Crypto exchange Bybit is mounting an impressive recovery following its major 2025 cyberattack, steadily reclaiming its position among the world’s leading trading platforms.

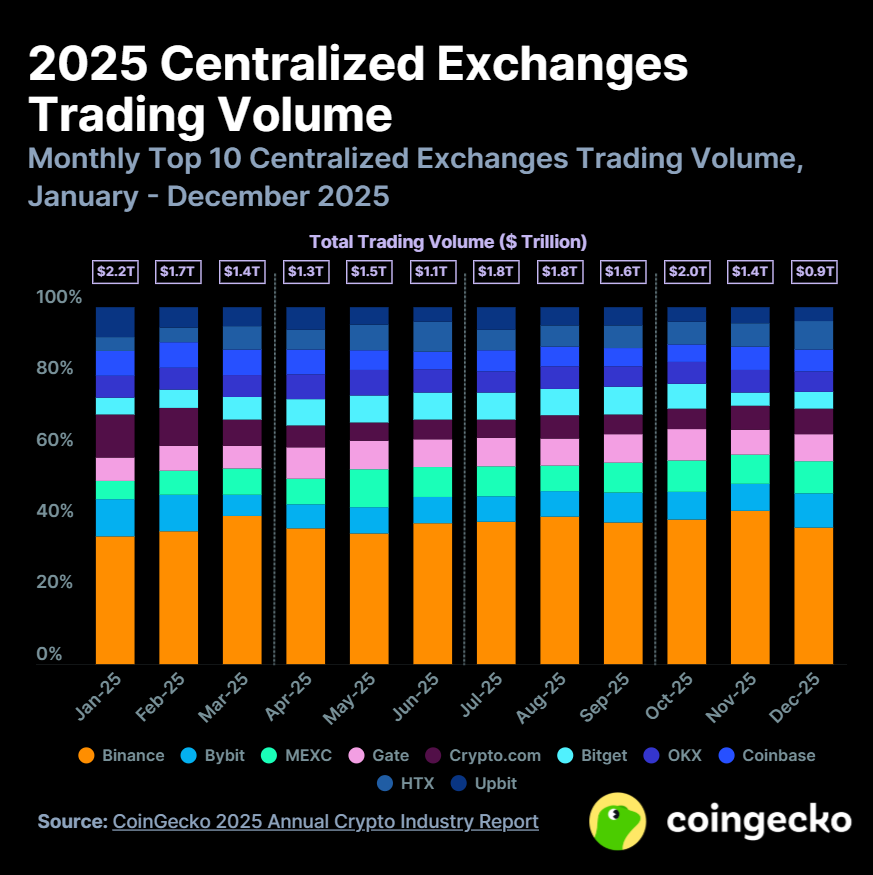

Bybit recovered from a $1.5B hack in Feb 2025, linked to North Korean actors, by keeping withdrawals open and securing liquidity. Hit $1.5T trading volume for the year (8.1% share). Binance at $7.3T, MEXC up 91% to $1.5T amid BTC/ETH rally. #Crypto pic.twitter.com/DDEKO8mQhW

— Vincent Bu Lu (@VincentBuLu1) January 30, 2026

According to a recent CoinGecko report, Bybit has posted consistent growth in trading volumes despite the initially devastating impact of the breach. The rebound highlights a carefully executed turnaround strategy centered on radical transparency, strengthened security, and renewed institutional trust.

What began as one of the industry’s most serious operational crises is now being cited as a case study in resilience.

A Methodical Rebuild After the 2025 Cyber Intrusion

The 2025 hack marked Bybit’s toughest technical and reputational challenge to date, triggering a sharp outflow of capital to rival exchanges.

Rather than falter, Bybit launched a comprehensive overhaul of its internal systems. Withdrawal stability was restored, and the platform moved quickly to reassure institutional clients through proactive communication and rapid compensation for affected users.

Bybit publicly acknowledged its vulnerabilities and outlined clear remediation steps, which is an approach that helped reverse negative sentiment and rebuild credibility.

Today, user perception appears to have shifted from skepticism to admiration, with many traders pointing to Bybit’s survival and recovery as proof of strong operational discipline.

CoinGecko Data Confirms Bybit’s Return to the Top

CoinGecko’s latest analytics show a sharply rising trajectory for Bybit’s ecosystem. Daily trading volumes have not only recovered to pre-incident levels but have surpassed previous records.

This resurgence is being driven in part by the rollout of new derivatives products, which have attracted professional traders seeking deep liquidity and competitive fees.

Bybit has successfully clawed back market share from major rivals such as Binance and OKX. Financial flow data indicates that assets on the platform reached a new all-time high this month.

The exchange now ranks firmly within the global top three for crypto futures trading—a notable achievement less than a year after its headline-making crisis.

Security Becomes the Cornerstone of Bybit’s New Trust Model

Determined to prevent a repeat of the 2025 incident, Bybit has invested heavily in next-generation custody infrastructure. Multi-signature authorization is now mandatory across all cold wallets, dramatically reducing single-point-of-failure risks.

The exchange also introduced monthly third-party security audits, ensuring continuous oversight and transparency. These measures have become central to Bybit’s value proposition for both retail and institutional users.

Its expanded bug bounty program now incentivizes cybersecurity researchers worldwide, with vulnerabilities handled under strict priority protocols.

By transforming past weaknesses into present strengths, Bybit is redefining user expectations around exchange security. Once shaken, confidence now appears stronger than ever—bolstered by public proof-of-reserves and a visible commitment to safeguarding customer assets.