Bitlight price predictions attract more and more attention from beginner investors who look for the next simple crypto story. In mid-January, the price of Bitlight stood near $0.6. In the last month, the token showed strong moves. The monthly low reached $0.43 on December 30. The monthly high jumped to $4.8 on December 22. This range shows how fast this market can change.

Many new users now ask a simple question. Is LIGHT a good investment, or is it only short-term hype? This article gives clear and honest answers. It explains what Bitlight is, how it works, and why its price moves so much. It also covers Bitlight price predictions for the coming years in a way that anyone can understand.

You will learn what affects the price of LIGHT and what experts think about its future. You will also see possible scenarios for 2026, 2030, and even 2050. If you are new to crypto, this guide will help you decide with more confidence and less stress.

| Current LIGHT Price | LIGHT Price Prediction 2026 | LIGHT Price Prediction 2030 |

| $0.6 | $0.88 | $3.55 |

Bitlight (LIGHT) Overview

Bitlight (LIGHT) is an infrastructure project built by Bitlight Labs. The main goal is to expand what Bitcoin can do. The project uses the RGB protocol and the Lightning Network. This setup allows native smart contracts and asset tokenization on top of Bitcoin. In simple words, Bitlight wants to bring DeFi, tokens, and modern apps to the most secure blockchain in the world.

The LIGHT token works as both a utility and governance asset. Users pay fees with it. They also use it for voting and staking. This makes the token an important part of the whole ecosystem.

Bitlight Labs stands behind the project. It is the largest development team working on the RGB protocol. RGB has been in development since 2016 and reached mainnet in 2023. Key contributions came from Dr. Maxim Orlovsky and Pandora Core AG. The company raised seed funding in 2024. In September 2025, it closed a $9.6 million Pre-A round with a valuation of $170 million. The LIGHT token launched at the end of September 2025. It appeared on exchanges like Binance, WEEX, and MEXC.

The system combines two powerful technologies. The Lightning Network acts as a Layer 2 for fast and cheap payments. RGB adds smart contracts with client-side validation. This means data stays off-chain. It stays private and scalable. Bitlight builds tools like the RGB Lightning Network Node, developer SDKs, special wallets, and infrastructure for stablecoins and Bitcoin DeFi.

The mission stays clear. Bitlight wants to unlock DeFi, fiat tokenization, and stablecoin payments on Bitcoin. It focuses on speed, privacy, and scale. The roadmap covers strong ecosystem growth between 2025 and 2027, with planned token unlocks starting in March 2026.

LIGHT Price Statistics

| Current Price | $0.6 |

| Market Cap | $25,875,630 |

| Volume (24h) | $6,128,434 |

| Market Rank | #649 |

| Circulating Supply | 43,056,972 LIGHT |

| Total Supply | 420,000,000 LIGHT |

| 1 Month High / Low | $4.81 / $0.43 |

| All-Time High | $4.81 Dec 21, 2025 |

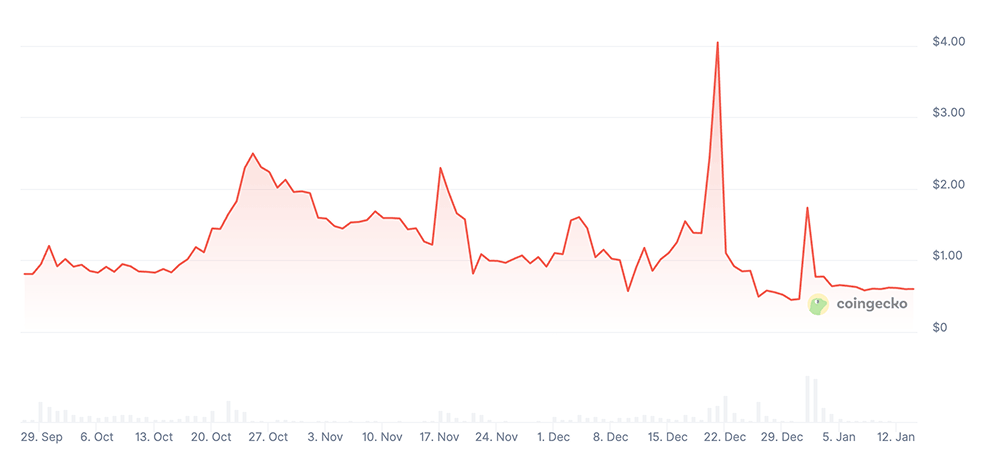

LIGHT Price Chart

CoinGecko, January 13, 2026

Bitlight Price History Highlights

Bitlight (LIGHT) entered the crypto market on September 27, 2025. From the first day, the token showed extreme moves. Trading started near $1.2. Very fast, strong selling pressure appeared. Many early users sold their airdrop tokens. Because of this, the price fell to about $0.53 in the first days. Still, the market soon tried to stabilize, and interest around Bitcoin Layer-2 projects started to grow.

In October 2025, LIGHT recorded its first strong rally. More investors noticed the RGB protocol and the Lightning Network idea. The price moved higher during the month and reached about $2.77 on October 21. This move showed that speculation around the project stayed strong. After this peak, the market started to cool down.

November 2025 brought a period of slow decline and consolidation. The token moved mostly between $1.12 and $1.18 at the start. Later, it drifted lower. By the end of November, the price fell to around $0.92. Many traders waited for new news or a strong catalyst.

At the start of December, momentum returned. The price moved between $1.06 and $1.76 in the first days. On December 19, it reached about $2.43. This was only the beginning of the biggest move in the token’s history. On December 20 and 21, two events changed everything. The project released the RGB whitepaper and gained a new major exchange listing. The price jumped to about $4.18 and then reached a record high near $4.8. Trading volume exploded to over $1.5 billion in one day.

The rally ended very fast. On December 22, the token crashed by more than 70%. The price fell from around $4.80 to about $1.40 in one day. Panic followed. Selling continued during the next days. On December 30, LIGHT reached its lowest level near $0.43. This meant a drop of almost 90% from the top.

On December 31, a strong rebound appeared. The price jumped more than 260% and reached about $1.67. The move continued into January 1, when the token touched about $2.46. After that, the market cooled again. By January 13, 2026, the price returned near $0.6.

Bitlight Price Prediction: 2026, 2027, 2030-2050

| Year | Minimum Price | Maximum Price | Average Price | Price Change |

| 2026 | $0.80 | $1.08 | $0.88 | +46% |

| 2027 | $1.14 | $1.52 | $1.27 | +111% |

| 2030 | $2.79 | $4.57 | $3.55 | +492% |

| 2040 | $401.82 | $485.99 | $429.88 | +71,500% |

| 2050 | $565.79 | $665.92 | $594.36 | +99,000% |

Bitlight (LIGHT) Price Prediction 2026

According to DigitalCoinPrice, Bitlight could trade between $0.8 (+35%) at the lower end and $1.08 (+80%) at the peak in 2026. This forecast suggests a gradual recovery and steady adoption of the project after its early market phase.

PricePrediction presents a very similar outlook. Their models estimate a minimum price of $0.84 (+40%) and a maximum of $1.06 (+75%), with the average price hovering around current resistance levels. Both sources point to a year of stabilization and moderate growth.

Bitlight (LIGHT) Price Prediction 2027

DigitalCoinPrice expects Bitlight to continue its upward trajectory in 2027, with prices ranging from $1.14 (+90%) to $1.43 (+140%). This scenario assumes increasing usage and a more mature market presence.

PricePrediction aligns closely with this view. Their forecast places LIGHT between $1.24 (+110%) and $1.52 (+155%), suggesting that 2027 could mark a stronger breakout phase driven by broader adoption and improved market sentiment.

Bitlight (LIGHT) Price Prediction 2030

By 2030, DigitalCoinPrice estimates that Bitlight could trade between $2.79 (+365%) and $3.67 (+510%), reflecting long-term ecosystem growth and wider market expansion.

PricePrediction is even more optimistic. Their projections indicate a minimum of $3.87 (+545%) and a maximum of $4.57 (+660%), assuming Bitlight secures a solid position within its sector and benefits from a full market cycle.

LIGHT Coin Price Prediction 2040

PricePrediction’s long-term outlook for 2040 is extremely bullish. According to their forecast, Bitlight could reach between $401.82 (+66,900%) and $485.99 (+80,900%), assuming massive global adoption and a dominant role in future blockchain infrastructure.

Bitlight Price Prediction 2050

Looking even further ahead, PricePrediction estimates that LIGHT could trade between $565.79 (+94,200%) and $665.92 (+111,000%) by 2050. This scenario assumes Bitlight becomes a major long-term player in the crypto ecosystem and benefits from decades of network growth and compounding adoption.

LIGHT Price Prediction: What Do Experts Say?

Many analysts and research teams have already shared their views on Bitlight. Most of them agree on one point. The project shows strong potential, but it also carries clear risks. In November 2025, Phemex published a technical analysis that described LIGHT as short-term bullish. The chart showed higher highs and higher lows, which often signal growing demand. At the same time, the token traded in a very volatile range. Analysts pointed to high utility potential but warned about future token unlocks. They marked the $1.2 to $1.3 zone as key support and the $2.3 to $2.7 zone as strong resistance. Their main message stayed simple. As long as the price holds above support, buyers keep control.

Around the same time, the Bitrue research team released a broader forecast. They combined technical and fundamental data. For 2025, they expected prices between $1.8 and $2.8. They saw $2.4 as a fair average level. Their bullish scenario suggested a move above $3 if adoption keeps growing. For 2026, they projected a range of $2.6 to $3.8. They also believed the uptrend stays valid as long as the price holds above $1.8. Looking further, they estimated a range of $3.5 to $5 for 2027. They linked earlier price surges to the launch of new tools that improved privacy and Bitcoin-based settlement.

In January 2026, analyst Dipayan Mitra published a different type of forecast using machine learning models. His analysis predicted a peak near $1.15 in 2026 with an average close to $0.96. For 2028, he expected prices above $2.40. For 2029, the model pointed to levels near $3.00. By 2030, the projected peak moved close to $3.70. These estimates focused on technical patterns and historical data. The study still described LIGHT as a strong long-term adoption candidate.

In December 2025, AInvest also shared a positive view. Their editors highlighted that LIGHT outperformed Bitcoin during a volatile period. They linked this to governance use, staking, and ecosystem incentives. They also pointed to strong funding and a $170 million valuation. At the same time, they warned again about token unlocks and regulation.

LIGHT USDT Price Technical Analysis

Bitlight (LIGHT) now trades in a bearish consolidation phase after strong selling pressure during the last two to three months. The current price stays near the $0.6 area across most exchanges. Market data shows high risk. Volatility remains very high. It now sits above 69%. This means the price can move fast in both directions. At the same time, the general structure still looks weak.

The market cap stays near $26 million. Daily trading volume moves between about $7 and $12 million. Only around 43 million tokens circulate. This equals just over 10% of the total supply. The token also ranks far from the top assets. This explains why price swings feel so sharp and sudden.

Recent performance confirms the bearish trend. Over the last 30 days, the price fell by almost 17%. Over 60 days, the drop reached nearly 60%. The last 90 days show a deep drawdown from much higher levels. This tells a simple story. Sellers still control the market.

All major moving averages send a sell signal. The price trades far below short and long averages. The 50-day average near $1.08 now acts as a strong wall. Any real trend change would need a move above this level. Until that happens, the trend stays down.

Momentum indicators give mixed signals. The RSI stays near the middle zone. This means the token is not oversold yet. It also shows weak buying pressure. The Stochastic RSI sits in an overbought area for the short term. This often signals another pullback. The MACD shows no clear direction. General momentum still points down.

Support and resistance levels stay clear. The nearest support sits near $0.6. The most important lower support stays near $0.5. A break below this zone could start another strong drop. On the upside, resistance appears near $0.64, $0.66, and $0.73. The $0.88 and $1.08 levels remain major barriers.

Volume data adds another warning sign. Futures trading volume is much higher than spot volume. This shows heavy leverage and strong speculation. High open interest means forced liquidations can appear fast. This also explains the extreme volatility.

Market sentiment remains bearish. The fear index shows fear. Many traders already left the market. Still, such conditions can also build the base for future rebounds. For now, the chart suggests patience. A break above $0.64 could bring short relief. A drop below $0.5 would likely open the door to another sell-off.

What Does the LIGHT Price Depend On?

The price of Bitlight depends on many simple factors. Some come from the project itself. Others come from the wider crypto market. When these elements change, the price of LIGHT usually follows.

The most important factor is Bitcoin. Bitlight builds on Bitcoin and the Lightning Network. When Bitcoin grows, interest in Bitcoin Layer 2 projects often grows too. When Bitcoin falls, most smaller tokens also fall. This creates a strong link between LIGHT and the general Bitcoin trend.

Technology progress also matters a lot. Investors watch if the team delivers new tools. They care about wallets, RGB integrations, and Lightning features. Real products build trust. Delays or bugs hurt confidence and push the price down.

Another key factor is token supply. Only a small part of all tokens is in circulation. New tokens will unlock in the future. This can create selling pressure. Many traders sell before or during unlock events. This often causes short-term drops.

Market demand plays a major role. Demand grows when more people use the network. It also grows when new exchanges list the token. It grows when partnerships appear. Without new users, even good technology cannot hold the price.

Some important drivers include:

Bitcoin market trend and sentiment.

New product launches and roadmap delivery.

Token unlock schedule and emission rate.

Exchange listings and trading access.

Growth of the Bitlight ecosystem.

Speculation also moves the price. LIGHT is still a small token. Small tokens move fast. Futures trading and leverage increase volatility. This can cause strong pumps and deep crashes in a short time.

Media and social networks also influence price. Positive news can bring fast inflows. Negative news can start panic selling. This effect stays strong in young projects.

Finally, long-term value depends on real usage. If Bitlight becomes useful for payments, stablecoins, and Bitcoin DeFi, demand may grow. If adoption stays weak, price will struggle no matter how good the idea sounds.

Bitlight (LIGHT) Features

Bitlight brings a set of technical features that focus on one clear goal. It wants to expand Bitcoin without changing Bitcoin itself. The project builds on the RGB protocol and the Lightning Network. This allows advanced functions while keeping Bitcoin secure and simple.

One of the most important features is RGB protocol integration. RGB introduces smart contracts built for Bitcoin. These contracts use a method called client-side validation. This means users validate data on their own devices. The network does not store heavy contract data on-chain. Because of this, the system stays fast, private, and scalable.

Client-side validation reduces data load on the network. It also keeps full cryptographic security. Each user can verify the state of assets without trusting a central party. This design fits well with Bitcoin’s philosophy.

Bitlight also uses a UTXO-based architecture. It binds asset states directly to Bitcoin transactions. This makes assets as secure as Bitcoin itself. It also keeps the system fully decentralized and resistant to changes.

Another key feature is single-use seals. Each asset state links to one unique Bitcoin output. Once spent, it cannot be reused. This prevents double spending without the need for global consensus or heavy on-chain checks. It is a simple and strong security model.

Lightning Network integration adds speed and low fees. Users can send RGB assets almost instantly. Costs stay very low. This solves Bitcoin’s normal limits with slow blocks and higher fees. It also makes Bitlight useful for daily payments and microtransactions.

Bitlight supports the RGB20 token standard. This allows developers to create fungible tokens and stablecoins directly on Bitcoin. These assets do not need sidechains. They also do not weaken Bitcoin’s base layer.

Privacy also plays a major role. The system uses blinded UTXOs and Taproot outputs. This hides sensitive data and protects user activity. Only the needed parties can see the details.

Deterministic commitments connect off-chain data with on-chain Bitcoin transactions. This creates a verifiable link without exposing private information.

Finally, Bitlight stays fully compatible with Bitcoin. It works as a Layer 2 system. It does not create a separate chain. It keeps Bitcoin’s security, decentralization, and trust model intact.