Bitcoin price forecast is heating up after BTC climbed above $89,000, following remarks by U.S. President Donald Trump that sent the dollar to its lowest level in nearly 4 years. After a slight pullback, the largest crypto is currently trading around $89,000 with a 24-hour trading volume of $37.92 billion.

While speaking with reporters recently, Trump said the dollar is doing great and that he is not worried about the recent declines. The U.S. dollar index (DXY) has been in a downtrend since October 2022, and with the President’s recent remark, it plunged to a new four-year low of $95.50.

A weakening dollar has historically helped Bitcoin’s price by driving investors to seek alternative assets and increasing global market liquidity. Another major focus this week will be on $10.8 billion on Friday expiry, especially as call (buy) options dominate overall market interest.

However, broader market sentiment is still bearish. Expert analysis shows that if dip buyers step in, Bitcoin could target $95,000 in the early stages, with mid-term targets as high as $100,000 over the next few months.

U.S. Dollar Weakness and Its Impact on Bitcoin

A falling U.S. dollar historically supports Bitcoin by increasing global liquidity and reducing the appeal of fiat-based assets. The U.S. dollar index (DXY) has dropped sharply by around 4% since January 19, with the decline extending after Trump’s comments, which led to an intraday 1.28% drop on Tuesday. The dip in the dollar has slightly supported the bullish Bitcoin price forecast.

BREAKING: The US Dollar tumbles to a fresh 4-year low after President Trump says the US Dollar is "doing great" and he is not concerned about its decline. pic.twitter.com/cMwBJvNTXx

— The Kobeissi Letter (@KobeissiLetter) January 27, 2026

Trump spoke just as the dollar was already losing strength, with traders on edge over the chance that U.S. and Japanese officials might step in together to support the yen.

Kyle Rodda, a senior market analyst at Capital.com, said, “It shows there’s a crisis of confidence in the U.S. dollar, and it would appear that while the Trump administration sticks with its erratic trade, foreign, and economic policy, this weakness could persist.”

Bitcoin has long been debated as a strong hedge against a weakening dollar. If market momentum returns and the dollar continues to move southward, investors could aggressively accumulate BTC as a safe asset.

$10.8 Billion Bitcoin Options Expiry

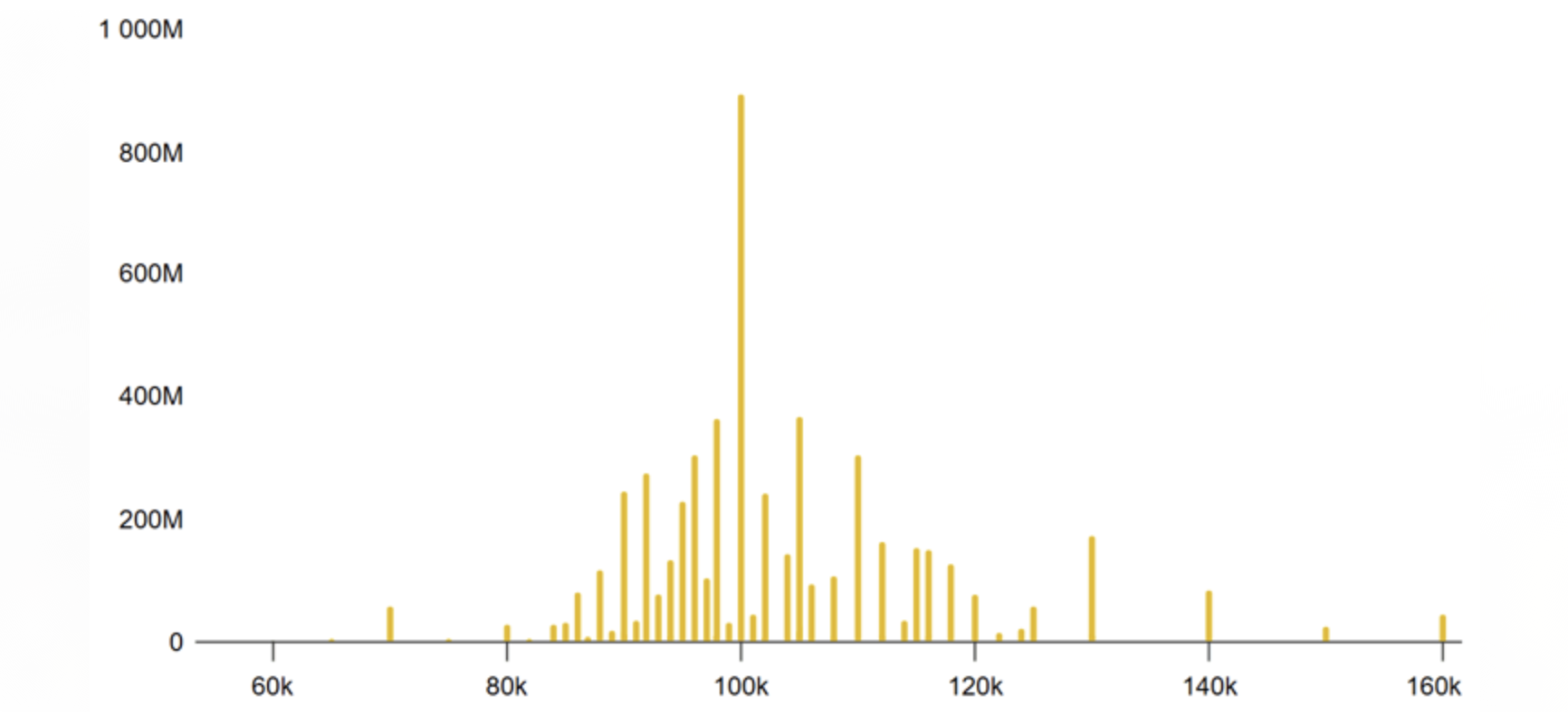

The major $10.8 billion Bitcoin options expiry this Friday could increase short-term volatility, especially as call options dominate open interest. If the Bitcoin price remains below $90,000, the odds tilt toward bearish option plays. Until BTC clearly breaks above that level, sellers retain the upper hand on the Bitcoin price forecast.

Call options have a total open interest of around $6.6 billion, far more than the $4.2 billion tied to puts. Many of the calls placed at $100,000 and above are part of covered call strategies, which aim to earn income rather than bet on a strong price rally.

Looking ahead to Friday’s BTC options expiry on Deribit, the outcome depends heavily on where the price settles. If Bitcoin closes between $86,000 and $88,000, put options gain a clear edge of about $775 million. A finish between $88,001 and $90,000 still benefits puts, though the advantage narrows to roughly $325 million. Bulls only gain the upper hand if BTC pushes above $90,000, at which point call options would hold an estimated $220 million advantage.

Bitcoin Price Forecast Shows Recovery Above $90,000 Before February

The strong bounce from the lower-inclining trendline towards $89,000 has opened the path to recovery above $90,000, which seems possible in the coming days. While the short-term price action remains volatile, Bitcoin holding the immediate support shows developing bullish sentiments towards the broader crypto market.

At press time, Bitcoin was trading at $89,000, up around 1% in the past 24 hours. The trendline that started in November has been providing constant support for the price, as it has bounced back more than twice from it. However, a follow-through above $90,000 could only confirm the bounce.

Image courtesy: TradingView

Along with the $90,000 psychological barrier, the 50-day moving average also acts as strong resistance. Next resistance levels sit around $92,500 and $95,000. More short-term bullish scenarios envision a $100,000 Bitcoin price target as investors move towards alternative safe assets amid a weakening dollar.

However, a failure to hold the local support around $86,400 could trigger another bearish leg and a broader market correction. In a highly bearish scenario, the support failure could drive the price towards November 2025 lows around $90,000. The erratic trade tensions, along with geopolitical issues, make the broader market highly volatile, and sharp price swings are expected.