Discover how Zero Knowledge Proof is positioning itself for trillion-dollar data markets as Ethereum and Dogecoin lag, with analysts watching major upside ahead.

The crypto market has started 2026 with momentum with market capitalization near $3.1 trillion, and trading activity staying strong. This environment is sharpening investor focus on projects positioned to outperform.

Ethereum continues to trade on steady fundamentals with price action tied to the broader market, while Dogecoin shows brief volatility that often fades quickly. Both remain relevant, but neither stands out as a clear new breakout.

This is where Zero Knowledge Proof (ZKP) starts pulling attention for a different reason. Analysts describe it as an infrastructure-focused blockchain project built to serve real-world data demand, not just token hype. Its roadmap is framed around targeting healthcare, finance, and science sectors where compliance, privacy, and secure data access are everything.

By letting institutions monetize data without exposing ownership, ZKP taps massive dormant value, making it the best crypto to buy right now.

Zero Knowledge Proof: Enterprise-Ready Blockchain Infrastructure

Zero Knowledge Proof (ZKP) is positioned as an infrastructure-first blockchain designed to turn privacy and proof-based computing into something enterprises can actually use. Built on Substrate, it combines high-speed finality with a framework that supports zero-knowledge wrappers and regulated data flows, pushing beyond the usual retail-only narrative.

The numbers sharpen the setup. ZKP has been framed as a 17-step presale auction with a projected raise of around $1.7B, backed by a 190M daily token auction and a model aimed at wide distribution rather than quiet accumulation. That structure is exactly why some analysts have started calling it the best crypto to buy right now before broader positioning begins.

But the real edge lies in the roadmap focus. Instead of chasing memes or short-lived hype cycles, ZKP is engineered for sectors where compliance is non-negotiable, such as health records, banking risk systems, and scientific research pipelines. This is where crypto usually fails, and where ZKP is designed to succeed.

Its tiered access framework is designed to let institutions preview data through metadata, then unlock deeper layers only when trust and terms are set. That reduces the risk of IP leakage while still allowing datasets to be priced, shared, and monetized across networks that demand privacy-first guarantees.

If ZKP becomes the backend layer for even one of these industries, experts argue the valuation story changes fast, because the market being targeted is enormous and under-monetized. That’s why researchers consider it the best crypto to buy right now for investors hunting a high-upside thesis with institutional scale.

Ethereum News Update: Record Activity, Low Fees

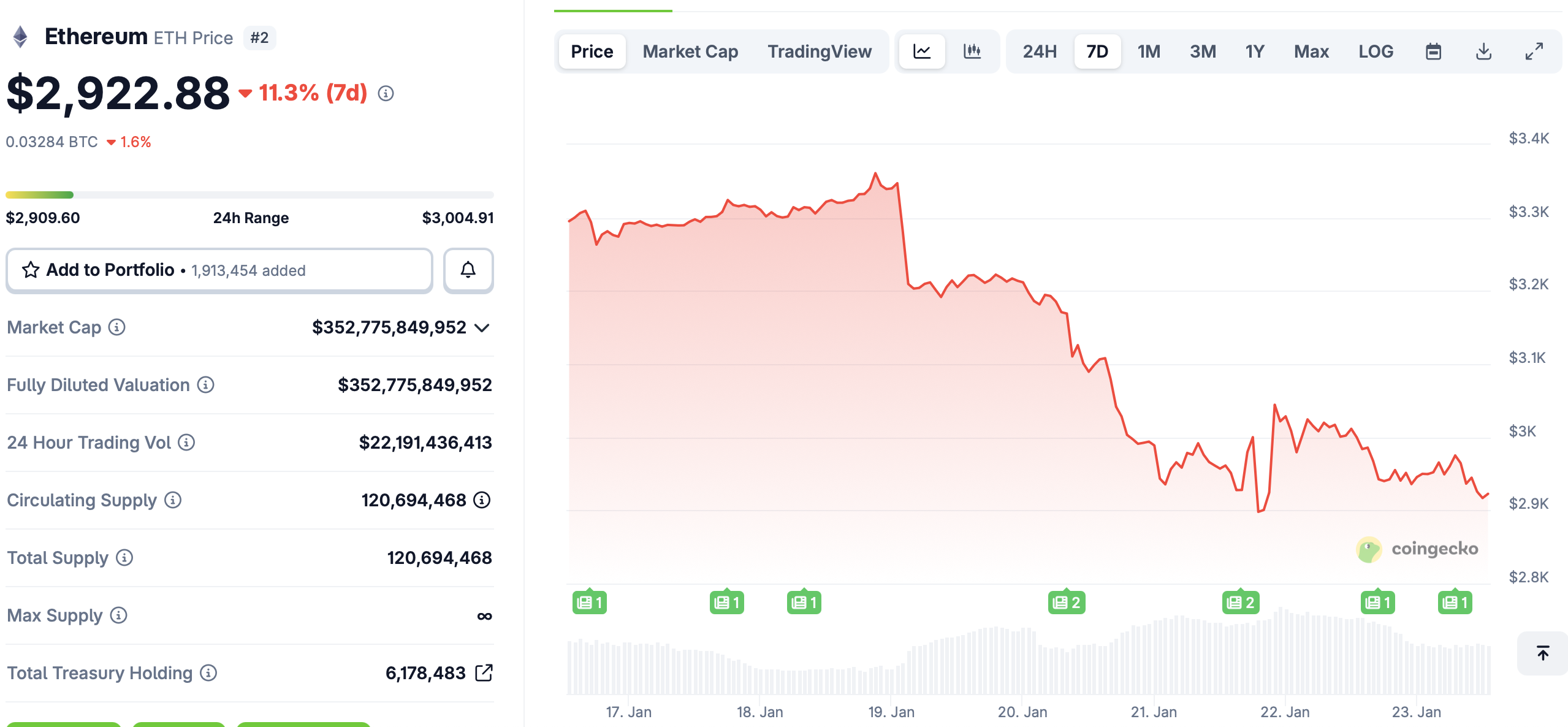

Ethereum news stayed strong on the network side even as the market cooled. At the time of writing, ETH traded near $2,900, moving with the broader risk-off mood. Even then, Ethereum still showed real usage strength. It processed around 2.8 to 2.88 million transactions in a single day, which was reported as a record level. What stood out more was that fees stayed low, with average gas costs around $0.15 to $0.18 during the same period.

Source: CoinGecko

Another key Ethereum news signal came from institutions. US-listed spot Bitcoin and Ether ETFs reportedly saw their best inflow week since October, with combined inflows close to $2 billion. On top of that, Layer-2 demand stayed healthy, with L2 total value secured sitting around $38B to $39B. Together, these numbers show Ethereum is still active and supported, even during market pullbacks.

Dogecoin Price Watch: $0.13 Break and Key Levels

Dogecoin price turned volatile on January 19, slipping around 7% and falling below the $0.13 mark. Reports linked the move to whale-driven selling, which pushed DOGE into a more cautious zone for short-term traders. After losing that level, the next key areas became clear: support sits near $0.127, while a stronger recovery would likely need a reclaim around $0.137.

Even with the drop, Dogecoin price action stays important because the coin still trades with heavy liquidity. Data around January 20 showed a market cap near $21.0B, a 24-hour volume around $1.0B, and a circulating supply close to 168.39B DOGE, with no maximum cap. In INR terms, DOGE also softened from about ₹11.66 on Jan 19 to roughly ₹11.42 on Jan 20, confirming the pullback.

Why ZKP Is the Best Crypto to Buy Right Now

Ethereum news has stayed strong on utility, with record transactions and low fees showing real network demand even during a market dip. It still looks like a core asset, but its size and maturity can limit how fast returns scale from here.

Dogecoin price action has been more aggressive, dropping below $0.13 and turning the focus to key support and reclaim levels. It remains highly liquid, but quick swings also mean upside can fade fast when momentum cools.

That gap is why experts have started admiring Zero Knowledge Proof as a unique opportunity. Analysts say its roadmap is built for regulated industries that need privacy, compliance, and secure data sharing. If it becomes the backend layer for even one of these sectors, researchers argue the upside story changes fast, which is why many call it the best crypto to buy right now.