What is dForce?

dForce aims to establish a permissionless liquidity infrastructure for Web3 dApps, fostering innovation, accessibility, and collaboration within the rapidly growing blockchain ecosystem.

The project researches a comprehensive suite of Web3 infrastructure protocols, including standardized decentralized stablecoins, a unified money market, yield tokens, RWA tokens, and more. The dForce development team is committed to building protocols that can enhance liquidity in the Bitcoin L2, DePIN, and decentralized AI ecosystems.

On December 30, Binance Futures listed the DFUSDT perpetual futures contract with leverage up to 75x at 17:45 UTC. Binance's announcement helped the DF token quickly rise from $0.082 to a daily high of $0.1045.

See more: Guide to trading on Binance Futures

DF token information

Token name: dForce

Symbol: DF

Blockchain: Ethereum

Standard: ERC20

Total supply: 999,926,146.63 DF

Circulating supply: 999,926,146.63 DF

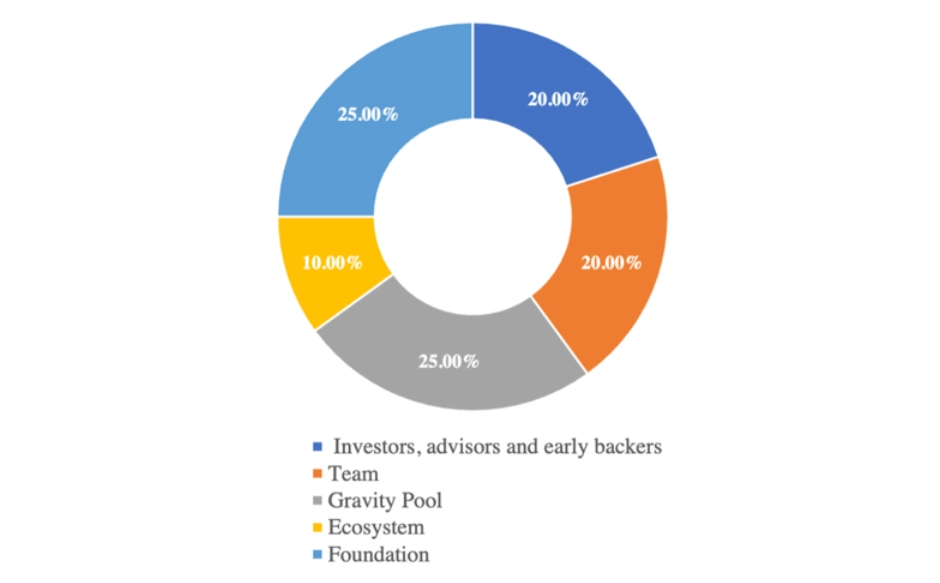

Allocation

Gravity Pool: 25%

dForce Foundation: 25%

Early supporters, investors, and advisors: 20%

Project development team: 20%

Ecosystem: 10%

Features

dForce Token (DF) is the governance token across the network, granting holders full control over protocol-related decisions, including introducing new assets and collateral into the system, altering risk parameters, fee accumulation, interest rate alignment, and more.

dForce has a combined staking model that includes Free Staking and Lock-up Staking:

Free Staking allows DF holders to stake and unstake at any time, earning passive returns.

Lock-up Staking requires locking DF tokens for a period ranging from one week (minimum) to four years (maximum) - the longer the lock-up period, the higher the returns and voting rights.

Lock-up Staking yields are accrued on top of the free staking returns. Additionally, most DF purchased on the secondary market is rewarded to those participating in Lock-up Staking.

Price movement and exchanges

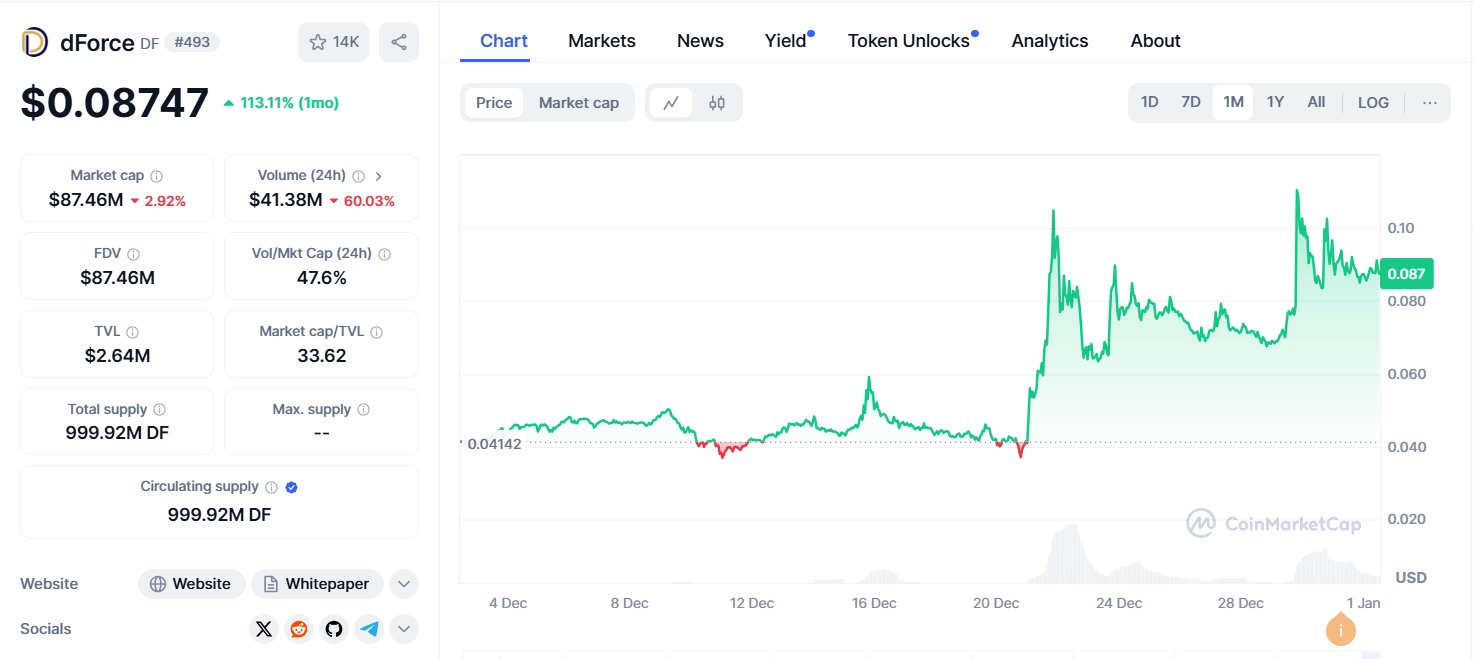

DF is trading at $0.08747, down 3.3% in the past 24 hours. The 24-hour volume of DF is $41.38 million, down 60%.

Despite the overall market decline, DF has maintained strong gains over longer time frames. According to Coinmarketcap data, the DF token has increased by 113.11% in the past month and 107% compared to the same period in 2023. The current market capitalization of dForce is $87.46 million.

Currently, users can trade DF on exchanges such as Binance, HTX, LBank, MEXC, KuCoin, etc.

dForce products

Unified money market

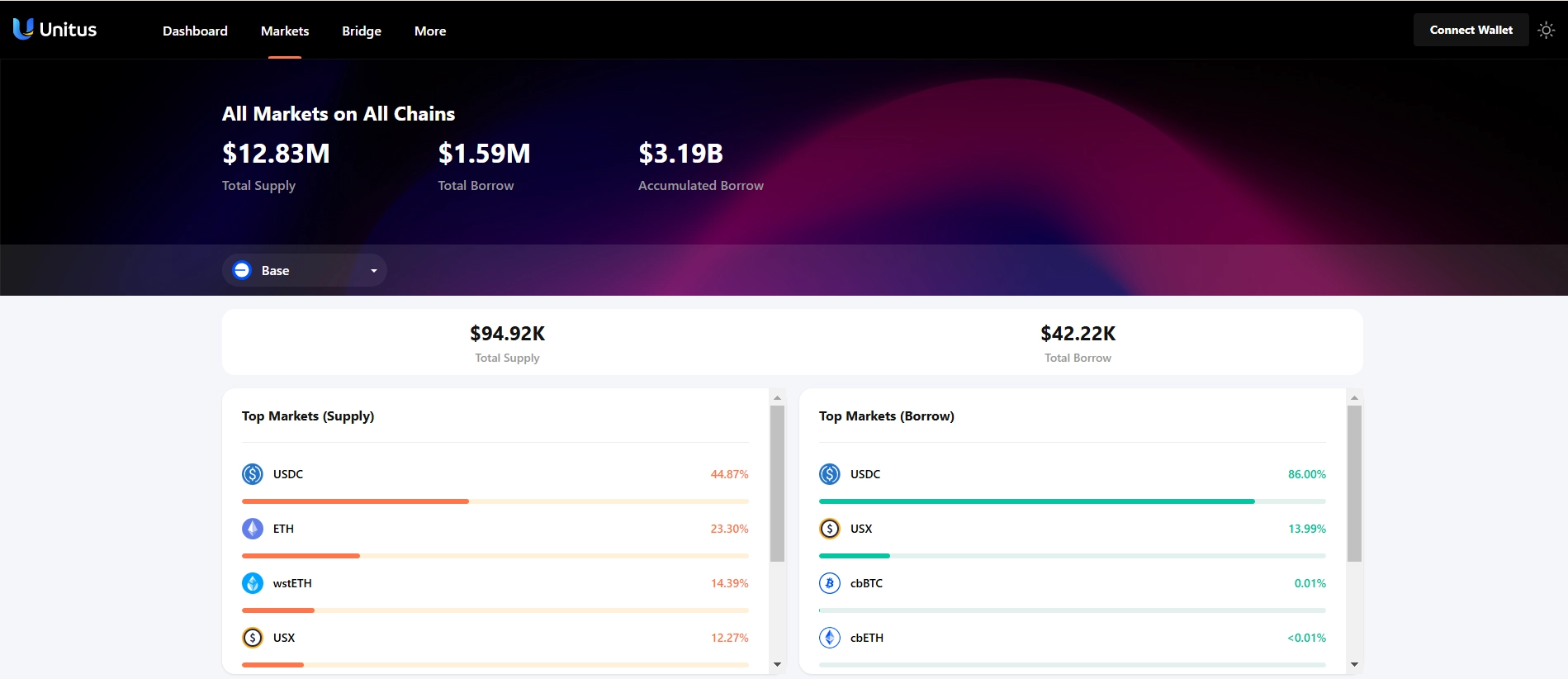

Unitus Finance is a unified money market that provides numerous customization options, liquidity pools, and risk allocations while maximizing capital efficiency. Unitus serves multiple asset types, all aimed at maximizing capital efficiency.

Additionally, Unitus introduces a tokenomics structure that prioritizes rewards for those committing long-term capital rather than short-term liquidity opportunities.

Yield-bearing asset standard

dForce offers scalable, risk-adjusted yield-bearing assets with high composability to facilitate integration with various DeFi applications. Yield-bearing assets on dForce can easily integrate into the existing DeFi infrastructure, enabling users to leverage multiple platforms and maximize capital efficiency.

RWA tokenization protocol

dForce introduces a unified, composable, and scalable RWA tokenization solution. The dForce RWA protocol allows tokenizing various real-world assets, such as real estate, commodities, or revenue streams, into digital tokens that can be easily traded, lent, or borrowed on DeFi platforms.

Omni stablecoin infrastructure

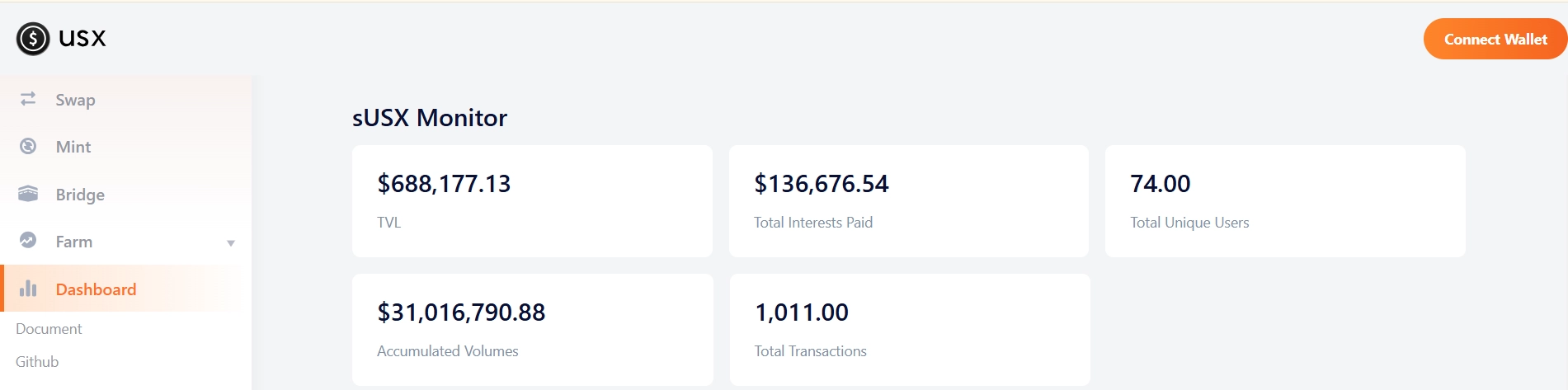

The USX Finance product is an interoperable, permissionless, and hybrid stablecoin infrastructure that enables high-efficiency cross-chain connectivity.

AI-driven automation

dForce leverages AI algorithms and machine learning techniques to analyze vast amounts of data, automate decision-making processes, and optimize transaction aggregation based on intent, liquidity pools, interest rate policies, and transaction automation.

Interoperable LSD

dForce develops LSD protocols that work seamlessly across multiple blockchains, enhancing interoperability and accessibility within the DeFi ecosystem.

dForce DAO

The dForce DAO organization ensures the long-term success of dForce by prioritizing decentralized elements in governance. Besides the DF token, the project has developed Vote-Escrowed DF (veDF) - representing locked DF tokens for voting in the dForce DAO.

When locking DF tokens to vote, users receive veDF based on the lock-up duration and the amount locked. The process is irreversible, and veDF tokens are non-transferable. Users can specify the number of tokens and the lock-up period they wish to participate.

The minimum lock-up period is one week, with a maximum of four years. The feature to extend and add more DF can be done at any time.