CertiK has joined the growing list of crypto firms eying an initial public offering.

But it won’t be easy for the New York-based blockchain security firm.

Certik has come under fire from critics in recent years for auditing code for a platform linked to cybercriminals, its handling of an exploit it discovered at crypto exchange Kraken, and the hacking of its X account.

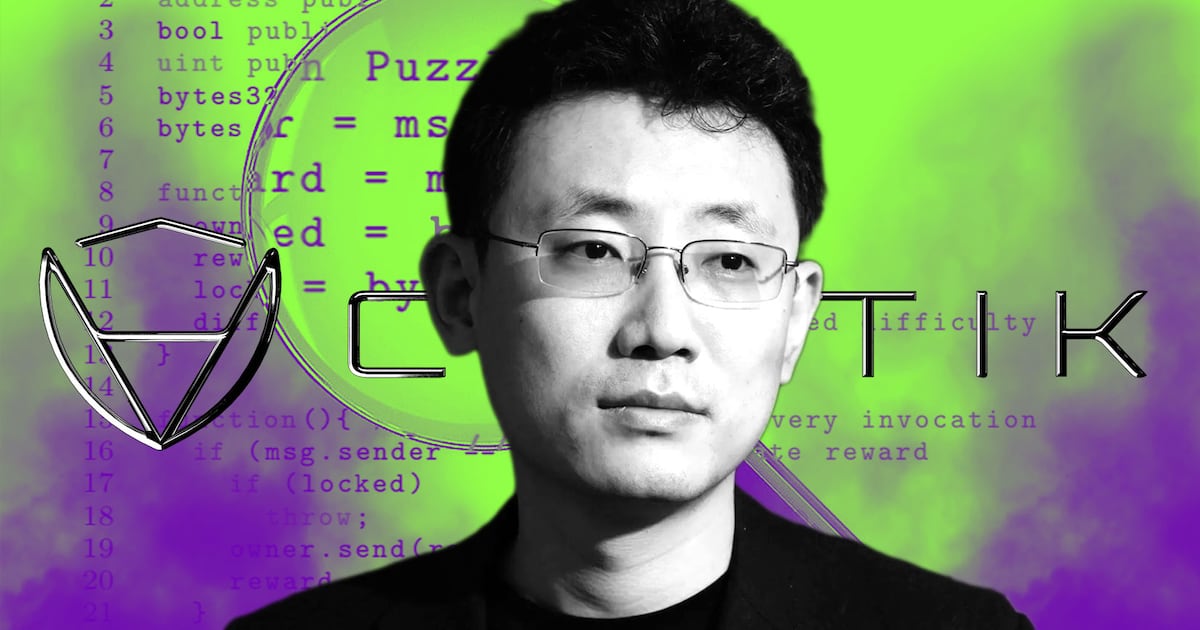

Ronghui Gu, the firm’s CEO and co-founder, is unfazed and announced the plans on Thursday in an interview with Acumen Media.

“Taking CertiK public is a natural next step as we continue scaling our products and technology,” Gu said in a statement.

“We remain focused on strengthening the trust, security, and transparency that regulators, institutions, and users expect from the Web3 ecosystem.”

IPO boom

CertiK’s announcement comes as more crypto firms look to go public amid institutional investors’ growing interest in the industry.

Last year, USDC issuer Circle’s IPO raised a whopping $1 billion from investors keen to own a slice of the burgeoning stablecoin industry.

Several more IPOs from Bullish, Gemini, Galaxy Digital, Figure, and Exodus also raised handsome sums by tapping into the demand for crypto companies.

2026 looks set to be another blockbuster year.

On Thursday, crypto custodian BitGo kicked off the year by raising $213 million from investors in its IPO.

Crypto titans Kraken, Ledger, Consensys and Aminoca Brands are all lining up their own public offerings for later in the year.

CertiK is no stranger to raising large sums of money.

The firm has collected $296 million in funding since its 2018 founding, landing a $2 billion valuation by early 2022. Investors include crypto exchange Binance, the SoftBank Vision Fund 2, Tiger Global, Sequoia Capital, and Goldman Sachs, among others.

On January 6, CertiK announced a strategic partnership with YZi Labs, the family office of Binance founder Changpeng Zhao.

“Recently Binance also made a follow up multi-eight figures investment into CertiK and became our largest investor,” Gu said in the interview.

Whether other investors will be as keen as Binance to invest in CertiK remains to be seen.

CertiK controversies

The firm has been caught up in several controversies in recent years, damaging its reputation.

In 2024, CertiK’s X account was compromised after one of its employees fell victim to a phishing attack, the firm told DL News.

Later that year, CertiK was roundly criticised after it announced its employees had discovered and exploited a $3 million bug in crypto exchange Kraken.

CertiK maintained that the incident was a “whitehat” operation designed to test Kraken’s security. It’s unclear why a business built on securing code for crypto appeared to break industry standards during the investigation and testing of the exploit.

In 2025, Certik apologised after working on a Cambodian marketplace linked to illicit activity.

The firm audited the code of a stablecoin launched by Huione Guarantee, a marketplace used by cybercriminals to launder stolen funds, buy and sell hacking tools and personal data, and whose vendors sold shock collars and stun batons for use by those running forced labour scamming compounds across Southeast Asia.

CertiK did not respond to a request for comment.