Gold’s explosive rally is once again flashing an early signal for Bitcoin, reviving a historical pattern that traders have come to associate with major crypto moves later in the cycle.

At the time of writing, gold is trading near $4,983, up roughly 1.5% over the past 24 hours and rapidly approaching the psychologically important $5,000 level. Silver has moved in lockstep, extending its own historic rally as capital continues to pour into precious metals.

Key Takeaways

Gold and silver are surging amid rising geopolitical uncertainty and a clear risk-off shift in global markets.

Gold’s advance toward the $5,000 milestone is reinforcing its role as a leading indicator for Bitcoin.

Bitcoin has reclaimed $90,000 and is consolidating near $91,000, historically a setup that has preceded strong upside moves.

The gold-Bitcoin divergence remains constructive unless gold enters a sustained correction, which could change the signal.

The surge reflects a broader shift in investor behavior as geopolitical tensions, fragile diplomatic relations, and uncertainty around global monetary policy push markets firmly into risk-off mode.

Bitcoin, meanwhile, has begun to show renewed strength. After several weeks of tight consolidation, BTC managed to reclaim the $90,000 level and is currently trading near $91,000. While the move is significant, Bitcoin’s pace still trails that of gold and silver – a divergence that has historically carried important implications for what comes next.

Gold’s Lead-Lag Signal and Why Markets Watch It Closely

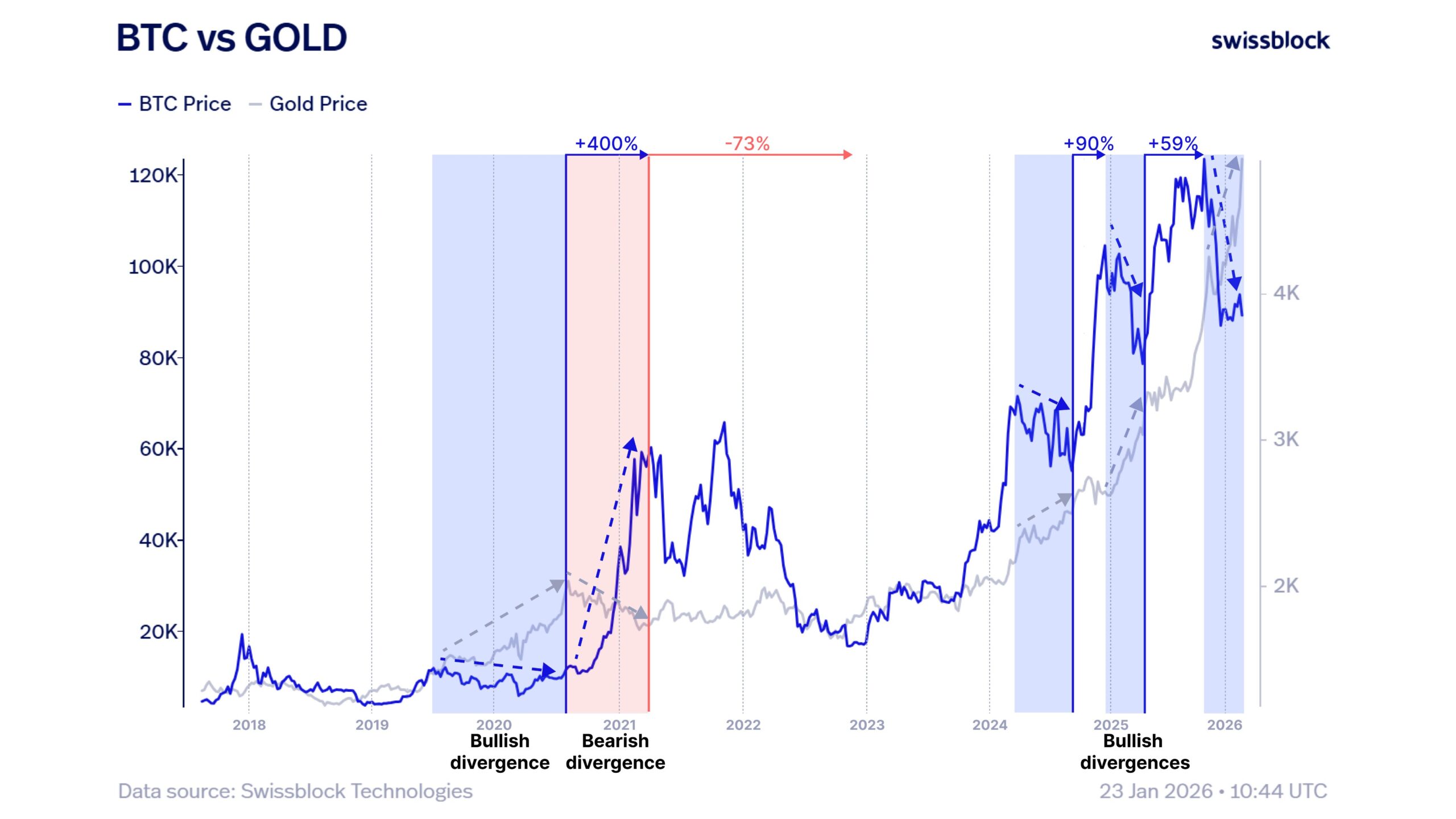

Across multiple market cycles, gold has acted as an early indicator for Bitcoin’s larger trend. When gold rallies aggressively while Bitcoin remains range-bound, it often reflects a cautious phase where investors seek safety before gradually rotating into higher-volatility assets. In these setups, Bitcoin has frequently followed with sharp, momentum-driven upside moves once confidence improves.

This relationship has repeated often enough to become a core macro signal for many traders. Gold tends to absorb early inflows during periods of stress, while Bitcoin reacts later as liquidity conditions stabilize and risk appetite returns. The current environment fits this template closely, with gold printing fresh highs as Bitcoin consolidates just below recent peaks.

Geopolitical Risk and the Rush Into Safe Havens

The latest surge in precious metals is not occurring in isolation. Heightened geopolitical uncertainty, unresolved global conflicts, strained alliances, and ongoing trade tensions have all contributed to a defensive positioning across financial markets. Investors are increasingly prioritizing assets with long-standing safe-haven status, particularly as concerns grow around central bank independence and long-term currency stability.

Gold and silver have historically benefited most from such conditions, and their current rallies reflect growing demand for hard assets that sit outside the traditional financial system. Bitcoin, while often grouped with risk assets in the short term, continues to attract attention as a longer-term hedge against monetary instability.

What History Suggests for Bitcoin’s Next Move

While the current divergence between gold and Bitcoin leans bullish for BTC, the signal is not unconditional. Past cycles also show that once gold completes a parabolic run and enters a sustained correction, Bitcoin has sometimes transitioned into late-cycle behavior. That shift has, in previous instances, marked the beginning of deeper BTC pullbacks or cycle tops – most notably during the 2020-2021 bull market.

GOLD has been in a parabolic move for 28 months straight

BITCOIN catch-up rally could be insane pic.twitter.com/uAq88iwpYg

— Ash Crypto (@AshCrypto) January 23, 2026

For now, however, gold remains firmly in an uptrend, and Bitcoin’s ability to hold above $90,000 suggests underlying demand remains intact. As long as gold continues to press higher rather than reverse sharply, the historical playbook points toward a potential catch-up phase for Bitcoin rather than an imminent breakdown.