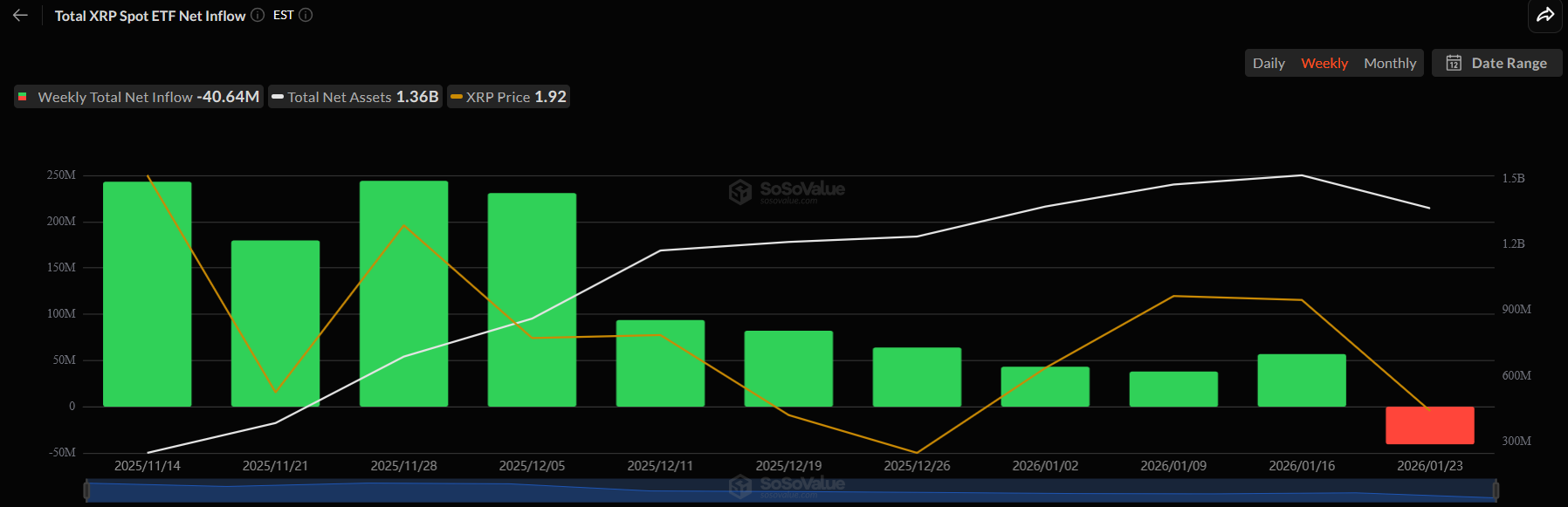

The XRP price forecast has turned cautious as XRP-linked ETFs recorded their first week of net outflow. Over $40 million in ETF outflows in the past week indicated reduced institutional demand and increasing bearish sentiment among investors.

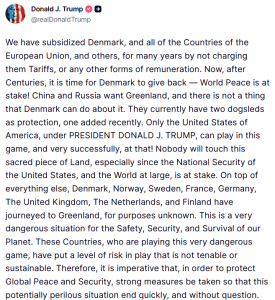

Increasing geopolitical risk in global markets is making investors even more cautious. Trade policy uncertainty has resurfaced after U.S. President Donald Trump suggested imposing tariffs on several European NATO members over renewed disputes involving Greenland and NATO burden-sharing.

Meanwhile, stronger U.S. economic data and cautious Fed commentary have reduced expectations of quick rate cuts in 2026. The Bank of Japan has also maintained a hawkish policy stance, signaling tolerance for yen strength and reducing expectations of liquidity easing. These indicate potentially reduced global liquidity and a weakening of investor risk appetite for crypto.

Additionally, ongoing uncertainty around U.S. crypto legislation is keeping XRP under significant pressure as the asset has a history of regulatory sensitivity. The U.S. Crypto Market Structure Bill was delayed in Congress in January 2026 as the Senate Agriculture Committee and the Senate Banking Committee postponed draft releases, pushing back the timeline for regulatory clarity.

Amid the rising U.S. policy risk and macro uncertainty, XRP’s price forecast has turned bearish, and it is struggling to hold above the $2 psychological level.

XRP ETF Outflows Signal Weakening Institutional Demand

Over $40 million in XRP ETF outflows last week suggests declining institutional confidence. The ETF flow pattern has quickly shifted to net outflows after months of strong inflows, adding considerable bearish pressure on the XRP price.

XRP ETFs have witnessed a steady decline in inflows since November 2024, but weekly flows turned negative for the first time since the products launched. This highlights a major turning point as institutional investors who were aggressively accumulating XRP are now selling and reducing their exposure.

The sudden reversal in XRP ETFs demand aligns with broader crypto market bearish sentiment and increased outflows in BTC and ETH ETFs.

If the outflow trend continues, selling pressure for XRP could increase drastically during broader market dips and when liquidity dries up. This would make it harder for the XRP price to sustain potential rallies.

Macro Headwinds Reduce Risk Appetite for Crypto

Tighter global monetary conditions are reducing liquidity and weighing on speculative assets like XRP. Recent U.S. economic data has shown resilience in key indicators such as inflation, employment, and consumer spending. As a result, there are reduced expectations for aggressive rate cuts by the Federal Reserve.

According to forecasts from the Congressional Budget Office and the Federal Reserve, short-term borrowing costs are expected to remain high in 2026. This has reduced the appeal of high-risk assets such as crypto, prompting investors to rotate toward safer securities. Fed commentary remains cautious. Comments from Fed officials have suggested that easing monetary policy is not imminent despite geopolitical risks and trade uncertainties.

Further adding to the macro headwinds is the Bank of Japan’s evolving stance and liquidity impact. The BOJ has recently kept its policy rate steady at a higher level and updated its growth and inflation forecasts, signaling a hawkish tilt in its monetary policy outlook.

U.S. Regulatory Uncertainty Remains a Key XRP Risk

Delayed U.S. crypto legislation continues to weigh heavily on XRP due to its regulatory sensitivity. The Crypto Market Structure Bill, which would provide clear definitions and regulatory frameworks for digital assets like XRP, has repeatedly been delayed by the Senate Banking and Agriculture Committees.

The Senate Banking Committee had scheduled the bill for markup on January 15, 2026, expected to be a key first step toward advancing the bill after many years of debate. However, it has now been delayed until late February or March, leaving investors and market participants frustrated and adding to bearish sentiment.

The effect is especially large on XRP as it is no longer trading as a purely speculative token but as a regulated, macro-sensitive asset.

XRP Price Forecast: Can XRP Rebound From $1.8?

XRP is struggling to hold above the $2 psychological support amid sustained selling pressure. The crypto has been trading in a sideways pattern for over a year, since December 2024, and has spent the majority of this time stuck in the $1.8-$2.7 range.

At the start of 2026, XRP surged by over 30% within a week, reaching a high of $2.4 on January 6, on rising inflows. After a decline from this high over the past few weeks, XRP has fallen back to the $1.8 key breakdown zone, trading in a consolidated price action as it struggles to regain momentum.

Technical oscillators highlight increasing bearish momentum. The MACD is well below the zero line and continues to decline sharply. While the RSI oscillator shows a value of 41, indicating significant downside room before XRP would be considered oversold.

The bearish XRP price forecast points to a drop below $1.8 unless the broader market rebounds and bullish momentum returns. The outlook may improve if ETF flows stabilize, macro risks ease, and regulatory clarity improves. However, the $2 level remains the key psychological level, and XRP is in the further downside risk zone until conditions improve.