Dogecoin (DOGE) stabilized around $0.107 on Tuesday after an 11% sell-off last week pushed the meme coin to a multi-month low. The token is down roughly 18% over the past seven days but remains marginally higher by 1.4% in the last 24 hours, signaling tentative dip-buying near the psychologically important $0.10 level. The move comes as broader altcoins consolidate amid fragile risk sentiment and declining retail volumes.

What does DOGE’s negative MVRV signal for traders?

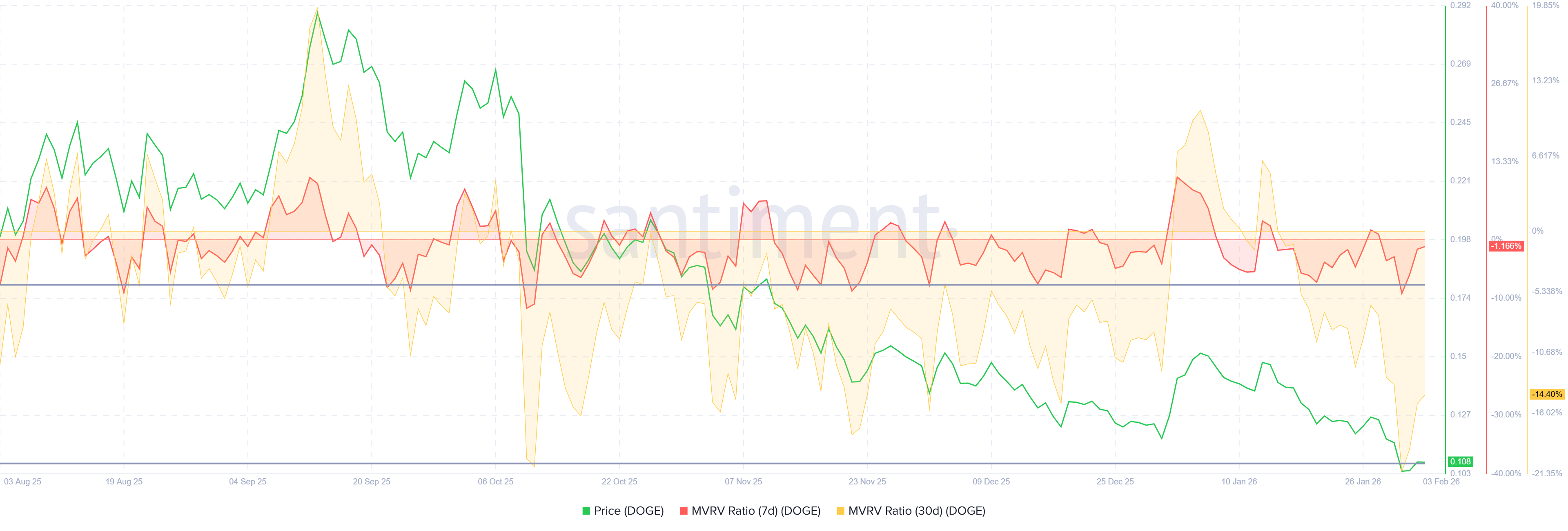

On-chain data points to potential short-term relief. Santiment’s 30-day Market Value to Realized Value (MVRV) ratio sits at -14.4%, improving from -20.8% over the weekend. A negative MVRV means recent buyers are holding unrealized losses, a condition that historically coincides with local bottoms as selling pressure exhausts.

Source: Santiment

The 7-day MVRV has also rebounded to -1.16% from -8.52%, suggesting downside momentum is slowing. For context, similar readings preceded short-term rebounds during prior corrections, supporting the idea of a tactical bounce rather than a full trend reversal.

Technical structure remains bearish despite oversold bounce

From a chart perspective, DOGE broke below weekly support at $0.119 on Thursday and slid to $0.095, marking an 11% decline in two days. Price has since reclaimed $0.10, but the broader structure remains below the 50-day moving average at $0.128, keeping the medium-term trend bearish.

Source: TradingView

The Relative Strength Index (RSI) on the daily chart reads 31, just above oversold territory. That level often attracts short-term buyers, but it also signals weak momentum. However, the MACD has maintained a bullish crossover on 3 February, and crypto trader Alex Choi believed that DOGE is targeting the $0.13 zone for a breakout.

Could $DOGE be targeting the 0.13$ zone for a breakout? ??$Dogecoin has confirmed a Bullish MACD print on the 4h time-frame along with some green price action.?

If bullish momentum persists in the crypto market (short-term) we could see $DOGE target its last pivot high. ? pic.twitter.com/kWYAxE3O1u

— Alex Choi ₿ (@Alexchoi_XBT) February 3, 2026

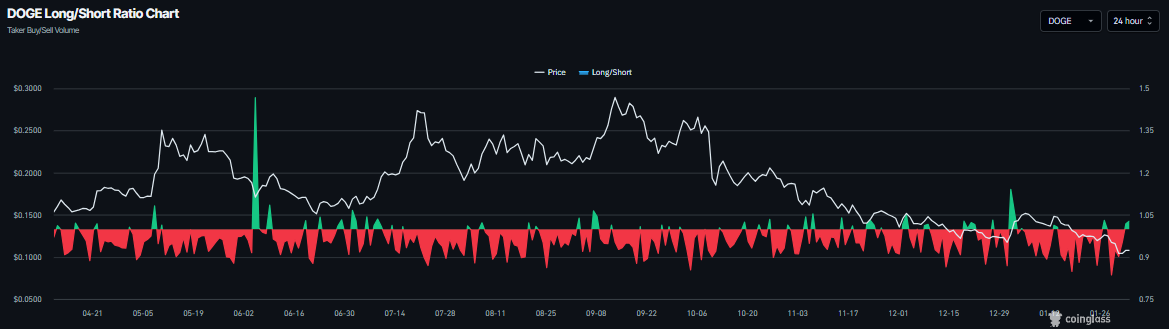

Positioning data hints at cautious optimism

Derivatives data shows a modest shift in sentiment. Coinglass’ long-to-short ratio stands at 1.02, indicating slightly more traders are positioned for upside than downside. While not extreme, this skew suggests expectations of a rebound toward resistance at $0.119.

Source: Coinglass

On-chain supply data shows no significant spike in exchange inflows, implying limited panic selling. That stability aligns with longer-term perspectives outlined in the Dogecoin long-term outlook, which frames current price action as part of a broader consolidation phase.

Downside risks still dominate the medium-term view

Despite improving on-chain metrics, risks remain tilted lower. A daily close below $0.095 would expose DOGE to the next weekly support near $0.078, representing a further 18% downside. Such a move would likely invalidate the near-term rebound thesis.

In the wider market, DOGE continues to lag other altcoins to watch, underscoring its dependence on speculative flows. Unless volume expands and price reclaims $0.119 with conviction, any recovery risks becoming a dead-cat bounce.

For now, Dogecoin’s stabilization at $0.10 reflects a balance between undervaluation signals and a firmly bearish technical trend. Traders are likely to treat rallies as tactical opportunities, while longer-term investors will look for confirmation that broader crypto market recovery narratives can translate into sustained demand.

Maxi Doge ($MAXI) Powers a High-Energy Meme Trading Community

Maxi Doge ($MAXI) takes the familiar Doge meme and turns it into a token that embodies bull markets’ energy. This meme coin aims to build a community for crypto degens who love high-risk/high-reward plays.

Holding $MAXI gives you access to a vibrant hub where retail traders share ideas, strategies, and high-risk plays.

The project also adds a layer of gamification by introducing weekly trading contests and themed challenges like Max Gains and Max Ripped, where top performers can earn rewards and climb the leaderboard.

Staking $MAXI is also promising. Token holders can earn an annual percentage yield (APY) of 73% at the time by locking up their assets until the presale ends.

To buy $MAXI, visit the official Maxi Doge website and connect your wallet. You can either swap USDT or ETH for this token or use a bank card instead.