Bitcoin’s weekend sell-off has likely pushed aggregate investor returns in BlackRock’s iShares Bitcoin Trust (IBIT) into negative territory.

Bob Elliott, chief investment officer at asset manager Unlimited Funds, said the average dollar invested in IBIT was “underwater” following Friday’s close as bitcoin slid into the mid-$70,000 range.

Dollar-weighted returns turn negative

Elliott shared a chart of aggregate, dollar-weighted investor returns showing cumulative gains slipping slightly below zero in late January.

The data suggest early IBIT buyers may still be in profit, but heavier inflows at higher prices pulled the overall, dollar-weighted return into the red.

By comparison, Elliott’s chart shows IBIT’s dollar-weighted returns peaked at roughly $35 billion in October when bitcoin was at record highs.

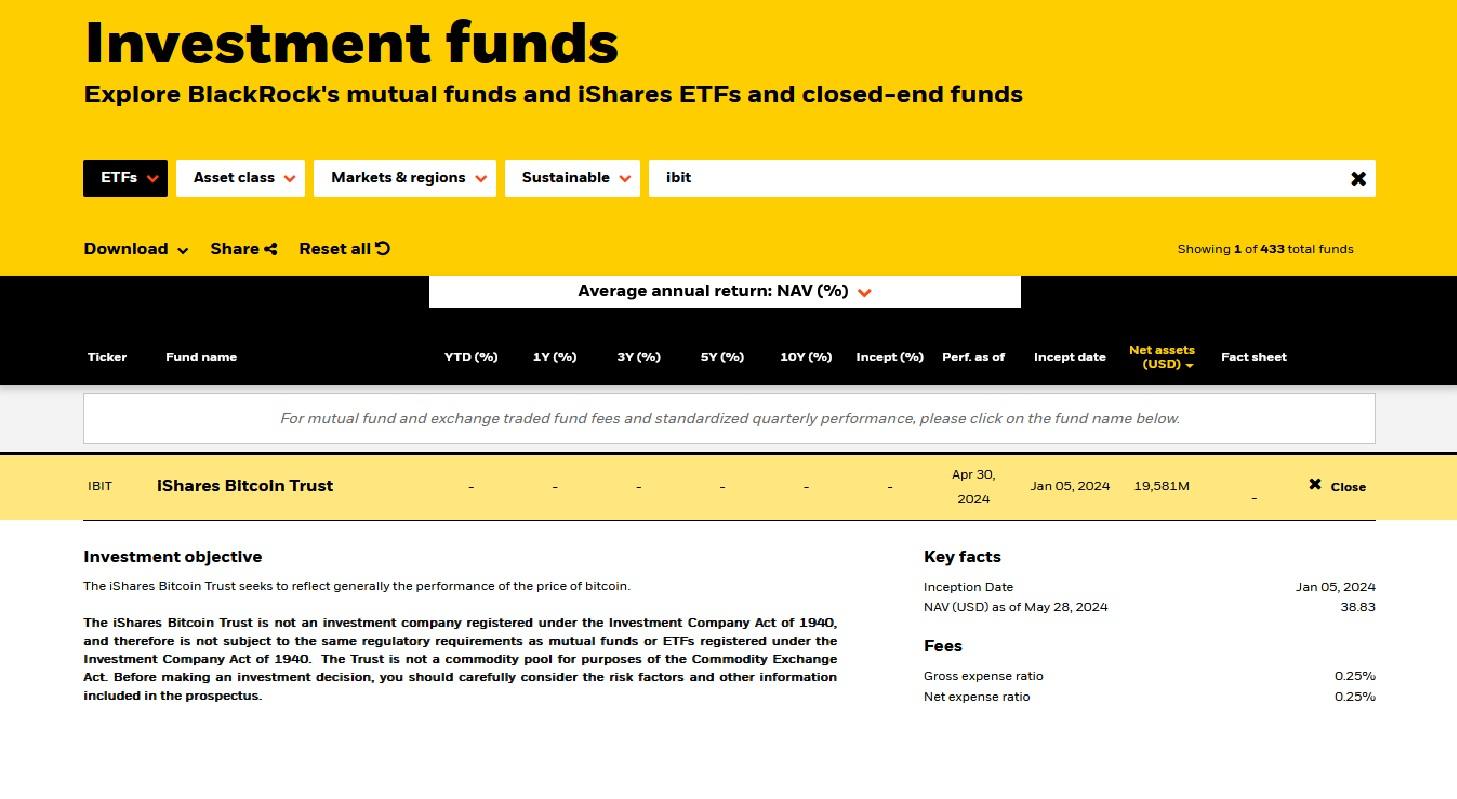

IBIT has been one of BlackRock’s most successful ETF launches, becoming the fastest fund to reach $70 billion in assets under management.

ETF outflows pick up

The shift in returns comes as Bitcoin ETFs face broader selling pressure.

CoinShares reported that in the week to Jan. 25, bitcoin-focused funds saw nearly $1.1 billion in outflows, while total digital-asset fund outflows reached $1.73 billion, with withdrawals heavily concentrated in the United States.

CoinShares said:

“Dwindling expectations for interest rate cuts, negative price momentum and disappointment that digital assets have not participated in the debasement trade yet have likely fuelled these outflows.”

Gold comparison cited

The report also referenced the “debasement trade,” describing positioning in assets expected to preserve value amid inflation and currency dilution.

It noted bitcoin has not attracted flows to the same extent as gold, which has remained in an uptrend for more than a year and recently set record highs above $5,400 per troy ounce.