Why is crypto down today? After a volatile Tuesday session on 3 February, 2026, Bitcoin fell sharply to an intraday low of $72,897, its weakest point in over three months. The downturn coincided with heavy liquidations, weakness in U.S. equities, and notable outflows from spot Bitcoin exchange-traded funds, amplifying selling pressure across all cryptocurrencies.

Ethereum declined nearly 10% to around $2,100, while most major altcoins posted losses ranging from 5% to 10% over the same period. The synchronized move highlights the continued sensitivity of crypto markets to both internal leverage dynamics and broader macroeconomic conditions.

As of writing, Bitcoin and Ethereum are trading at $76,145 and $2,262 repectively.

Liquidations and Leverage Drive the Initial Sell-Off

Market data indicates that leveraged positions played a central role in accelerating Bitcoin’s decline. More than $500 million in Bitcoin futures positions were liquidated during the sell-off, according to aggregated derivatives data. High leverage left traders vulnerable to relatively small price moves, triggering automatic liquidations that compounded downward momentum.

This is the news I was talking about. But right before it dropped, they liquidated another $500M in BTC longs.

Criminals. https://t.co/y5HWcQknIQ pic.twitter.com/W482Fb4N7g

— Rushi (@rushicrypto) February 3, 2026

Following the opening of U.S. markets, Bitcoin dropped an additional $1,700 in a short window, wiping out over $55 million in long positions within two hours. During this period, the total cryptocurrency market capitalization fell by nearly $50 billion, underscoring the scale of the move.

Equity Market Weakness and ETF Outflows Add Pressure

The crypto downturn mirrored declines in traditional risk assets. The S&P 500 fell close to 1.3%, reflecting a broader shift toward risk aversion among investors. Historically, cryptocurrencies tend to react more sharply than equities during such periods, a pattern that appeared to repeat during this session.

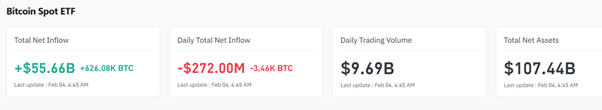

Spot Bitcoin ETF flows also weighed on sentiment. CoinGlass data shows that on February 3, spot Bitcoin ETFs recorded approximately $272 million in net outflows. BlackRock’s IBIT was an exception, registering around $60 million in inflows, while other funds experienced sustained selling. Persistent ETF outflows are often interpreted as a sign of reduced short-term institutional appetite, even if longer-term interest remains intact.

Source: CoinGlass

Broader Uncertainty and Profit-Taking Dynamics

Additional uncertainty emerged from renewed online discussion around historical links between Jeffrey Epstein, academic research, and early digital currency initiatives. While there is no evidence directly connecting these narratives to current market movements, analysts note that such discussions can exacerbate volatility during already fragile conditions.

Galaxy Digital CEO Mike Novogratz attributed the decline primarily to profit-taking rather than panic selling. He stated that investors who accumulated Bitcoin at significantly lower prices began realizing gains after the asset surpassed $100,000 earlier in the cycle, describing the move as a natural “seller’s wave” driven by supply and demand dynamics.

Galaxy Digital is seeing its stock under pressure. CEO @novogratz tells Bloomberg that Bitcoin’s recent pullback reflects a "seller's virus," driven by widespread profit-taking. He adds that pessimism across crypto markets is high, but sentiment could improve if market structure… pic.twitter.com/kTPlIxe1vp

— Bloomberg TV (@BloombergTV) February 3, 2026

Key Levels in Focus

Market participants are now closely monitoring the $76,500 area as a near-term support zone. A sustained break below this level could expose lower historical demand areas, while any recovery would likely require a broader improvement in macro sentiment and stabilization in ETF flows. For now, analysts caution that volatility may remain elevated as the market digests recent losses and reassesses risk.

Bitcoin Hyper ($HYPER) Presale Brings Next-Gen Speed to the Bitcoin Network

Bitcoin Hyper ($HYPER) aims to give Bitcoin something it has never truly had: fast, low-cost, scalable transactions.

Instead of relying on workarounds or fragmented tools, Bitcoin Hyper introduces a Solana-based layer-2 built to support the next generation of DeFi apps, meme coins, and payment platforms for the OG blockchain.

For years, Bitcoin has been limited to roughly seven transactions per second, which results in slow confirmation times during network spikes.

Bitcoin Hyper tackles those constraints by adding a high-performance layer that reduces latency and opens the door to broader Web3 integrations. To get started, investors can safely send their BTC tokens to the Hyper Bridge to get the corresponding amount on the Hyper L2 almost instantly.

Analysts agree that once top wallets and exchanges embrace the solution, the demand for $HYPER should explode.

To buy $HYPER before the presale ends, simply visit the official Bitcoin Hyper website and connect your wallet. You can either swap USDT or SOL for this token or use a bank card instead.