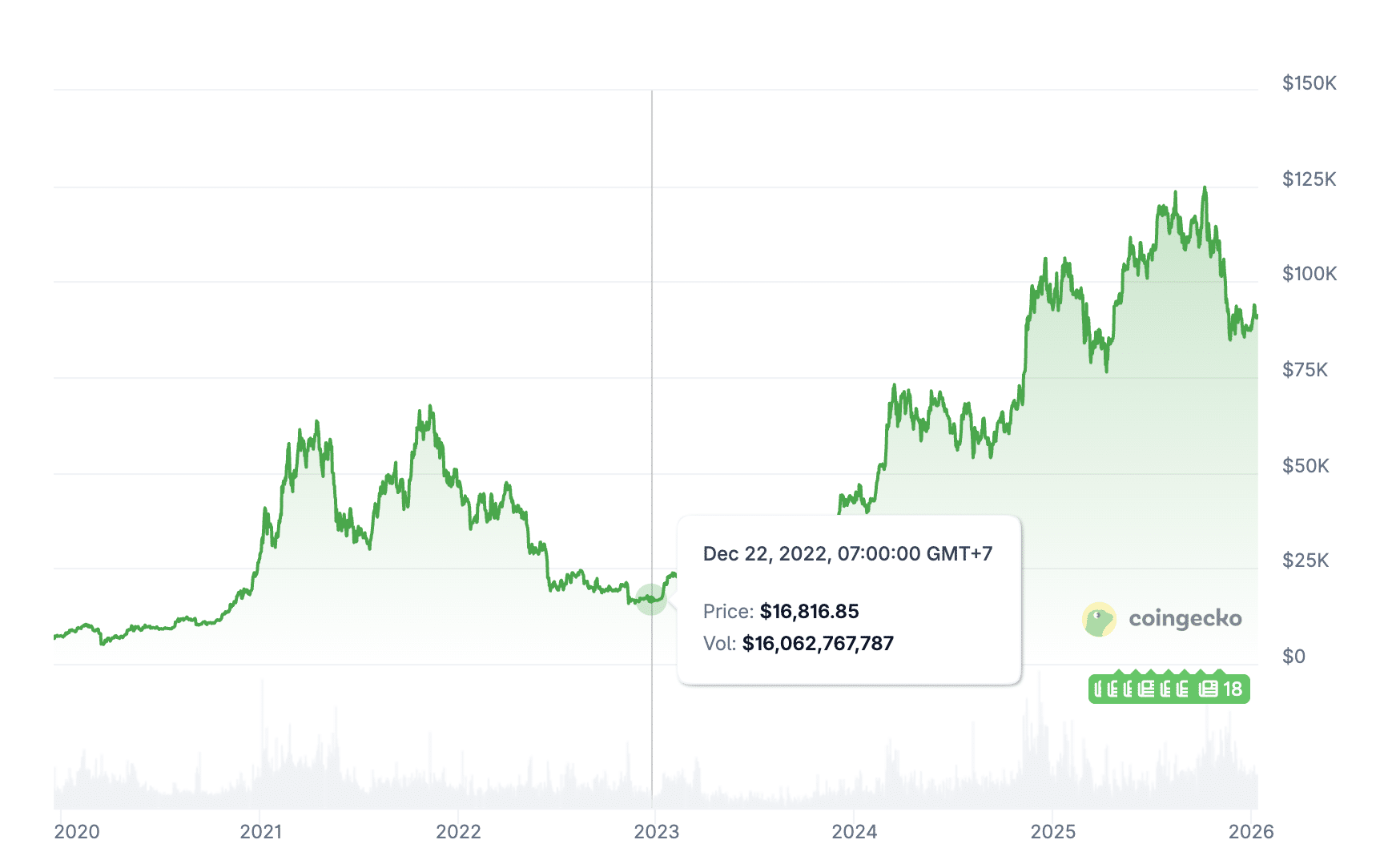

Bitcoin dropped to below $17K after the fall of exchange FTX, showing the power of black swan events. Source: CoinGecko

Bear Markets and Black Swans

In a bear market or after a black swan event, the majority of the market can drop sharply and remain at much lower levels than before. These events are hard to impossible to predict, and may leave you with permanent losses.

Should You Invest in the Best Short-Term Crypto Coins?

To make this investment decision, weigh the potential benefits against the key risks, then align it with your risk tolerance and financial goals.

The benefits are exposure to sharp short-term price movements for short-term traders and the ability to make use of narrative or event-related information.

The risks, though, are rapid and unpredictable price swings, a higher risk of losing money compared to holding or other types of financial trading, and extreme sensitivity in the crypto market to sentiment shifts, macro developments, and geopolitical world movements.

Investors should always bear in mind that history doesn’t repeat, but it often rhymes, and past performance is never a guarantee of future price action. Consider your risk tolerance and do due diligence.

Conclusion

Overall, our methodology has led us to large, established coins such as Bitcoin and XRP, which have historically retained or regained interest and are subject to volatility suitable for short-term cryptocurrency speculation.

We also chose narrative coins with good historical performance, such as in the AI sector. Established memes play an important part due to their inherent volatility, while the presales and early-stage projects we considered typically carry the highest risk but can offer short-term price spikes.

Make sure to do your own evaluation when choosing a short-term crypto, consider your financial situation, and don’t invest more money than you can afford to lose.