BlackRock is looking to expand its bitcoin product lineup with a proposed iShares Bitcoin Premium Income ETF, according to a Securities and Exchange Commission filing dated Jan. 21.

How the fund would work

The registration statement describes a fund that would hold bitcoin directly to track the asset’s price, similar to BlackRock’s existing iShares Bitcoin Trust.

Alongside spot exposure, the fund would pursue an actively managed covered-call strategy.

That approach would involve selling call options to collect option premiums as income.

Where the yield comes from

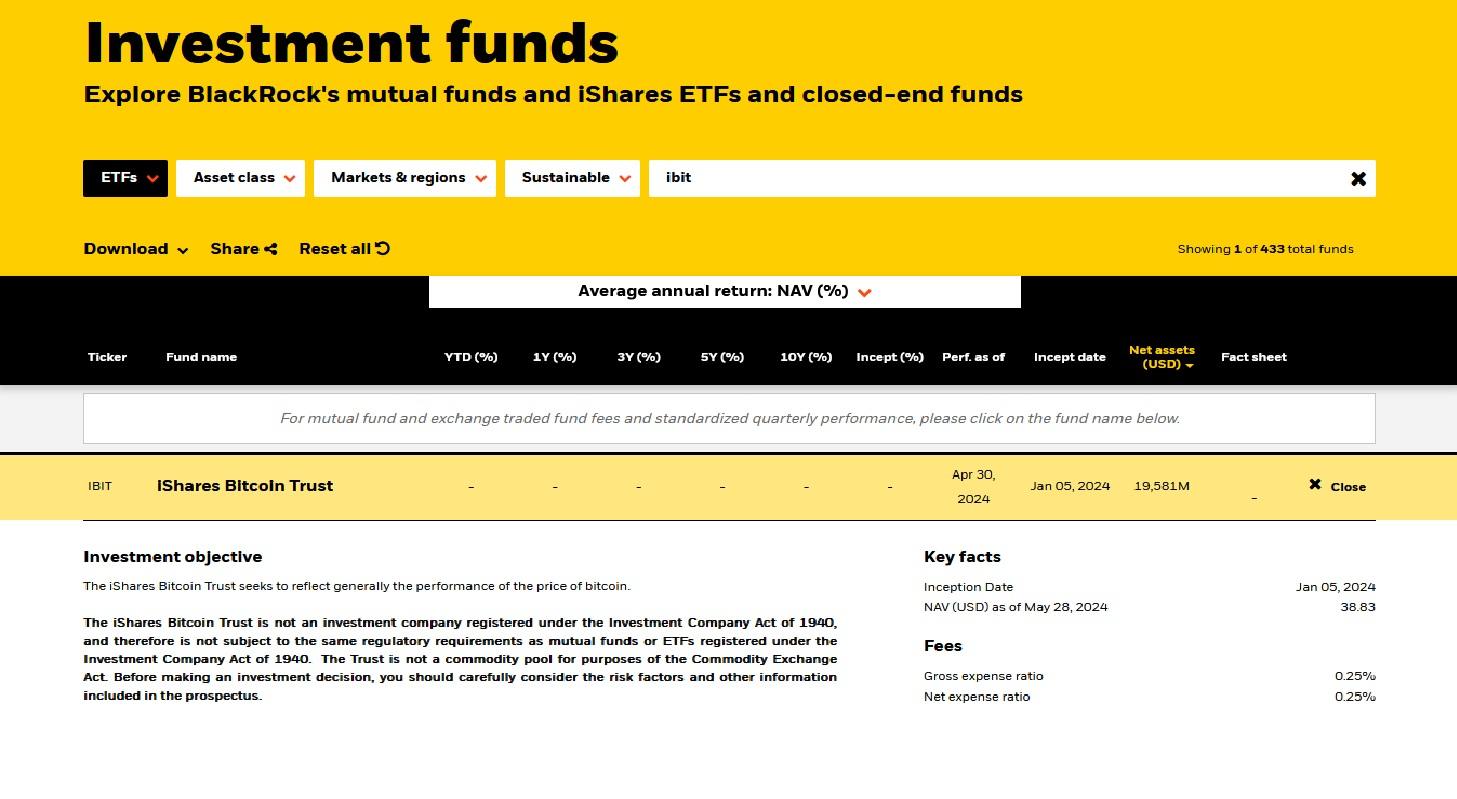

According to the filing, the investment adviser would primarily sell call options on shares of BlackRock’s iShares Bitcoin Trust, IBIT.

The strategy may also use options tied to other bitcoin-tracking exchange-traded products or related indices.

The fund does not yet have a ticker.

Context in the ETF market

Covered-call products generally trade some upside potential for periodic income.

The filing frames the structure as a way to add yield-generation to spot bitcoin exposure, in contrast to some Ethereum or Solana funds that generate income through staking.

BlackRock’s Nasdaq-listed iShares Bitcoin Trust is the largest spot bitcoin fund, with about $69.75 billion in assets under management.

The firm’s spot bitcoin and Ethereum ETFs have also been among the fastest-growing funds on record.

What BlackRock said in the filing

The filing describes the fund’s income approach as a covered-call strategy:

“To generate yield, the fund’s investment advisor will actively sell call options, primarily on IBIT shares, though sometimes on other Bitcoin-tracking ETP indices, capturing those option premiums as income.”