Stablecoins are increasingly looking less like a competitive market and more like a tightly controlled duopoly.

New data shows that just two issuers dominate nearly the entire sector, raising fresh questions about how upcoming U.S. regulation could reshape capital flows rather than stabilize them.

Key Takeaways

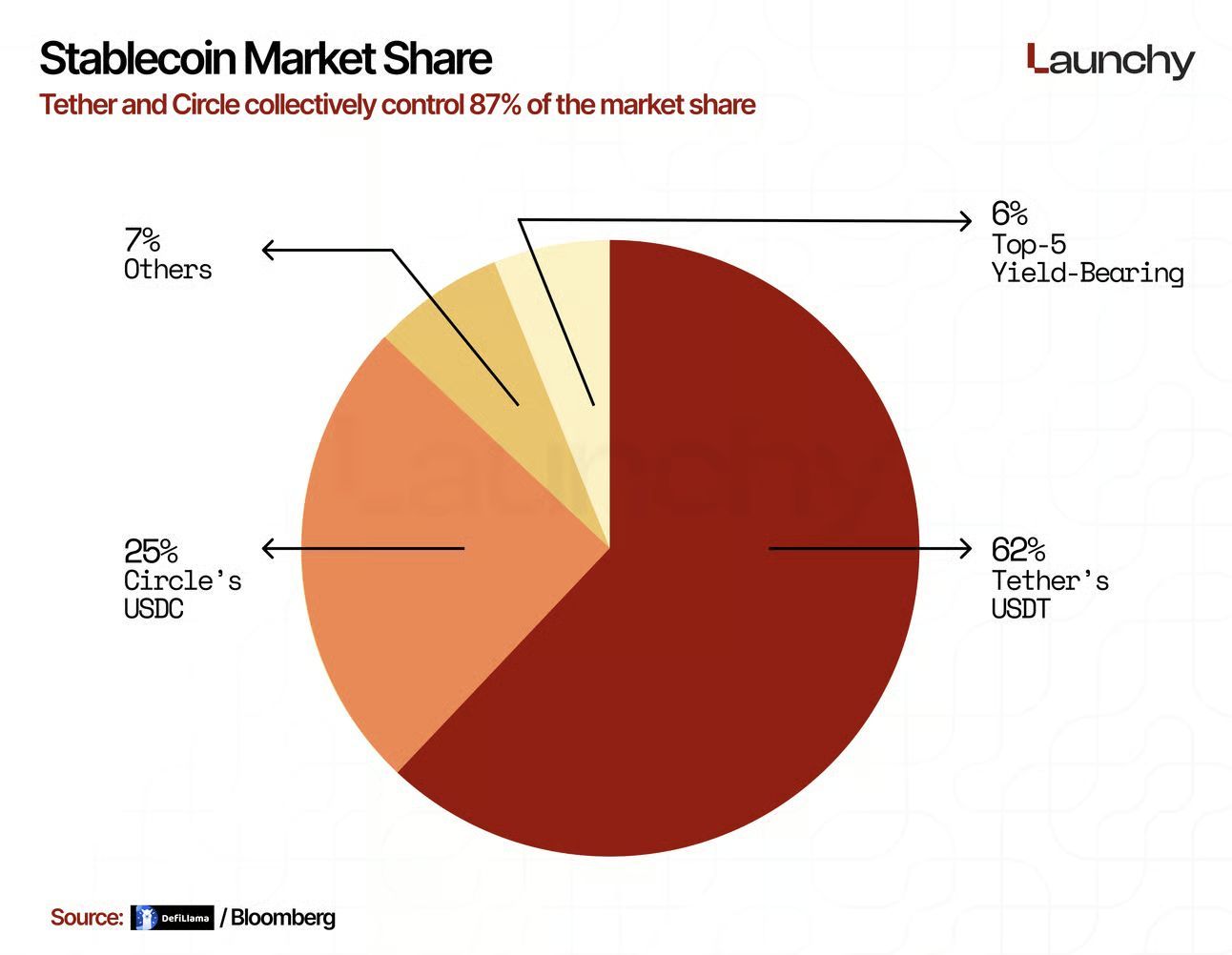

Tether and Circle control about 87% of the global stablecoin market, leaving little room for competitors.

Proposed U.S. rules would ban yield on payment stablecoins despite Treasury-backed returns.

Yield demand shifts offshore or into synthetic and less transparent dollar alternatives.

Restrictions may weaken regulated stablecoins while accelerating growth in gray zones.

At the center of the market sit Tether and Circle, which together account for roughly 87% of global stablecoin supply. Tether’s USDT alone commands about 62% of the market, while Circle’s USDC contributes another 25%. Everything else – including yield-bearing stablecoins – is reduced to a thin slice of the pie.

A market already concentrated

The chart highlights just how little room is left for alternatives. The top yield-bearing stablecoins combined represent only around 6% of total market share, while all remaining issuers together make up roughly 7%. In other words, the stablecoin economy is already highly centralized before regulators even step in.

That context matters as U.S. lawmakers debate new rules for so-called payment stablecoins. Under current proposals, these tokens would be prohibited from offering yield to users, even though they are typically backed by short-term U.S. Treasury bills yielding roughly 3% to 4%.

Who captures the yield

The result is a widening disconnect between where value is generated and who receives it. While reserves earn steady returns through government debt, those gains are captured by issuers and banking partners. End users, meanwhile, earn nothing for holding assets that function as digital cash equivalents.

From a capital allocation perspective, that trade-off is increasingly difficult to justify. Markets tend to adapt quickly when incentives are misaligned, and demand for yield does not simply vanish because regulation restricts it.

Capital finds another path

Instead, yield-seeking behavior shifts elsewhere. Some of it moves offshore, beyond the reach of U.S. frameworks. Some flows into synthetic dollar products such as Ethena’s USDe. Other capital migrates into more complex or less transparent structures that sit in regulatory gray zones.

Ironically, this dynamic risks undermining the very stability policymakers aim to protect. By restricting yield on the most regulated and transparent stablecoins, growth pressure is redirected toward products with higher opacity and potentially higher systemic risk.

Stability with unintended consequences

The stablecoin market was already consolidated long before these proposals emerged. By banning yield on compliant payment stablecoins, regulators may be reinforcing that concentration while simultaneously weakening the competitive position of the safest products.

In practice, the rules could lead to less oversight, not more, as activity migrates away from the most visible corners of the ecosystem. The attempt to impose stability may end up exporting risk instead.