Bitcoin is heading into its largest options expiry of 2026, with more than $8.53 billion in BTC options set to expire this Friday at 08:00 UTC.

This event represents the biggest expiry of the year so far and arrives at a time when Bitcoin is trading near a critical technical zone around $90,000, making short-term price direction highly sensitive to major volatility swings.

Key Takeaways

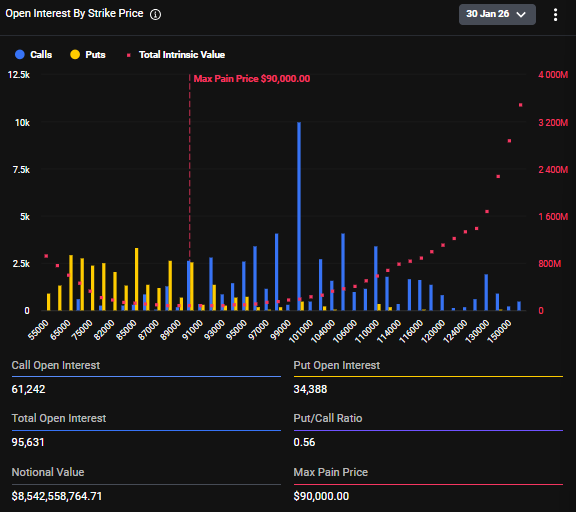

Over $8.53 billion in Bitcoin options expire this week, the largest expiry of 2026

Call options are heavily stacked near $100,000, while puts dominate around $85,000

Max pain sits near $90,000, where option sellers benefit the most

Short-term price action is likely to be driven by hedging flows and dealer positioning

How Options Positioning Can Move Bitcoin’s Price

Large options expiries often influence spot price behavior due to hedging activity by market makers. With calls concentrated at $100,000, dealers who sold those calls may hedge by buying Bitcoin as price approaches higher levels, potentially amplifying upside moves. Conversely, heavy put positioning near $85,000 creates downside hedging pressure if price begins to slide toward that zone.

The max pain level at $90,000 is particularly important. This is the price at which the greatest number of options expire worthless, minimizing payouts for option buyers and benefiting sellers. Historically, Bitcoin often gravitates toward this level into expiry as hedging flows compress volatility. However, if price decisively moves away from max pain, volatility can accelerate sharply as hedges are adjusted.

Investors actively use this information to position for short-term volatility, favoring strategies such as reduced leverage, tighter risk management, or directional trades aligned with potential post-expiry breakouts.

Technical Structure: What the Chart Is Signaling

From a technical perspective, Bitcoin is currently trading around $90,100, holding just above a key horizontal support zone. The Relative Strength Index (RSI) is elevated near 68, indicating strong momentum but approaching overbought territory. This suggests buyers remain in control, but upside may be more reactive to catalysts rather than trend-driven in the immediate term.

Meanwhile, the Moving Average Convergence Divergence (MACD) remains positive, with momentum lines above the signal line, supporting the broader bullish structure. However, momentum has begun to flatten, aligning with the idea of price compression ahead of options expiry.

Volume remains moderate, reinforcing the notion that the market is waiting for a trigger – most likely the expiry itself – to define the next directional move.

What Investors Are Watching After Expiry

Once the options expire, two dominant scenarios tend to play out. If Bitcoin holds above $90,000 and reclaims the $92,000-$94,000 zone with volume, dealers may unwind hedges, opening the door for a momentum push toward $100,000, where call interest is heavily concentrated.

On the other hand, failure to hold $88,000-$89,000 could expose downside liquidity toward $85,000, where put positioning is strongest. In that case, volatility could expand quickly as protective hedges are triggered.

For many investors, the strategy is clear: expect volatility, respect key levels, and wait for confirmation after expiry rather than front-running the move. Historically, the most decisive trends often emerge after large options events, not before them.

Аlthough one of the major indicators for Bitcoin is the expected Fed rate decision later today. This event usually has impact for the investor sentiment and the price action. With the expectation of keeping the rate at its current level, investors will be closely watching Jerome Powell’s comments on inflation and the jobs market, that could signal the next direction for both crypto and traditional markets.