Harvest Finance is a DeFi platform that enables users to take a more relaxed approach to yield farming. Much like Yearn Finance or DFI Money, Harvest will automatically farm the highest yields available across various DeFi protocols. Furthermore, its strategy is optimized to re-invest the received yields in a way to maximize potential earnings for its users. Though Harvest does not use the term Vault on its interface, this is the same type of DeFi product.

What is Harvest Finance?

The premise is quite simple, there are now hundreds of new DeFi protocols popping up all with their own reward structures and tokens. Moving funds around manually are highly inconvenient for most people who have normal day jobs. And let’s not forget the high amount of transaction fees you will be paying just to shuffle around your DeFi portfolio.

High gas prices on Ethereum meant smaller investors were pretty much priced out of the DeFi summer craze. Harvest Finance solves this problem by enabling you to pool funds together with others, forming one super investor.

Note, Harvest Finance’s smart contracts have not yet received a full security audit. Haechi Labs did a quick review and did not find any serious business logic. Peckshield and Certik have been commissioned to provide a full security audit.

Understanding Harvest DeFi Strategy

Let’s dive a little deeper and understand how their yield farming strategy is working its magic. For example, if you deposited stablecoins directly into Curve to earn interest. The next step would be to stake your LP tokens and start farming CRV tokens. To maximize your yields, you need to claim your CRV tokens, sell them on a decentralized exchange, and compound the earnings with your base investment.

Pro DeFi Tip: check out Furucombo and learn how you can remove steps from strategies by bundling actions together into one transaction.

That is a lot of steps that start to add up in transaction costs and time. Not to mention that you may suddenly realize you could earn more interest in a different protocol, such as Cream Finance. Now you need to withdraw all your funds from Curve and deposit them elsewhere! More transactions. Harvest Finance removes all this headache by doing the heavy lifting for you.

What are FARM tokens?

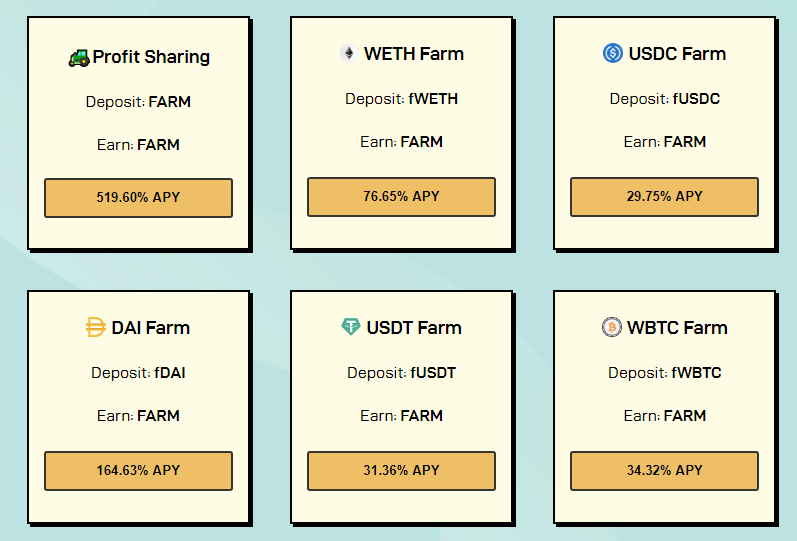

FARM is the governance token for Harvest Finance. FARM holders vote on proposals around protocol operations and how to use the FARM operational treasury. Harvest finance also implements profit-sharing into its ecosystem, where FARM holders can receive a 30% share from the operations. Remember that to participate in profit sharing, you must stake your FARM tokens via their dashboards.

How to earn FARM tokens?

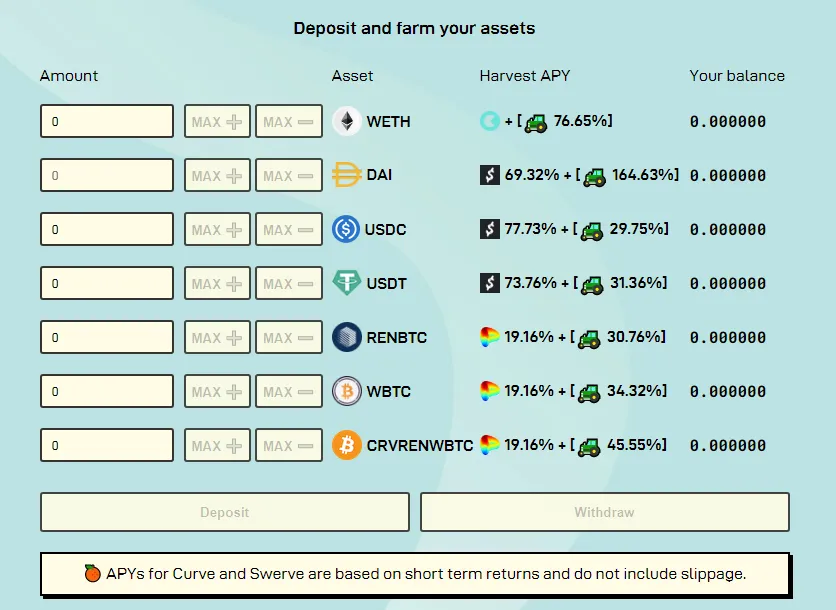

When you deposit any funds into Harvest Finance, you will receive an fAsset in return which represents your deposit. You can choose to stake these fAssets in various pools to earn rewards in FARM tokens. The token distribution is as follows: 70% for liquidity providers, 10% rewards to the operational treasury, and 20% rewards to the team.

A great part of FARM tokenomics is that the distribution is planned to take place over 4 years. As a result, the token has a total supply set at 5,000,000. Many new DeFi protocols farming protocols we have reviewed seem to have unlimited token supply’s which cause inflation and high sell pressure.

Looking to the future… the developers behind Harvest have already integrated Curve, Balancer, Compound, MTA, Cream, and Swerve into their yield farming strategies. With security audits on the way, and FARM tokenomics that have long term sustainability, I can see FARM being listed on bigger exchanges in the near future.