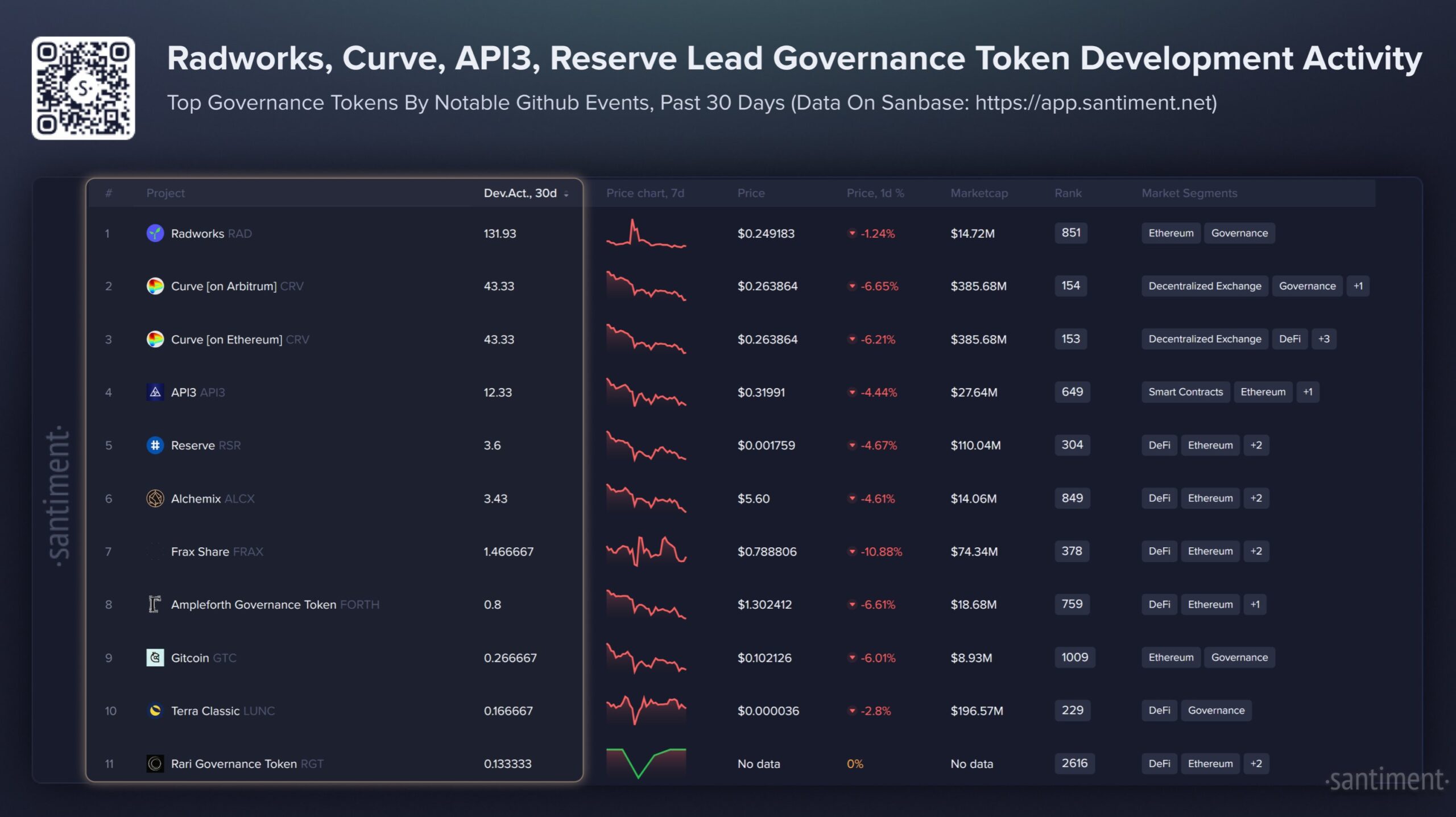

Crypto development activity is back in focus after Santiment introduced a new screener ranking governance tokens by GitHub activity.

Key Takeaways

Santiment data shows governance tokens remain actively developed despite weak prices.

Radworks and Curve Finance lead GitHub activity among DeFi projects.

Developer momentum continues even as market sentiment stays cautious.

Instead of tracking price momentum, the tool highlights which decentralized projects are seeing the most consistent developer engagement as markets remain under pressure.

The latest data from Santiment shows infrastructure-heavy DeFi protocols dominating the rankings, suggesting building activity remains resilient even as token valuations lag. Santiment noted that the screener will be updated regularly to track how development trends evolve over time.

Below is a breakdown of the top governance tokens by development activity and what each project is building.

Radworks (RAD) Leads Governance Development

Radworks tops the list, reflecting sustained work on its developer-first ecosystem. Formerly known as Radicle, the network provides sovereign, peer-to-peer infrastructure for open-source code collaboration and funding. RAD holders govern the treasury and guide decisions for products such as Radicle and Drips.

Curve Finance (CRV) Maintains Strong Core Development

Curve Finance ranks second as development continues across its liquidity and incentive systems. The protocol specializes in low-slippage stablecoin and pegged-asset trading, while the CRV token underpins its veTokenomics model, allowing locked holders to influence reward distribution and earn protocol fees.

API3 (API3) Advances First-Party Oracle Infrastructure

API3 secures the third spot, driven by ongoing development of its oracle framework. The project enables traditional APIs to connect directly to blockchains through first-party Airnodes, eliminating intermediaries. API3 holders govern the DAO and stake tokens into an insurance pool that backs data feed reliability.

Reserve Protocol (RSR) Expands Stablecoin Architecture

Reserve Protocol remains near the top as work continues on its stablecoin platform. The system enables the creation of overcollateralized RTokens and decentralized token portfolios, with RSR acting as a backstop asset that stakers use to insure stablecoins against collateral failure in return for protocol revenue.

Alchemix (ALCX) Builds on Self-Repaying Loans

Alchemix shows consistent development tied to its unique lending model. The protocol allows users to take loans that repay themselves over time using yield generated from deposited collateral. ALCX functions as the governance token, giving holders influence over yield strategies and protocol upgrades.

Frax Finance (FRAX) Pushes Its Layer-2 Ecosystem

Frax Finance continues to rank highly as it expands its ecosystem beyond stablecoins. Originally focused on its hybrid stablecoin design, Frax has evolved into a full-stack stablecoin operating system. As of 2026, FRAX serves as the native gas token for the Fraxtal Layer-2 network and captures value across the broader Frax stack.

Ampleforth (FORTH) Develops Elastic Monetary Tools

Ampleforth maintains notable development activity around its experimental monetary system. FORTH governs the protocol behind AMPL, an elastic-supply asset that adjusts daily based on demand, while also overseeing the development of complementary stability tools such as SPOT.

Gitcoin (GTC) Sustains Public Goods Funding Infrastructure

Gitcoin remains a key player in open-source funding. The platform supports public goods through mechanisms like Quadratic Funding, with GTC enabling decentralized governance over grants programs, treasury management, and identity tools including Gitcoin Passport.

Terra Classic (LUNC) Shows Ongoing Community-Led Work

Despite its past collapse, Terra Classic continues to see development contributions. LUNC represents the original Terra blockchain and is now fully community-governed, used for staking and voting on initiatives focused on network recovery, transaction tax burns, and supply reduction.

Rari Capital (RGT) Continues Post-Restructuring Development

Rari Capital rounds out the list following significant protocol restructuring. Initially built for automated yield strategies and permissionless lending via Fuse, the project still records development activity as governance and system changes continue after historical security incidents.

Overall, Santiment’s screener suggests that while governance token prices remain under pressure, developer engagement across major DeFi and infrastructure projects remains active, highlighting a persistent disconnect between market sentiment and on-chain building.