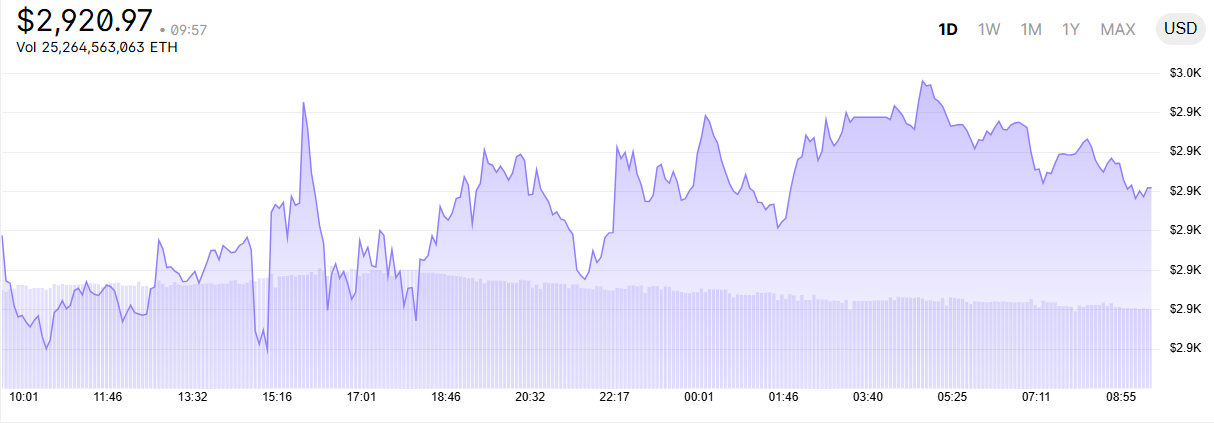

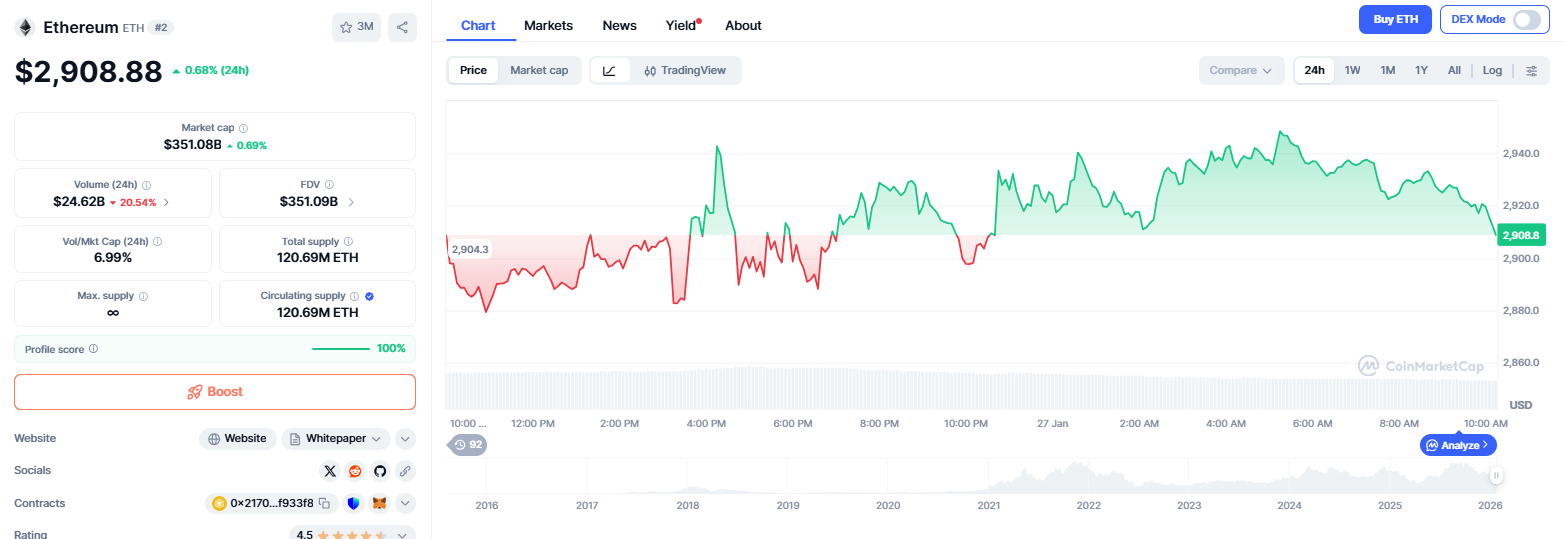

The Ethereum price forecast is heating up as ETH trades at $2,920, up 0.38% over the last 24 hours, with fresh institutional inflows and macro signals aligning.

Corporate treasuries, including BitMine, have resumed heavy accumulation, while on-chain data shows rising address activity near a realized price of $2,720. Ethereum’s market cap has stabilized at $352 billion, supported by circulating supply of 120.69 million ETH.

Analysts point to the same global liquidity conditions that preceded Ethereum’s 226% rally in 2021, suggesting the market may be entering a similar multi-month expansion window.

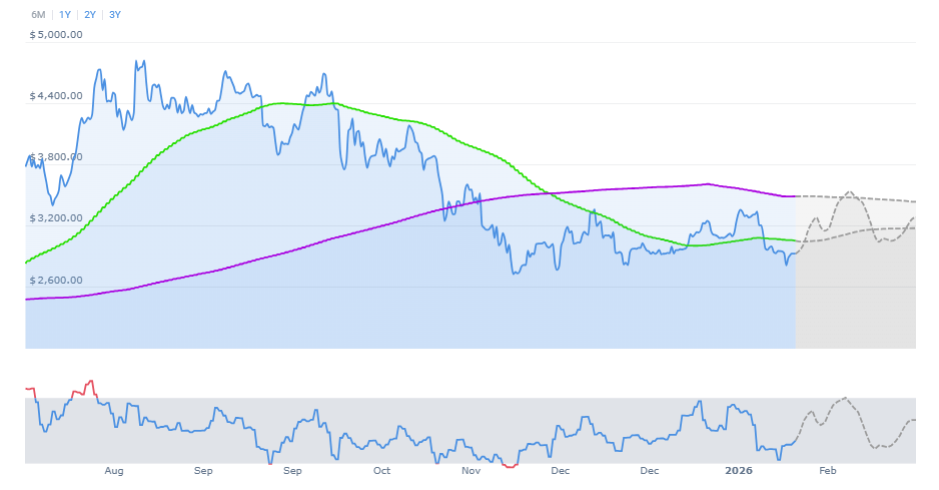

Forecast models predict ETH could reach $3,240 by February 1, 2026, but long-term projections extend much higher, with targets as high as $20,000 over the next cycle.

$58M Ethereum Buy Reinforces Treasury Demand

On Monday, BitMine, a treasury firm linked to Tom Lee, purchased 20,000 ETH for $58 million, marking one of the largest institutional ETH acquisitions since mid-2025.

This move brings BitMine’s total holdings to over 4 million ETH, positioning it as one of the largest Ethereum corporate treasuries globally.

Lee cited ongoing discussions at Davos as proof that institutions are actively exploring Ethereum-based infrastructure for smart contracts, tokenized assets, and on-chain settlements.

This shift reflects a structural evolution in ETH demand, as firms increasingly treat Ethereum as a balance sheet asset, not just a speculative trade. As treasuries move in, liquidity deepens, creating a price floor and supporting the bullish Ethereum price forecast through 2026.

Macro Liquidity and Russell 2000 Hint at March Surge

Ethereum may be flashing the same global liquidity setup that triggered its explosive 2021 run. Analysts report that macro liquidity indicators, small-cap equity strength, and ETH’s on-chain accumulation structure have aligned once again.

Notably, Ethereum surged 226% in 2021, beginning 119 days after a breakout in the Russell 2000 index. That same index just printed a new monthly high, prompting speculation that ETH could follow in March 2026.

Liquidity appears to be leading this setup, not technical momentum. Ethereum’s realized price has risen to $2,720, confirming support from long-term holders.

These signals are not short-term noise. They support the thesis that Ethereum’s next leg up will be macro-driven and potentially aggressive.

Forecast Models Predict $3,240 in February, $5K–$20K in 2026

Short-term Ethereum forecasts project a steady climb to $3,240.57 by February 1, marking an 11.05% gain from current prices.

February’s average projected price sits at $3,773, with March forecasts pushing above $4,700, and a maximum price of $5,336. Long-term models are even more aggressive.

Tom Lee expects ETH to hit $7,000–$9,000 by early 2026, while analysts at Standard Chartered have raised their forecast to $7,500, citing institutional accumulation and stablecoin dominance.

More bullish scenarios from firms like Fundstrat envision $20,000 ETH as Ethereum cements its role as the default settlement layer for tokenized financial assets, as the best altcoin.

These wide-ranging forecasts reflect one key point: Ethereum price forecast models are no longer speculative – they’re structured on adoption, liquidity, and infrastructure demand.

Ethereum Dominates Treasuries, Stablecoins, and ETF Accumulation

Ethereum now anchors a growing segment of the institutional asset landscape, driven by both real-world utility and smart contract scalability. Corporate treasuries and ETFs have acquired approximately 3.8% of all ETH in circulation since June 2025, as the next crypto to explode.

Treasury firms alone bought 2.3 million ETH over just two months – a pace double that of comparable Bitcoin phases.

Ethereum powers over 50% of global stablecoins, generating 40% of total blockchain transaction fees, confirming its dominance as a settlement network.

This balance-sheet-driven demand supports ETH’s structural price base far more effectively than retail speculation.

Combined with ETF inflows and infrastructure growth, these fundamentals give the Ethereum price forecast significant upside credibility through 2026 and beyond.