While many widely followed altcoins to buy remain under pressure, one crypto presale token has been moving in the opposite direction.

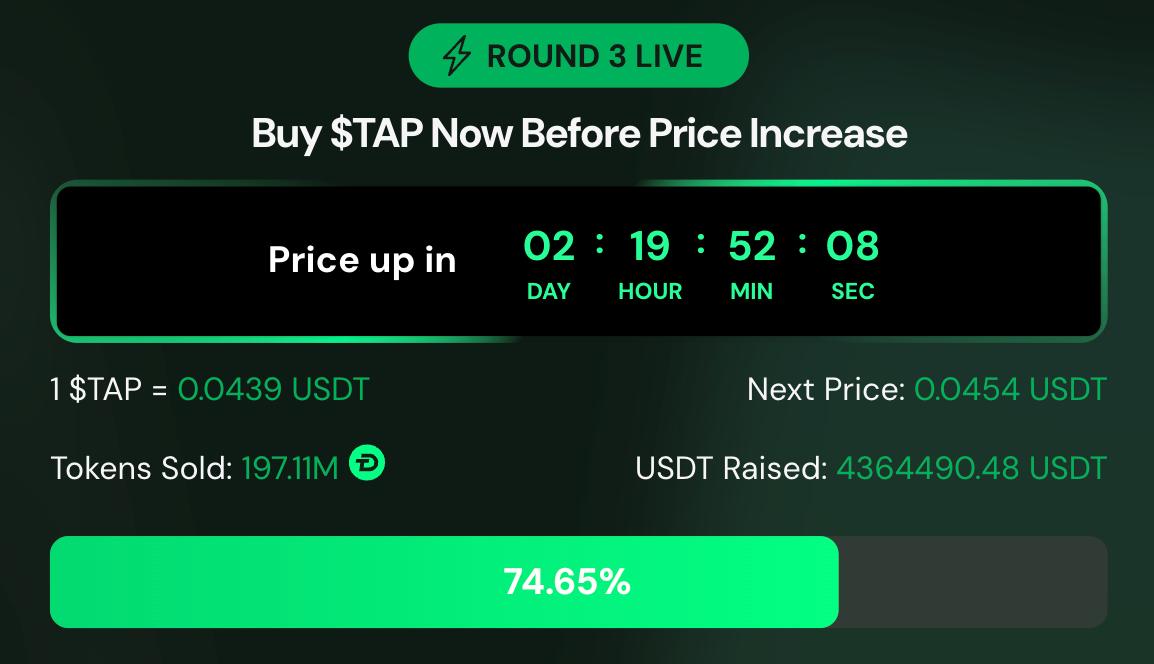

Digitap ($TAP) has gained 251% since the start of its presale, rising from $0.0125 to $0.0439, even as broader market sentiment stays cautious.

That early move hasn’t come from a single headline or short-term push. The presale has raised over $4.3 million, and the team has already set a $0.14 listing price, leaving a wide gap from today’s price.

There’s still roughly 219% upside just to listing, and if staking keeps a large share of tokens locked after launch, the same momentum that’s played out in presale could extend well beyond that. Under those conditions, a 10x move by 2026 starts to look realistic.

Post-Listing Behavior: Supply Matters More Than Sentiment

When evaluating early-stage tokens, the key variable is rarely launch-day demand. It is how supply behaves once liquidity is introduced.

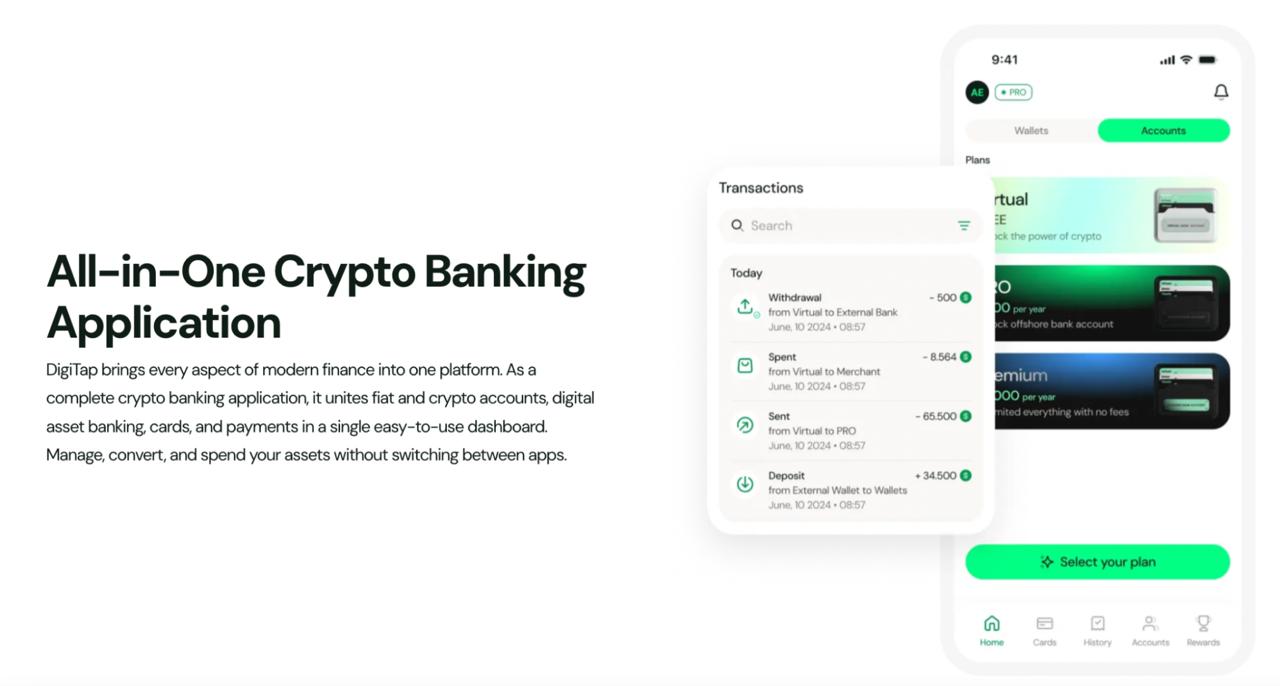

Digitap enters the market with several characteristics that materially affect post-listing supply. Total token issuance is fixed, allocation is transparent, and a large portion of circulating tokens is incentivized to remain locked through staking. This combination tends to produce a different post-listing profile compared to tokens where yield is funded through ongoing inflation.

Instead of assuming immediate distribution, the base case here is that a meaningful share of tokens remains off the market during the first phases of trading. That reduces initial sell pressure and shifts price behavior away from short-term speculation and toward gradual re-pricing as demand builds.

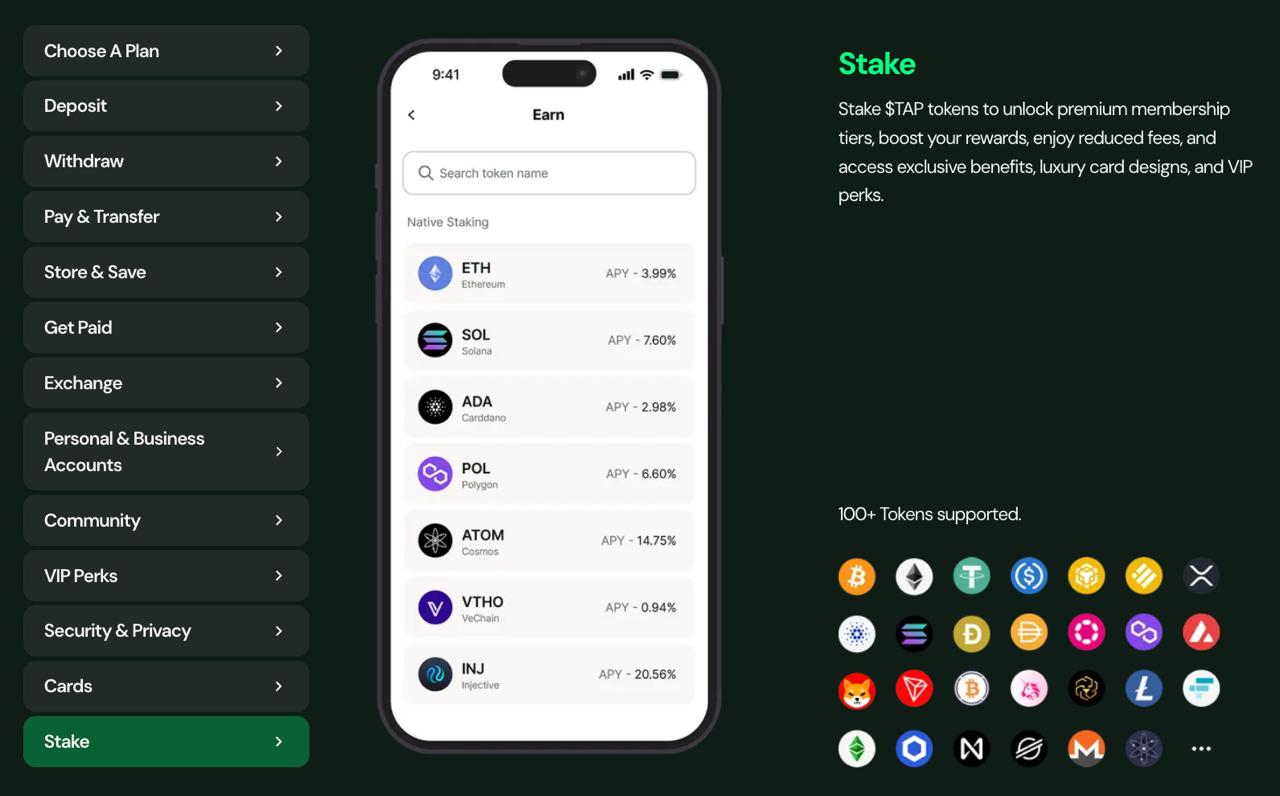

Best Altcoin To Buy For Staking: $TAP’s Model Explained

The most important variable in Digitap’s price model is staking. The design is restrictive by intent.

Staking rewards are paid from a pre-allocated pool, not through token minting. There is no automatic compounding, which prevents recursive inflation. Early exits incur penalties, with up to 25% of unclaimed rewards burned, directly reducing future supply. Longer lockups are rewarded with higher APRs, and anti-whale mechanisms limit reward concentration.

For presale participants, incentives are strongest before listing. Staking yields of up to 124% APR are available ahead of the Token Generation Event. After listing, rewards remain high, up to 100% APR, but still draw from the same capped pool.

From a price-formation perspective, this has two consequences:

Early participants are financially incentivized to hold rather than sell into initial liquidity.

Tokens that do exit staking reduce future supply through burn mechanics.

The result is a tighter effective float, even as the nominal supply remains fixed.

What A 10x Scenario for $TAP Would Actually Require

A 10x move from the current presale price would place $TAP near $0.44 by the end of 2026. This is not framed as a listing-day outcome, but as a 12–18 month scenario driven by constrained supply and incremental adoption.

$TAP has already increased 3.5x during the crypto presale. Reaching the confirmed listing price places it roughly 11x above its starting valuation. Extending beyond listing does not require exponential demand; it requires sustained participation in staking and gradual expansion in token access.

Under a base-case scenario where staking participation remains elevated and broader market conditions stabilize, a multi-fold expansion beyond listing is plausible. Under a bearish scenario, weaker adoption, lower staking participation, or prolonged risk aversion, upside would compress.

Altcoins to Buy in 2026: Where $TAP Fits

Digitap’s price trajectory to date has been driven by structure. 251% presale appreciation, defined price tiers, a fixed listing benchmark, and a non-inflationary staking system provide a measurable framework for evaluating future outcomes.

For investors assessing the best altcoin to buy for staking, $TAP’s appeal lies in how its mechanics shape supply behavior after launch. That alone makes $TAP worth close monitoring as the crypto presale progresses into its later stages.