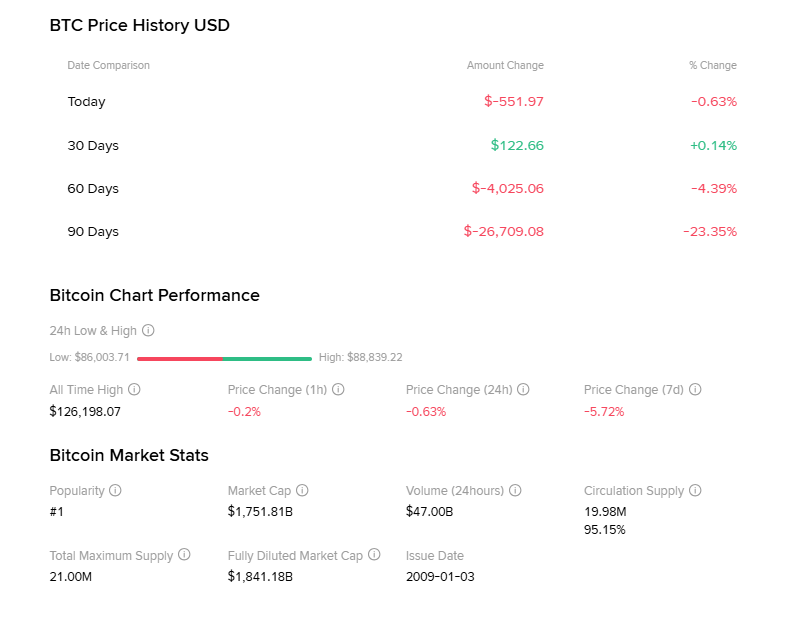

ChatGPT predicts that the Bitcoin price prediction could soon enter a new phase of growth as institutional demand builds and ETF inflows accelerate. Trading above $87,600, Bitcoin’s price has shown unusual resilience despite macro headwinds.

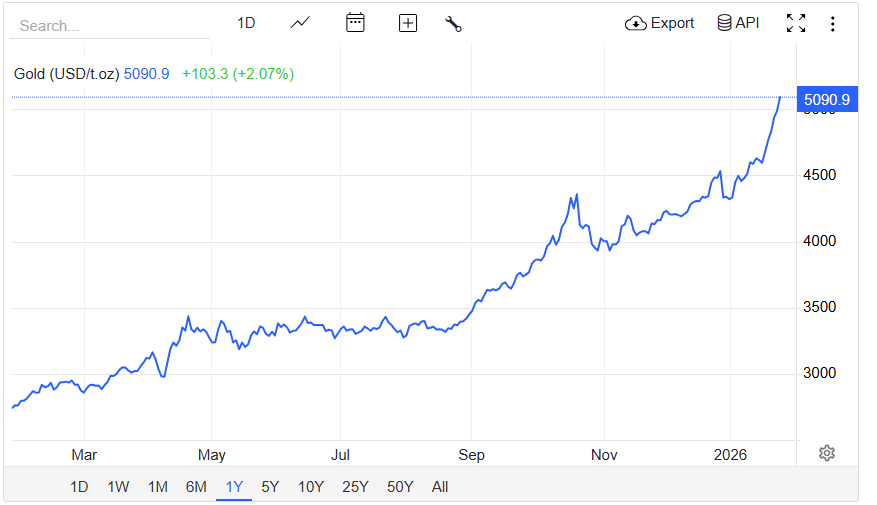

At the same time, gold has crossed $5,000 per ounce, reinforcing its role as a traditional safe haven. This rare moment of convergence has sparked a wider discussion about the changing dynamics between digital and physical stores of value.

With the U.S. debt at historic highs and monetary easing on the table, investors are now watching both assets for signs of the next breakout.

Bitcoin Strengthens as ETF Demand and Network Activity Surge

Bitcoin’s current price action is backed by more than speculation. On-chain data shows a notable rise in active addresses, signaling renewed user activity.

Meanwhile, spot Bitcoin ETFs have attracted over $15 billion in inflows since their approval, according to industry trackers – a historic milestone for mainstream adoption.

These inflows reflect rising institutional interest and long-term accumulation, particularly from wealth managers reallocating portfolios. ChatGPT predicts that if current demand holds,

Bitcoin could test the psychological $100,000 level in the first half of 2026. The volatility remains, but the presence of large buyers is providing strong support near $85,000, a level previously considered overextended.

Gold Extends Gains as Fiscal Pressure Drives Safe-Haven Flows

Gold’s recent climb to $5,094 per ounce continues a powerful trend driven by sovereign accumulation, ETF buying, and macro risk aversion. With a 64% rise in 2025, gold outperformed nearly every major asset class.

Analysts cite the $1.8 trillion U.S. budget deficit, inflationary pressures, and geopolitical instability as key drivers. As the dollar’s purchasing power weakens, gold has once again become the asset of choice for capital preservation.

ChatGPT predicts that unless policy makers move aggressively to shrink the deficit, gold prices could remain elevated – with some forecasts suggesting a move toward $5,500 by mid-year.

Bitcoin Fundamentals Improve Despite Supercycle Debate

The Bitcoin market is also benefiting from tightening supply dynamics, making it the next crypto to explode. Exchange balances continue to decline, suggesting that large holders are moving BTC into cold storage.

Miner selling pressure has dropped significantly as fees increase, allowing mining firms to hold more reserves. Moreover, Bitcoin’s hash rate reached an all-time high, a sign of network security and confidence among miners ahead of the next halving.

While figures like CZ have cast doubt on the four-year cycle narrative, others argue that the current cycle is not broken – it’s simply evolving. ChatGPT predicts that if institutional allocations rise further, Bitcoin may see a smoother ascent with fewer dramatic corrections.

Gold vs Bitcoin: Diverging Paths, Shared Drivers

Although both assets have risen in tandem at times, their underlying narratives are now diverging. Gold thrives on fear and monetary debasement, while Bitcoin is increasingly linked to tech adoption, digital infrastructure, and financial innovation.

Still, both benefit from the expansion of money supply, which has climbed sharply since 2020. Charts tracking M2 money supply vs. gold suggest a clear correlation, and Bitcoin may follow a similar pattern if investor trust strengthens.

With traditional asset yields under pressure, crypto-native and institutional investors alike are exploring Bitcoin not just as a hedge, but as a high-beta macro asset.

ChatGPT Predicts $92K Resistance Next as Sentiment Turns Cautious

In the near term, ChatGPT predicts Bitcoin will likely test $92,000, but profit-taking and macro noise could keep it in a tight range.

Traders are watching for a breakout above that zone to confirm a bullish continuation in the best long-term cryptos. Funding rates have normalized, and volatility has declined slightly – signs of a healthier market structure.

ETF inflows, increasing hash rate, and stronger HODL behavior form a bullish trifecta that wasn’t present during past tops. If U.S. inflation data softens and equity markets stabilize, Bitcoin may outperform traditional risk assets in Q2.