Will Ethereum reach $12,000 this cycle, or should you look elsewhere for maximum gains? Ethereum's path to $12,000 depends on layer-2 scaling and increased DeFi adoption.

The network upgrades continue improving efficiency. However, Ethereum’s massive market cap limits explosive percentage moves from current prices.

Smaller projects starting from presale valuations like Pepeto ($PEPETO) offer mathematical advantage. Same dollar investment generates vastly different returns based on entry price. For investors seeking maximum gains rather than stable appreciation, the choice between mature platforms and emerging opportunities determines outcome.

Ethereum Upgrade Roadmap Supports Long-Term Growth

At the time of writing ETH maintains $2,916 at the valuations commanding $351B market capitalization after successful proof-of-stake transition.

With 120.69M ETH circulating and a $347B valuation, Ethereum maintains dominance as the second-largest cryptocurrency. The development roadmap includes Glamsterdam and Hegota upgrades arriving in 2026, bringing Verkle Trees and enshrined Proposer-Builder Separation that will reduce node requirements and enhance decentralization.

Spot Ethereum ETFs have established pathways for institutional capital despite experiencing recent outflows. Regulatory clarity emerging in U.S. markets removes uncertainty that previously suppressed valuations. With staking participation increasing and liquid supply tightening, fundamental supply-demand dynamics favor upward price movement across coming quarters as adoption continues expanding throughout DeFi, gaming, and tokenization sectors.

DeFi Infrastructure Demands Drive Ethereum Adoption

Ethereum powers the majority of decentralized applications, with total value locked consistently exceeding $50B across lending platforms, decentralized exchanges, and synthetic asset protocols. This utility creates constant demand for ETH through gas fees and staking requirements. However, Ethereum reaching $12,000 represents about 317% gains, large yet modest compared to opportunities available in earlier-stage projects building complementary infrastructure.

Pepeto Builds Cross-Chain Bridge at Presale Prices

Infrastructure development creates specialized opportunities like Pepeto, securing $7.18M at $0.000000179 for cross-chain solutions. of entering at $0.000000179 per token. This pricing creates entry points that institutional participants can no longer access in established cryptocurrencies. The zero-fee bridge technology addresses network fragmentation, enabling users to transfer assets between Ethereum, Binance Smart Chain, and other ecosystems without paying transaction costs that currently limit cross-chain activity.

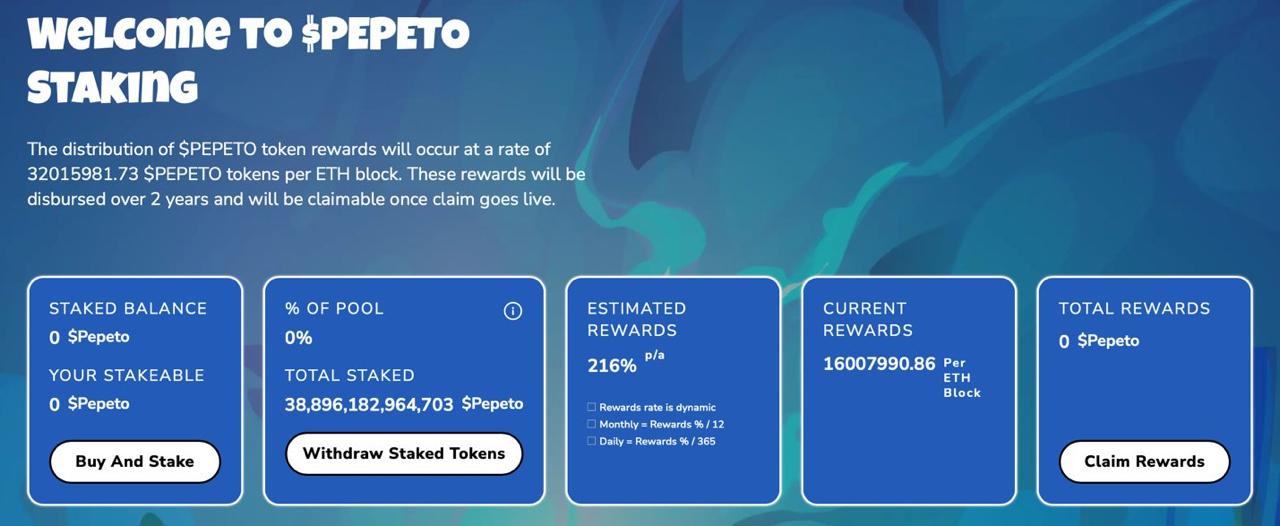

This infrastructure solves critical friction limiting DeFi adoption across multiple networks. Users currently pay large bridge fees that reduce economic viability of smaller transactions. Pepeto eliminates these costs entirely while maintaining decentralized security advantages. Beyond bridging, 214% staking rewards provide passive income encouraging long-term holding behavior that secures the network through delegated proof-of-stake consensus mechanisms.

Meme Utility Ecosystem Creates Multiple Revenue Streams

Pepeto Swap launches as a full-featured decentralized exchange supporting trading across multiple blockchains. This DEX infrastructure creates destinations for users seeking low-fee trading without KYC requirements. The platform creates transaction fees flowing to token holders, establishing sustainable revenue beyond speculative trading. The upcoming launchpad positions Pepeto as infrastructure for next-generation community tokens, with projects gaining access to Pepeto’s user base while maintaining fair distribution.

With 420T token supply matching PEPE’s structure, Pepeto taps into proven meme dynamics while layering utility sustaining value beyond initial hype. The familiar supply creates immediate recognition among massive communities surrounding Dogecoin, Shiba Inu, and PEPE, yet the added DeFi functionality gives ongoing reasons for usage beyond speculation, addressing sustainability challenges plaguing pure meme coins lacking utility infrastructure.

Smart Money Accumulation Signals Institutional Interest

On-chain tracking reveals whale wallets accumulating Pepeto during presale, with large holders building positions before public exchange access. These institutional-sized purchases suggest experienced crypto investors recognize asymmetric risk-reward profiles available at current prices. Accumulation continues despite approaching the $10M cap, indicating sustained confidence in post-launch performance among sophisticated market participants who understand early-stage opportunity dynamics.

On-chain tracking reveals whale wallets accumulating large presale positions. Pepeto Exchange listings are in high demand, with 850+ projects submitting applications. The $700,000 giveaway program distributes tokens to active community members while generating viral marketing momentum. Community growth metrics demonstrate accelerating adoption as awareness spreads through crypto Twitter, Telegram channels, and YouTube content. This grassroots support gives foundations for sustained growth as Pepeto transitions from presale into public market trading with exchange listings.

Conclusion

Ethereum’s journey toward $12,000 depends on layer-2 scaling success and continued DeFi dominance. The technical roadmap looks solid. Development activity remains high. However, ETH already trades with $400B+ market cap. This valuation reflects years of adoption and growth. New ETH investors buy at prices reflecting established success.

Pepeto offers different opportunity: presale access at $0.000000179 before mainstream discovery. The zero-fee bridge infrastructure generates revenue immediately. With $7.18M raised approaching $10M cap approaching $10M cap with 214% staking from actual operations, Pepeto delivers what ETH can’t: ground-floor entry enabling explosive percentage moves.

Both serve different needs. ETH provides stability through proven smart contract platform. Pepeto offers big upside as the best crypto to buy through early positioning in functional DeFi infrastructure during presale phase capturing full bull cycle appreciation from listing through peak.