Ethereum’s network fundamentals are quietly strengthening, even as price action remains under pressure.

Key Takeaways

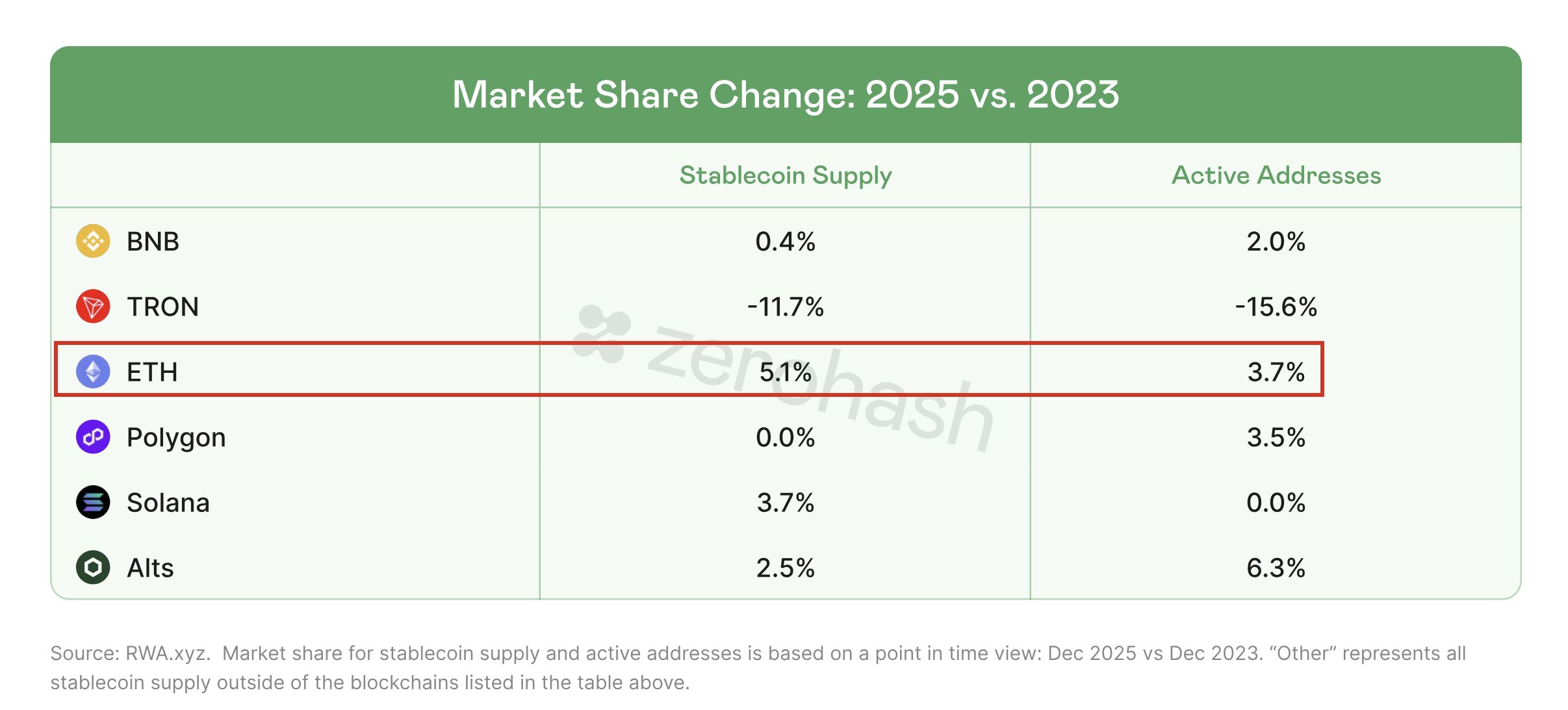

Ethereum is increasing its dominance in stablecoins, gaining market share in both supply and active addresses.

ETH price remains weak in the short term, trading near $2,300 and more than 50% below its all-time high.

Looking toward 2026, historical cycle patterns suggest Ethereum could see a strong recovery once broader market conditions stabilize.

New data shows that the Ethereum blockchain has increased its share of global stablecoin supply by 5.1% since 2023, while active stablecoin addresses on the network are up 3.7% over the same period. The shift highlights where capital is choosing to settle, not just where transactions are cheapest.

By contrast, TRON has lost double-digit market share in both stablecoin supply and user activity. While low-fee chains continue to attract wallet growth, the data suggests that deeper liquidity, security, and institutional trust still anchor capital on Ethereum.

At the time of writing, Ethereum is trading near $2,300, down 11.3% over the past week. The network carries a market capitalization of roughly $278 billion, with 24-hour trading volume around $55.6 billion. Despite these figures, ETH remains more than 50% below its all-time high near $4,950, underscoring the gap between network growth and market sentiment.

Stablecoins Signal Structural Strength

The stablecoin data reinforces Ethereum’s role as the settlement layer of crypto markets. While alternative chains capture retail activity through lower fees, large pools of capital continue to concentrate where liquidity is deepest and counterparty risk is perceived to be lowest. This trend has become more visible since 2023, as Ethereum steadily absorbed market share rather than losing it.

For long-term observers, the takeaway is clear: usage measured in capital deployed is diverging from usage measured purely by address counts. Ethereum is winning the former battle.

Technical Picture: Short-Term Pressure Remains

From a technical perspective, ETH is still stabilizing after a sharp correction. On the 4-hour chart, RSI remains below the neutral 50 level, indicating that momentum is weak but no longer deeply oversold. MACD is still negative, though the histogram shows early signs of downside momentum slowing, suggesting selling pressure may be exhausting.

In the near term, Ethereum is attempting to build a base above the $2,200-$2,250 region. A sustained move above $2,450 would improve the short-term structure, while a loss of support could reopen downside risk toward previous liquidity zones.

A Broader View Into 2026

Macro-oriented analysts are already looking past short-term volatility. According to Michael van de Poppe, Ethereum’s current drawdown mirrors prior cycles where ETH completed its decline well before major macro assets peaked.

In previous instances, similar setups were followed by multi-month periods of underperformance before Ethereum began a powerful relative recovery against Bitcoin.

Van de Poppe notes that in the last comparable cycle, Ethereum eventually rallied more than 300% against Bitcoin after completing a deep correction phase. With ETH already down roughly 31% from recent highs and significantly below its all-time peak, he argues that much of the downside risk may already be priced in, assuming broader market conditions stabilize.

Conclusion

Ethereum is expanding its dominance where it matters most – stablecoin capital and liquidity. Price action remains fragile in the short term, but momentum indicators suggest selling pressure is easing. If historical patterns repeat, 2026 could mark a period where Ethereum’s network growth finally converges with stronger relative price performance.