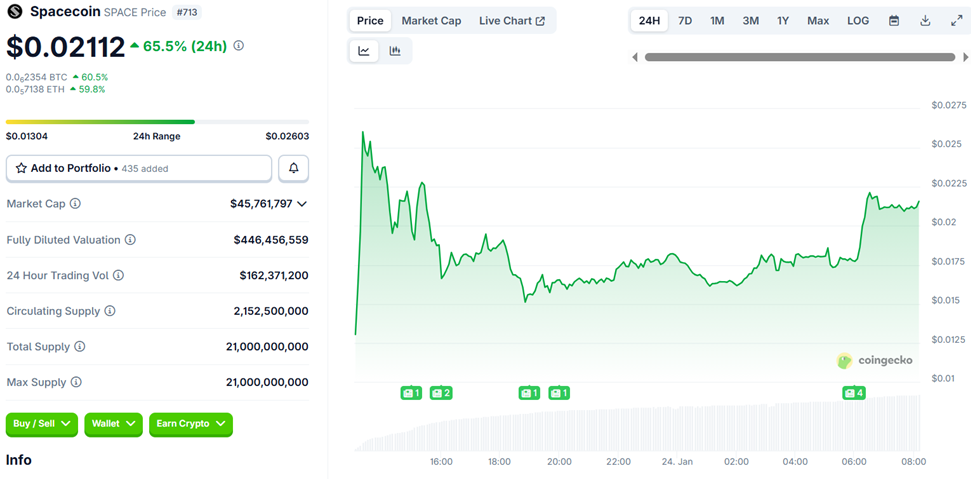

Spacecoin’s newly launched SPACE token surged more than 65%, as the project unveiled detailed plans for its Season 1 airdrop, exchange listings, and cross-chain rollout.

It marks a significant step for a venture positioning itself at the intersection of blockchain, satellite infrastructure, and telecom networks.

Spacecoin Season 1 Airdrop Plans

As of this writing, Spacecoin’s SPACE token was trading for $0.021, just shy of this peak price of $0.026 achieved amid launch frenzy. It is up nearly 66% over the last 24 hours, with prospects for further short-term gains, suggesting growing investor interest.

Indeed, investors have a lot to look forward to after Spacecoin’s announcement that SPACE is now live across multiple blockchain ecosystems, including Creditcoin, Ethereum, Binance Smart Chain (BSC), and Base.

The token launch represents what the project describes as the “economic heartbeat” of its decentralized satellite internet vision. It allows community members (Cadets) to participate directly in the emerging space economy.

Momentum is further boosted by immediate access to deep liquidity. On launch day, SPACE listed across a wide range of centralized exchanges. This includes Binance (Alpha and Futures), Kraken (Spot), OKX (Spot and Perpetuals), KuCoin, MEXC, Bitget, Coinone, Blockchain.com, and Bybit.

— Kraken (@krakenfx) January 23, 2026

The breadth of listings, spanning both spot and derivatives markets, helped amplify early trading activity and price discovery.

Decentralized trading options also went live in parallel. SPACE is available on PancakeSwap for swaps and liquidity provision.

Despite the impressive 65% rally and broad exchange coverage, the SPACE price surge remains typical of early-stage token launches fueled by airdrop hype and multi-platform listings rather than proven utility at scale.

Aster DEX Helps Ignite Spacecoin’s 65% Rally

Meanwhile, Aster DEX launched a limited-time trading campaign featuring reward pools totaling $150,000 in ASTER tokens and 15.75 million SPACE tokens.

The dual CEX-DEX strategy highlights Spacecoin’s push for broad accessibility. It mirrors its stated goal of building an internet layer without geographic or financial barriers.

At the center of the excitement is the Season 1 airdrop, designed to reward early supporters who engaged with the Spacecoin ecosystem before token generation (TGE).

Eligible participants can now claim their allocations through the official claims portal by connecting the wallets they used during the campaign. To reduce friction, Spacecoin is distributing 0.01 CTC (Creditcoin) to eligible wallets to cover gas fees during the claim process.

Notably, however, the airdrop comes with strict eligibility criteria and anti-abuse measures.

Participants must have held specific assets such as CTC, WCTC, or designated NFTs.

They must have also completed social missions and event activities during the open period.

Accounts flagged for suspicious behavior would be excluded, ensuring rewards go to genuine community members rather than bots.

Token unlocks are structured to limit immediate supply pressure. For Season 1, 25% of rewards unlock at the TGE, with the remainder vesting monthly over three months.

Will the Hype Last?

Beyond trading and airdrops, Spacecoin also launched a limited-time staking program offering a 10% APR for SPACE tokens on the Creditcoin network alongside cross-chain transfers powered by Wormhole.

Together, these features position SPACE as a multi-chain asset designed for both speculation and long-term participation.

Nevertheless, while Season 1 airdrop’s partial unlock (25% at TGE) and anti-abuse filters are positive steps to curb dumps, vesting schedules across seasons could still create staggered selling pressure as recipients cash out rewards.

Additionally, high trading volumes on day one often signal speculative froth more than sustained demand.

Overall, the fundamentals remain strong for Spacecoin. Yet, its launch rally is still largely driven by speculation, and nearly 90% of all airdropped tokens fail within the first 3 months. Maintaining a positive price structure within this period would be crucial for the SPACE token.