Development activity, not price action, is increasingly shaping the Real World Asset (RWA) sector.

Key Takeaways

RWA leadership is being decided by development activity, not price or hype.

Hedera leads, with Chainlink, Avalanche, and Stellar close behind.

Institutional-focused infrastructure is where the real progress is happening.

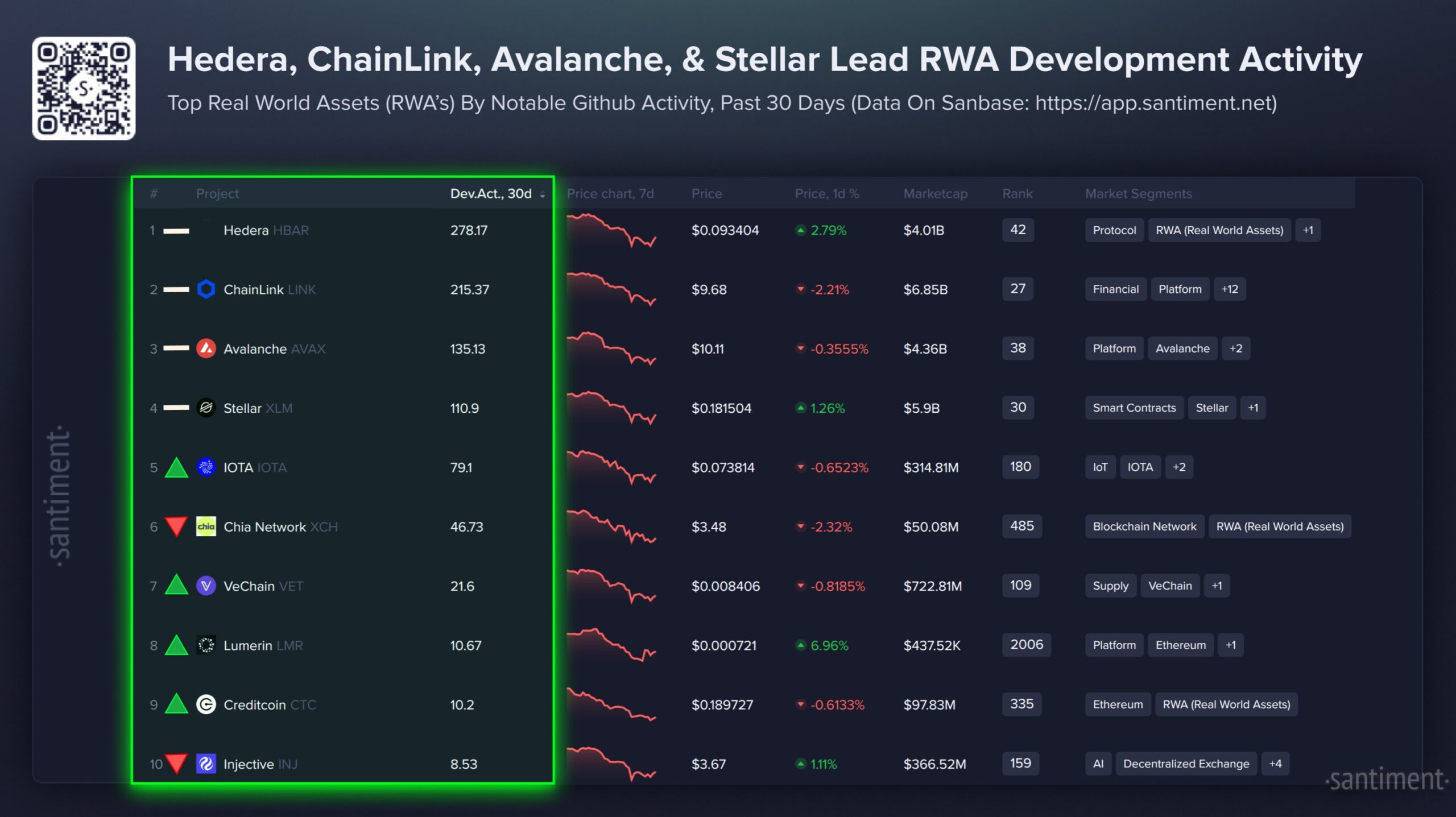

Fresh data from Santiment highlights which blockchain networks are doing the heavy lifting behind the scenes – committing code, upgrading infrastructure, and laying the groundwork needed to move real-world assets on-chain at scale.

Over the past 30 days, GitHub activity across RWA-focused projects has painted a clear picture of where long-term effort is concentrated. Instead of reacting to market volatility, a small group of protocols has continued to push forward with measurable engineering output, signaling serious preparation for institutional and enterprise adoption.

This matters because RWAs demand reliability, compliance, and technical depth. Tokenizing bonds, funds, credit, or commodities isn’t a marketing exercise – it requires robust settlement, data, and security layers that only sustained development can deliver.

Hedera, Chainlink, Avalanche and Stellar Lead the Builder Pack

At the top of the rankings sits Hedera, which recorded the highest development score by a wide margin. The consistency of its GitHub activity reflects an ongoing focus on enterprise-grade architecture, governance, and regulated use cases. Rather than chasing short-term narratives, Hedera’s progress suggests long-term positioning for institutional RWA issuance and settlement.

Close behind is Chainlink, reinforcing its growing role as core infrastructure for tokenized finance. As RWAs depend heavily on real-world data, pricing feeds, compliance triggers, and cross-chain communication, Chainlink’s developer momentum underscores how essential oracle networks have become to the RWA stack.

Avalanche ranks third, reflecting steady development across its subnet architecture and tooling. Avalanche’s activity points to continued preparation for customized, institution-specific deployments, where scalability, control, and interoperability are critical for asset tokenization at scale.

In fourth place, Stellar continues to build on its long-standing focus on tokenized money and cross-border settlement. Its developer activity aligns closely with real-world financial use cases, particularly around compliant asset issuance, stablecoins, and payment rails designed to integrate with existing financial systems.

RWA Progress Is Expanding Beyond the Top Tier

Beyond the leading four, a broader group of networks is quietly maintaining development momentum. IOTA shows continued activity tied to data integrity and machine-driven asset flows, while Chia Network remains focused on infrastructure suited for regulated environments.

VeChain continues to push forward in enterprise supply-chain tokenization, while smaller but consistent efforts from Lumerin, Creditcoin, and Injective reflect niche approaches to decentralized credit, data markets, and tokenized trading infrastructure.

The broader takeaway is clear. The RWA sector is maturing away from hype cycles and toward execution. As banks, funds, and enterprises move closer to issuing tokenized bonds, private credit, commodities, and funds, development activity offers a clearer signal than price action. The projects leading today aren’t necessarily the loudest – they’re the ones steadily building the rails for real-world finance to move on-chain.