The term River in the digital asset space currently refers to two distinct entities: a decentralized finance protocol and a Bitcoin-only financial services firm. The $RIVER token is the native utility asset of the River DeFi protocol, which recently gained significant traction for its cross-chain stablecoin infrastructure.

River Financial, conversely, is a traditional brokerage and custody provider that focuses exclusively on Bitcoin. While both companies operate within the digital asset ecosystem, they serve different purposes and do not share the same technical infrastructure or tokenized assets.

Key Takeaways

$RIVER is a governance and utility token for a DeFi protocol focused on chain abstraction and the satUSD stablecoin.

River Financial is a Bitcoin-only brokerage that does not have its own cryptocurrency token or DeFi features.

The River DeFi protocol (formerly Satoshi Protocol) uses an Omni-CDP system to mint stablecoins across different blockchains without traditional bridges.

Understanding River DeFi Protocol

The River DeFi protocol is an infrastructure project designed to solve liquidity fragmentation across multiple blockchains. It utilizes a technology called "chain abstraction," which allows users to interact with various networks like Ethereum, BNB Chain, and Arbitrum through a single interface.

At the heart of the protocol is the satUSD stablecoin. Users can deposit collateral such as Bitcoin or Ethereum on one chain and mint satUSD on another, bypassing the need for risky asset bridges or wrapped tokens.

The $RIVER token functions as the coordination layer for this ecosystem. Holders use the token to vote on protocol updates, adjust collateral ratios, and earn a portion of the protocol's revenue through staking.

In early 2026, the $RIVER token saw a surge in valuation, reaching prices above $40. This growth was largely driven by the launch of "Smart Vaults," which automatically deploy user funds into low-risk yield-generating strategies.

The protocol also includes a social engagement layer known as River4FUN. Participants earn River Points by contributing to the community, which can later be converted into $RIVER tokens through a dynamic airdrop mechanism.

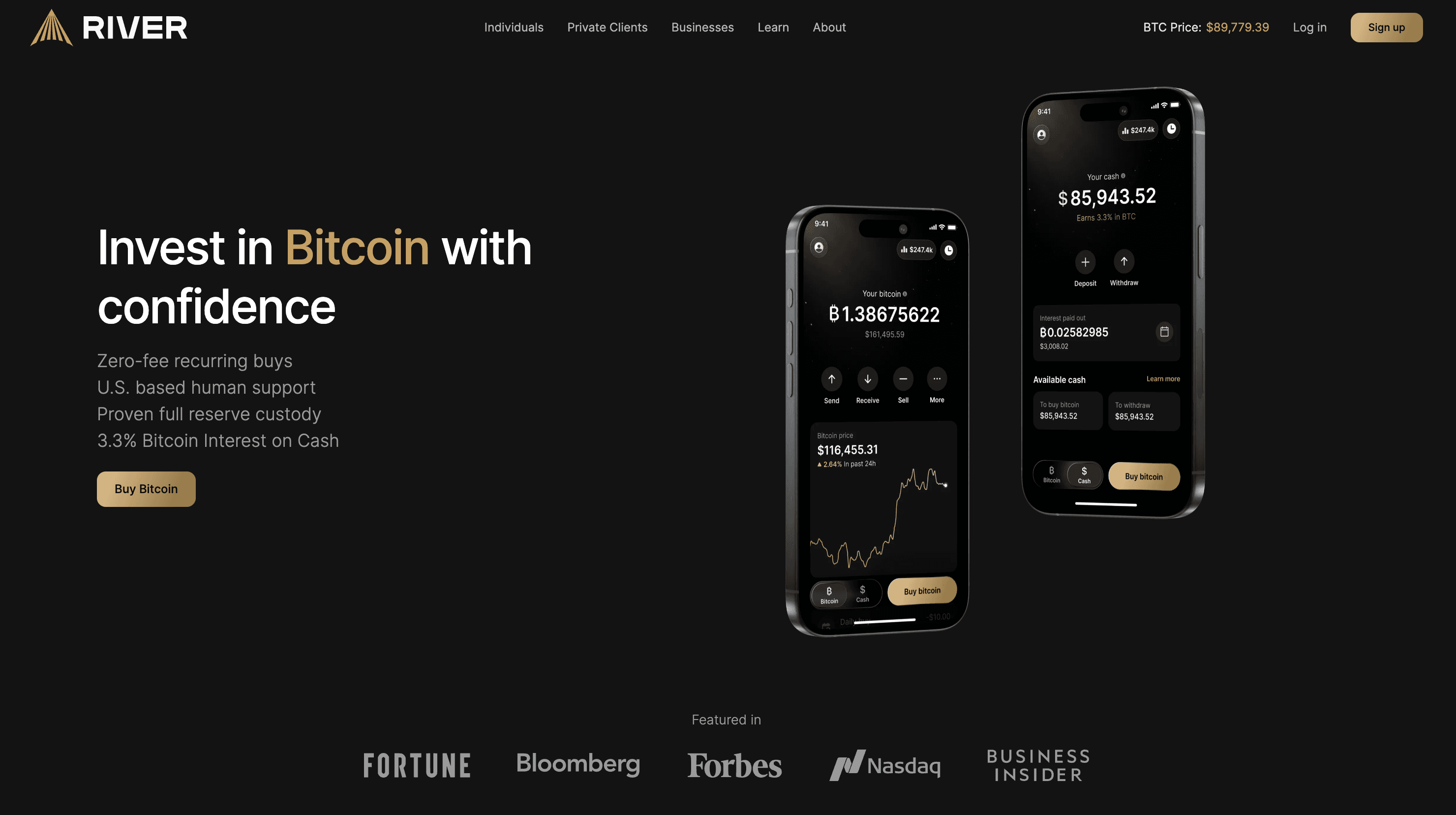

What is River Financial

River Financial is a San Francisco-based financial institution that provides a high-security platform for long-term Bitcoin investors. Unlike the DeFi protocol, River Financial does not support any altcoins or tokens and focuses purely on the Bitcoin ecosystem.

The company offers a suite of services including zero-fee recurring buys, institutional custody, and Bitcoin mining hardware. It is known for its "proof-of-reserves" transparency and its use of military-grade cold storage for client assets.

A standout feature of River Financial is its interest-earning cash account, which pays out yield in Bitcoin rather than fiat currency. This product is designed for high-net-worth individuals and businesses looking to grow their Bitcoin holdings passively.

Because River Financial is a regulated financial services provider, it requires full identity verification (KYC). This contrasts with the River DeFi protocol, which is a decentralized application that users access via private digital wallets.

Investors should be careful not to confuse the two entities. Purchasing the $RIVER token on an exchange provides exposure to a multi-chain decentralized finance protocol, not the equity or the Bitcoin-focused operations of River Financial.

Experience secure XRP trading and intelligent crypto insights—only on Bitrue.

Conclusion

The distinction between the River DeFi protocol and River Financial is fundamental for any digital asset participant. While the $RIVER token powers a sophisticated cross-chain stablecoin system, River Financial remains a premier destination for traditional Bitcoin accumulation and custody.

As the "digital asset industry" continues to evolve, names like River may become more common. However, the technical mechanics—one being a decentralized utility token and the other a centralized brokerage—remain entirely separate and serve different investment strategies.