The team behind IPO Genie has not yet announced an end date for the presale. As of now, the presale is active, with tokens being released in structured stages. No official Token Generation Event (TGE) date has been confirmed.

In this post, we will cover the presale timeline, stage milestones, and all officially disclosed details, including pricing, raising goals, vesting arrangements, and so on. Readers will get facts about the IPO Genie launch date and project structure without speculation.

Featured Alternative – Editor’s Choice

IPO Genie Presale Timeline – Key Dates

| Event | Date | Status |

| Presale Start | 1 November 2025 | Confirmed |

| Presale End | Not announced | N/A |

| Token Generation Event | Not announced | N/A |

| Token claiming | Not announced | N/A |

| Exchange Listings | Not announced | N/A |

When Does the IPO Genie Presale End?

The IPO Genie presale does not yet have a confirmed end date. The team has officially started the presale on 1 November 2025, but no final closing date has been announced. As such, the IPO Genie presale end date remains unconfirmed.

Presale Stages and Price Increases

The project uses a stage-based pricing ladder during the presale. As the sale progresses, each stage’s price increases slightly from the previous one. Let’s take a look at the IPO Genie presale schedule.

| Stage | Price | Raise Goal | Status |

| Stage 1 | $0.0001000 | Initial presale price | Completed |

| Stage 6 | $0.00010140-$0.00010170 | Incremental pricing band | Completed |

| Stage 11 | $0.00010310 | Continued gradual increase | Completed |

| Stage 22 | $0.00010750 | Mid/later presale stage | Completed |

| Stage 45 | $0.000118 | Current presale stage | Ongoing |

Each presale stage’s price is pushed incrementally as the previous stage sells out.

The exact raise goals for each stage aren’t published in the whitepaper and aren’t consistently disclosed in official project documents. This structure also defines the current IPO Genie phase dates.

What to Expect at TGE (Token Generation Event)

The project has not confirmed an official IPO Genie TGE date in the whitepaper or in formal project announcements as of the presale period. There is no official launch date that’s tied to token distribution at this point.

Token claiming overview:

According to available communications around the presale structure, tokens will become claimable shortly after the presale concludes, once all conditions are met. This is a pretty common phrasing when projects with token presales share their claiming timelines, though in this case, no firm calendar date exists just yet.

Staking availability:

The whitepaper talks of staking as part of the $IPO utility once the ecosystem is live, but staking workflows aren’t part of the presale itself. Full staking launch details, including official start timing, are expected after the sale period and platform infrastructure are live.

Vesting and lockups:

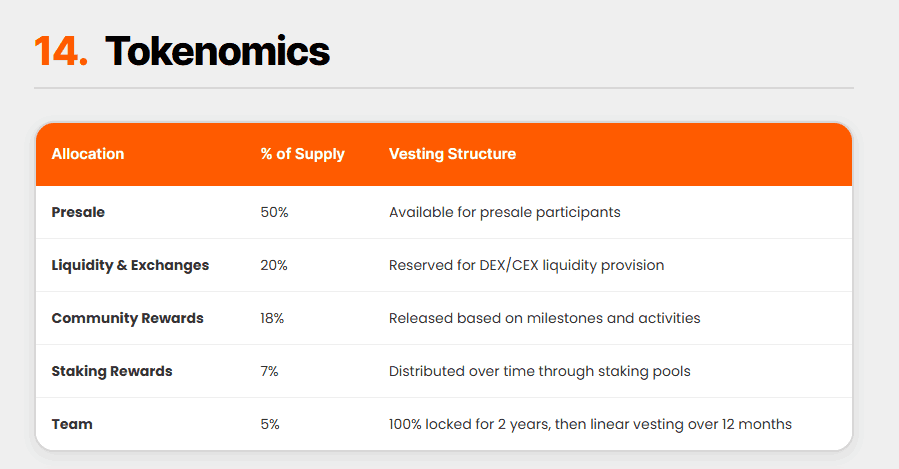

The official tokenomics include a vesting structure for team tokens (locked for 2 years, with a linear release over 12 months thereafter).

There is no publicly released vesting schedule for presale participants published in the whitepaper. Presale token unlock mechanics are expected to be managed according to the standard token issuance procedures once TGE is confirmed.

Genie allocated 50% of the total token supply to the presale. Source: Genie Whitepaper

When Will IPO Genie List on Exchanges?

At this time, IPO Genie has not announced an official IPO Genie listing date. The team has also not confirmed which exchanges, if any, the token will list on. They haven’t spoken on whether listings will happen immediately after the Token Generation Event (TGE).

Based on current disclosures, the presale is ongoing, and both the TGE timing and post-TGE listing plans remain unannounced. Readers who look for official sale information can refer to the IPO Genie IPO Presale Page for live disclosures.

IPO Genie Roadmap – Key Milestones Ahead

Let’s now take a look at the IPO Genie roadmap and what has been completed so far.

Delivered Milestones:

Presale launch: The IPO Genie presale officially began on 1 November 2025.

Public audits: The project has been audited by SolidProof and Certik, two reputable auditing companies in the industry.

Multi-chain infrastructure disclosed: Support for Ethereum, BNB Chain, Solana, Base, and Polygon has been publicly presented.

Tokenomics published: Token distribution, token vesting terms, and supply details have been disclosed in the tokenomics section.

Upcoming Milestones:

Presale continuation and completion: The presale remains ongoing. An end date has not yet been announced.

Token Generation Event (TGE): The team has not confirmed a TGE date.

Token claiming details: Claiming mechanics are expected to be shared closer to the end of the presale. Right now, no instructions have been released.

CEX onboarding and listing: CEX onboarding is listed under Phase 2, but no exchanges or dates have been named.

Fund-as-a-Service (FaaS): Activation of the white-labeled Fund-as-a-Service platform is listed as a Phase 2 objective.

Insurance pool beta: An insurance pool beta launch is shared under Phase 3, without a timeline.

Long-Term Milestones:

AI signal agents: Deployment of AI-driven market signal agents is planned as part of Phase 3.

Tokenized investment products: Index funds, deal builder tools, and tokenized portfolio infrastructure are listed.

Developer and education tools: A Fund Builder SDK, an academy platform, and a mobile application are listed under Phase 4.

Governance expansion: Ongoing governance and voting functionality is referenced, but without fixed rollout dates.

These items represent the IPO Genie’s upcoming milestones, without fixed timelines.

Development Status – What Exists Today?

Live Today:

Presale dashboard: A live presale dashboard is available, displaying real-time data like funds raised, tokens sold, current phase, pricing, and countdowns to price changes.

Smart contract audits: The project lists completed audits by SolidProof and CertiK, both named audit partners on the official website.

Multi-chain deployment: The presale infrastructure supports multiple networks, including Ethereum, BNB Chain, Solana, Base, and Polygon.

In Development:

Staking functionality: Staking is described as a planned utility of the $IPO token, but no confirmation is provided that a live staking contract is currently active.

Product modules: Features such as AI deal scoring, insurance pools, Fund-as-a-Service (FaaS), index funds, and the deal builder marketplace are presented as upcoming or phased releases.

Platform integrations: Ecosystem integrations across liquidity, funds, and analytics are shared in the roadmap, but have not yet been confirmed as fully deployed.

CEX listing negotiations: The roadmap also references centralized exchange onboarding, but no exchanges or agreements have been disclosed so far.

Factors That Could Affect the Launch Timeline

There are several considerations that may influence the timing of the IPO Genie launch and the related milestones. Let’s take a look at them:

Regulatory hurdles: Changes in regulatory requirements across different jurisdictions could affect token distribution or exchange listings.

Product delays: Delays in completing planned platform modules or integrations can change launch-related timelines.

Contract readiness: Additional testing, upgrades, or revisions to the already audited contracts could be required before certain features go live.

Market conditions: Broader market stability and liquidity conditions can also impact the exchange onboarding or token distribution.

Fundraising pace: The speed at which presale stages progress can influence when milestones, such as the TGE, are scheduled.

How to Stay Updated on IPO Genie Launch Announcements

To track verified updates about the IPO Genie launch date, and avoid fake accounts or impersonators, check these channels directly:

Official website: The primary source for announcements, whitepaper downloads, presale statistics, and more.

Twitter / X: The official project account posts updates and links to the team’s verified pages @IPOGenie on Twitter.

Telegram: The official presale community group is available on Telegram as well.

Important safety notes:

Beware of fake social accounts and impersonators. There are unofficial Telegram and X profiles not controlled by the project.

Do not follow private DMs claiming they are “admins”. Official communication is only through the verified channels listed above.