KEY TAKEAWAYS

RIVER surged over 1,800% on heavy funding, short squeezes, and high-profile investments.

Allegations of supply concentration threaten the rally, with leverage far outweighing spot liquidity.

While the trend remains bullish above, any major sell-off could trigger a sharp and violent reversal.

River (RIVER) has become the most polarizing token in crypto right now, with its price action looking unstoppable.

Over the last 30 days, RIVER’s price has increased by 1,858%, driven by a surge in trading volume. Despite that, the project faces a serious allegation that could halt the momentum.

In this analysis, CCN reveals how RIVER’s price surged, the controversy surrounding it, and what could be next for the cryptocurrency.

Why Is the RIVER Crypto Rising?

RIVER’s move has been extreme. The token rallied from a $4 base in December to fresh local highs in what traders now call a textbook “God Candle” phase.

Big names lit the fuse. Arthur Hayes’ Maelstrom Fund led a $12 million funding round.

Days later, Justin Sun followed with an $8 million strategic investment.

That capital is tied to integrating River’s satUSD stablecoin into the TRON ecosystem. The signal was loud. Smart money was in.

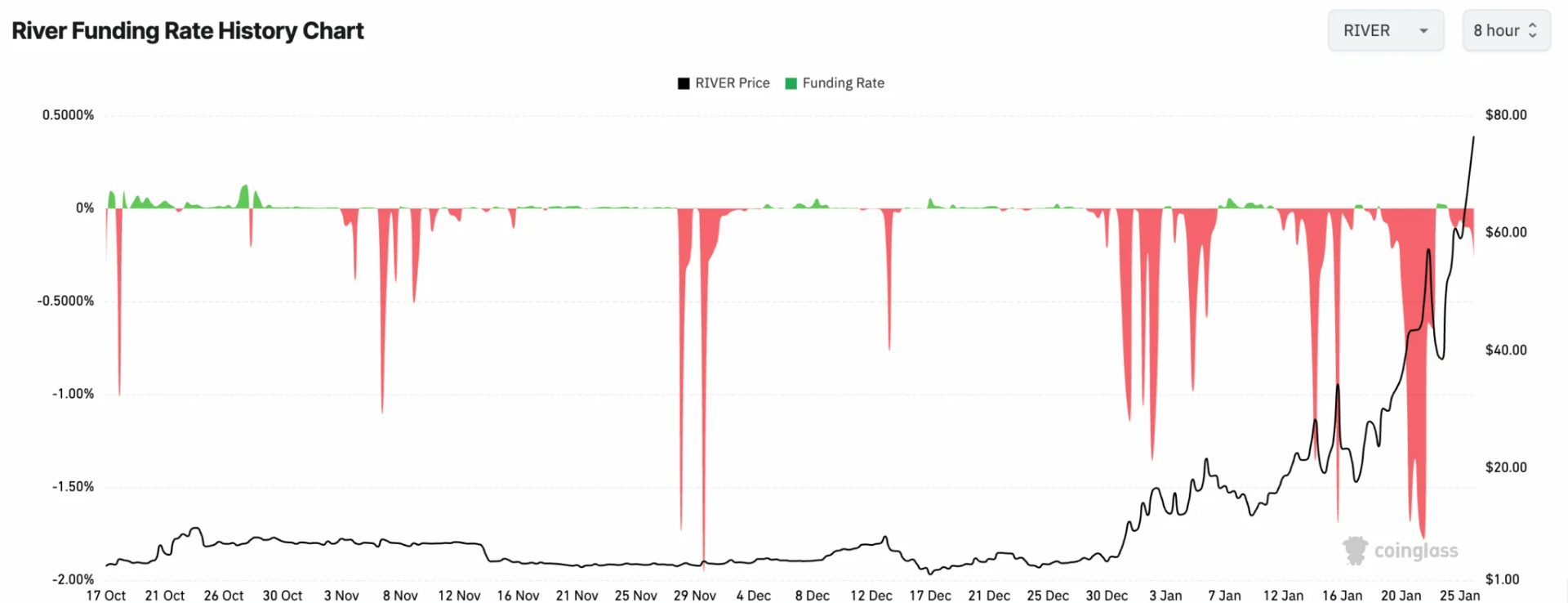

Then came the squeeze. Funding rates flipped profoundly negative, dropping to -16% on some exchanges. Bears paid a premium to stay short. Liquidations stacked up. Price accelerated.

This created a violent gamma squeeze, pushing RIVER high above the $70 region.

RIVER Price Holds Bullish Setup

On the technical side, the 4-hour chart shows that RIVER extended its upside move as the price pushed deeper into a rising channel.

The breakout above the mid-$60 zone marked a clear shift in structure. This move did not happen in isolation.

Volume expanded on the breakout, signaling stronger participation rather than a thin squeeze.

Momentum indicators confirm the trend’s strength. For instance, the Moving Average Convergence Divergence (MACD) remains positive, showing that bullish momentum is accelerating rather than stalling.

At the same time, the Money Flow Index (MFI) has surged into overbought territory, reflecting aggressive buying pressure. While this points to strong demand, it also suggests that short-term pullbacks are possible.

Importantly, former resistance near the low-$60 area has flipped into support. As seen below, RIVER’s price briefly retested that zone before pushing higher again, reinforcing it as a key level to watch.

As long as RIVER holds above this reclaimed range and stays within the ascending channel, the broader bias remains bullish.

However, the steep angle of ascent means volatility could increase, especially if momentum cools from current stretched conditions.

Scandal Rocks the Rally

But the upside-down story now faces a serious threat.

On Jan. 24, on-chain researchers dropped a bombshell. They traced nearly 50% of RIVER’s circulating supply to a single entity operating through 2,418 linked wallets.

Accumulation began near $4.12. At current prices, unrealized profits exceed $350 million.

“The pattern is clear, supply is cornered and withdrawn from bitget and ends deposited to bitget in the end in almost all cases This exchange is facilitating or complicit with this (and there have been countless other token examples with this exchange) Binance and co are also confortable taking in fee money for perps and liquidating their users gambling on this,” on-chain analyst WazzCrypto highlighted.

The accusations escalated fast. Analysts now allege industrial-scale wash trading.

The claim is simple. Volume looks large, but much of it may be artificial. The goal, critics say, is to pull in retail buyers before a coordinated exit.

Derivatives data adds fuel to the fire. CoinGlass shows futures volume outweighing spot volume by more than 80×.

That imbalance is dangerous. It means leverage dominates real liquidity. If the dominant holder sells, the RIVER price could gap down violently.

What Happens Next?

RIVER sits at a crossroads. Momentum is real. So is the risk.

At the time of writing, RIVER’s price accelerated as buyers extended the breakout. Furthermore, the altcoin has pushed above the 0.786 Fibonacci level, confirming that momentum has shifted in favor of bulls.

This move follows weeks of compression, which helped fuel the breakout once resistance gave way.

At the same time, price remains well above the 20-day EMA, which has turned higher and is now acting as a key support. This alignment keeps the trend firmly intact and suggests dip buyers remain active.

Momentum indicators echo the price action. The Awesome Oscillator (AO) has flipped positive and is building higher bars, pointing to accelerating upside pressure.

That said, the rally’s speed has pushed RIVER’s price away from key averages, increasing the odds of short-term consolidation or brief pullbacks.

Structurally, former resistance at $62.95 has now flipped to support. Should this remain the same, RIVER’s price will likely hold above $75.

In a highly bullish scenario, the market value could reach $127.69. On the contrary, if selling pressure increases, this might not be the case.

Instead, RIVER might decline toward $49.87.