The cryptocurrency market continued to slide on Wednesday, with Bitcoin once again driving losses across major digital assets.

Selling pressure intensified as traders reduced risk exposure, pushing the broader market deeper into negative territory.

Key Takeaways

Bitcoin fell to around $86,000, extending pressure across the crypto market.

ETH, XRP, SOL, and ADA all posted notable losses alongside BTC.

Total crypto market cap dropped nearly 3% to about $2.94 trillion.

Long liquidations surged, with over $160 million wiped out in the past hour.

Bitcoin fell to around $85,400, sliding more than 4% over the past 24 hours and breaking below the $86,000 level. The decline marked a continuation of the broader downtrend, with BTC once again setting the direction for the rest of the market.

Altcoins Follow as Risk Appetite Weakens

Major altcoins mirrored Bitcoin’s weakness, posting widespread losses. Ethereum dropped to roughly $2,830, while XRP slid to near $1.81. Solana underperformed many large-cap assets, falling to around $118, and Cardano declined to approximately $0.33.

The synchronized sell-off across top tokens underscored a clear risk-off environment, with little evidence of rotation into alternative assets as traders moved to reduce exposure.

Total Market Cap Drops Nearly 3%

The broader crypto market reflected the sell-off, with total market capitalization falling almost 4% to approximately $2.89 trillion. Despite the decline, trading volumes remained elevated, suggesting active repositioning rather than a low-liquidity pullback.

This combination of falling prices and steady volume points to decisive selling rather than temporary volatility.

Long Liquidations Accelerate the Downmove

Derivatives data showed a sharp spike in forced liquidations during the downturn. In the past hour alone, total liquidations reached roughly $328 million, with long positions accounting for about $321 million of that figure. Short liquidations remained minimal.

The heavy imbalance indicates that bullish positioning was caught off guard by the renewed downside move, amplifying volatility as leveraged trades were unwound rapidly.

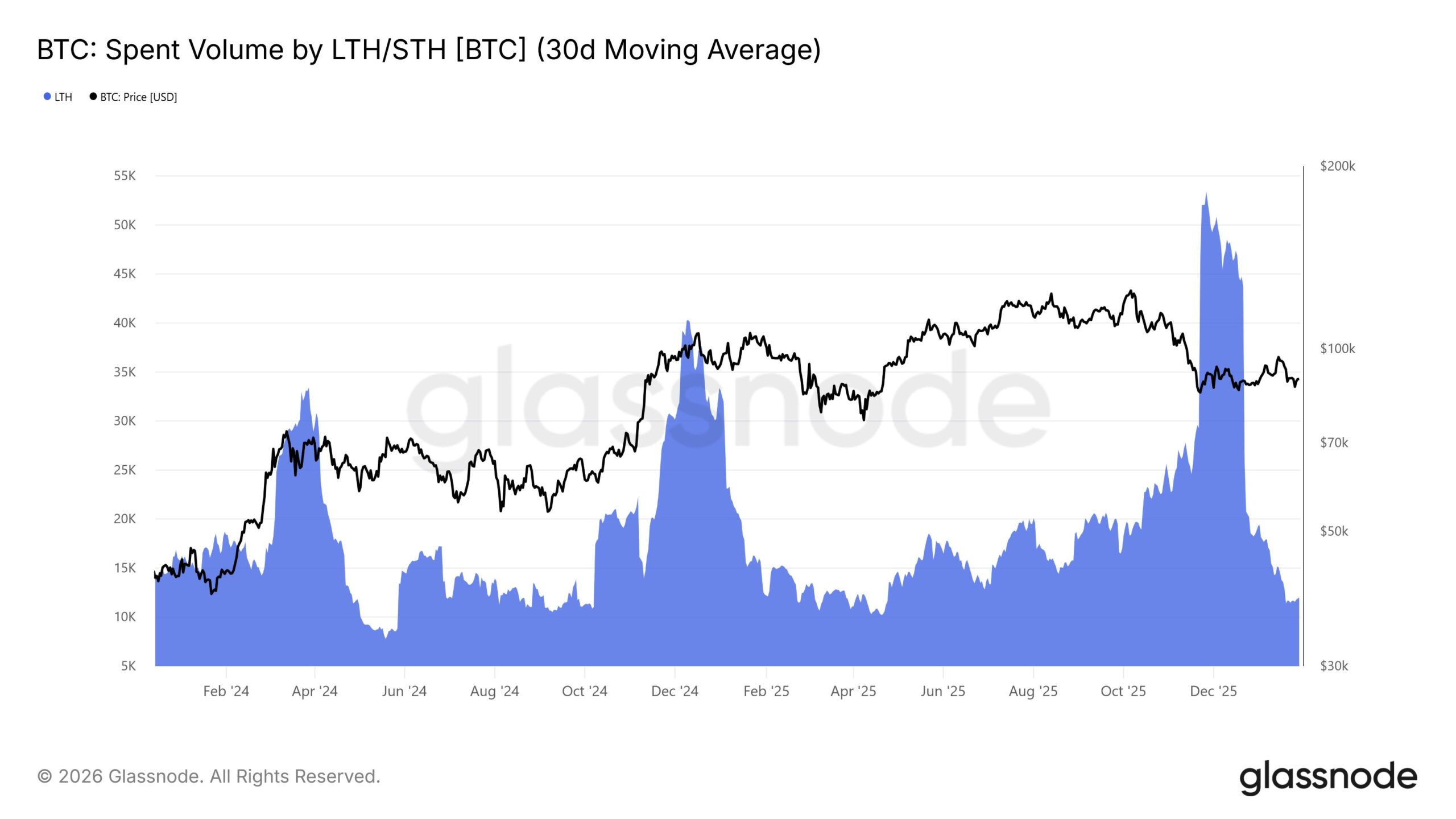

Long-Term Holders Increase Bitcoin Distribution

On-chain data from Glassnode adds another layer of context to the current weakness. Long-term Bitcoin holders have been spending more than 12,000 BTC per day on average over the past 30 days, equivalent to roughly 370,000 BTC per month.

This level of activity highlights the scale of gross distribution taking place beneath the surface, even if net flows appear less dramatic. Historically, sustained long-term holder spending often coincides with heightened volatility as additional supply meets softer demand.

U.S. Senate Vote Could Shift the Narrative

Market participants are now watching Washington closely, as the U.S. Senate is set to vote today on the Crypto Market Structure Bill, one of the most important regulatory moments for the industry in years.

Clear rules could reshape the crypto landscape by unlocking institutional capital, reducing compliance risk for companies operating in the U.S., and accelerating long-term adoption. With Bitcoin hovering near key support levels, the outcome of this vote may play a critical role in shaping market sentiment in the near term.