The crypto market may be closer to a turning point than sentiment suggests, as prolonged consolidation, fading volatility, and extreme investor boredom begin to resemble classic late-cycle basing conditions.

Key Takeaways

Bitcoin holding near $78,000 suggests selling pressure is fading despite extreme fear and negative headlines.

Altcoins have spent years consolidating, a setup that has historically preceded major upside rotations.

Low volatility, washed-out speculation, and investor boredom point to conditions often seen near market bottoms.

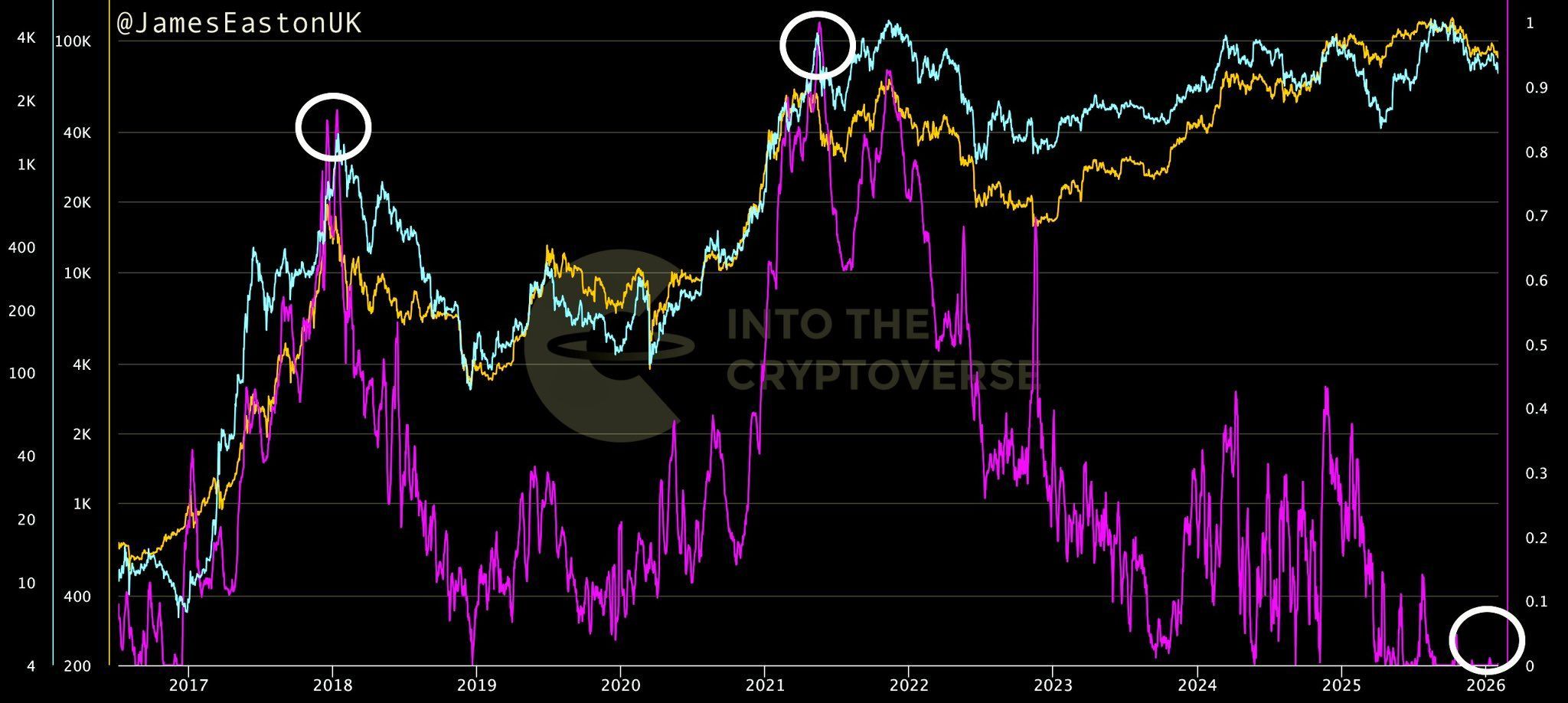

According to market analyst Credible Crypto, altcoins have spent nearly four years moving sideways inside a broad range while Bitcoin absorbed the bulk of capital flows.

During that period, Bitcoin climbed from roughly $15,000 to six-figure territory at its peak, leaving much of the broader market compressed and under-owned. Historically, major rotations into altcoins have tended to follow Bitcoin’s dominant run rather than precede it, reinforcing the idea that the long consolidation phase may be nearing its resolution.

Bitcoin stabilizes as selling pressure fades

Bitcoin is currently trading around $78,000, holding steady after weeks of heavy selling pressure. Despite persistent negative headlines, regulatory uncertainty, and macro-driven fear, price action has stabilized. Rather than accelerating lower, the market appears to be absorbing supply – a sign that forced selling may be largely exhausted.

The crypto market has also shown resilience in the face of extreme fear and sustained FUD. Instead of cascading lower, prices have begun to base, suggesting that panic-driven positioning may already be behind the market.

Boredom replaces fear as accumulation conditions emerge

Several structural indicators support the idea that downside risk is becoming increasingly limited. Volatility across crypto markets has fallen to levels rarely seen outside of major accumulation phases.

Speculative excess has been largely flushed out, retail participation has dropped sharply, and trading activity is now dominated by long-term holders and builders rather than short-term momentum traders.

Market observer James Easton has noted that major market resets rarely occur at moments of peak fear. Instead, they tend to form during periods of deep apathy, when price movement slows, attention fades, and conviction thins. Current conditions align closely with those historical patterns, suggesting that the emotional reset required for a sustainable rebound may already be underway.

While short-term volatility remains possible, the broader crypto market appears to have found its footing. If historical cycles continue to rhyme, this extended phase of compression may ultimately resolve higher once capital rotation resumes and sentiment shifts away from extreme pessimism.