BlackRock’s iShares Bitcoin Trust (IBIT) posted a record day of trading activity on Thursday as bitcoin sold off sharply.

Record volume during the sell-off

Bloomberg ETF analyst Eric Balchunas said IBIT “crushed its daily volume record,” with about $10 billion worth of shares changing hands.

Balchunas added that IBIT fell 13% on the day, its second-worst daily drop since launch.

Recent flows and price declines

IBIT saw net outflows of $373.4 million on Wednesday, and has logged just 10 trading days of net inflows so far in 2026.

Bitcoin fell about 12% over the past 24 hours to around $64,000 after briefly touching roughly $60,300.

For context on the move, bitcoin is down about 50% from its early-October peak near $126,000, according to CoinGecko.

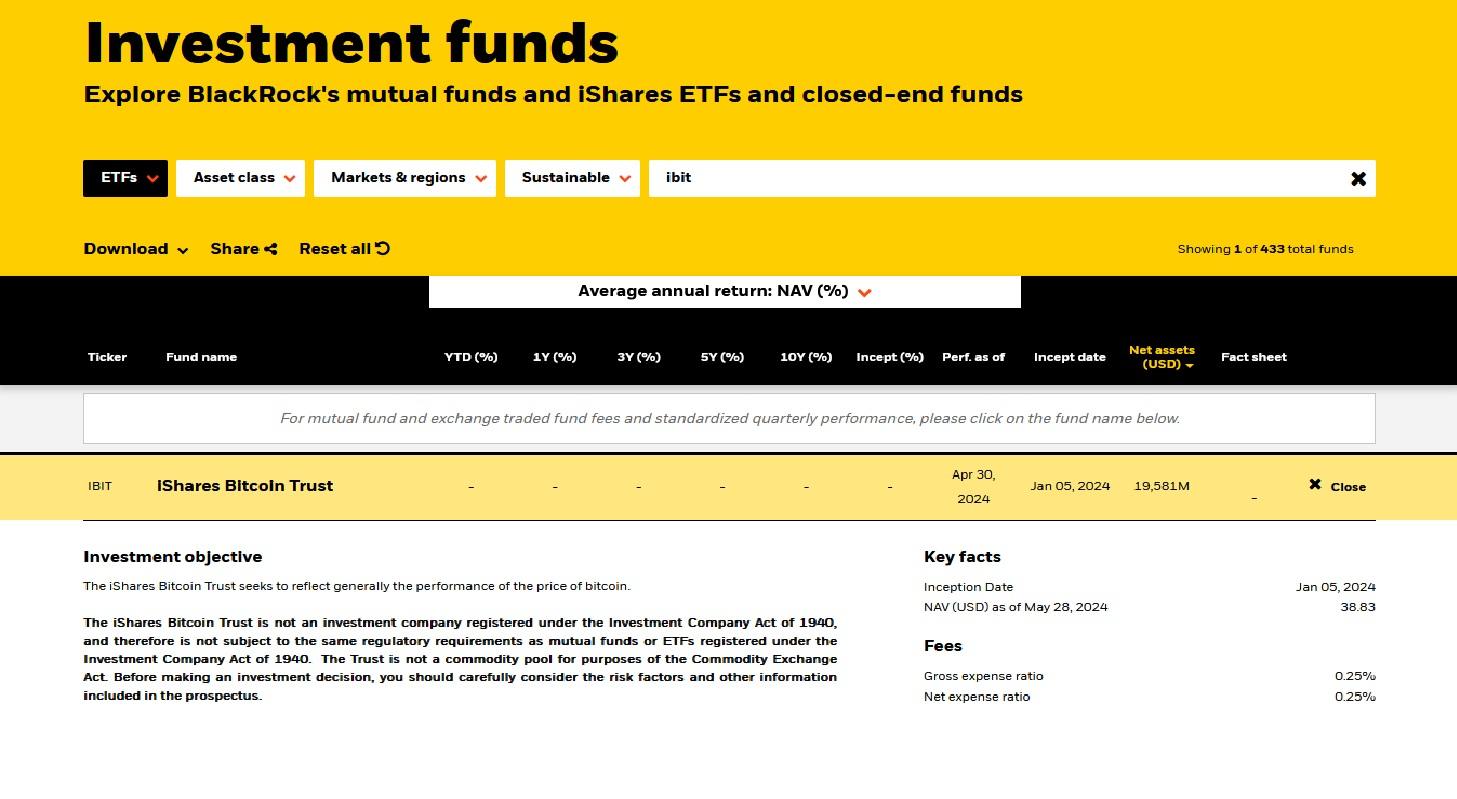

IBIT has tracked the drawdown, peaking near $70 in early October and closing Thursday around $36.10.

Analysts point to macro pressure

Bob Elliott, investment chief at Unlimited Funds, previously said the average dollar invested in IBIT is now underwater.

The latest drop comes as markets react to weak US jobs data and concerns about capital concentration in the artificial intelligence sector.

Veteran trader Peter Brandt also warned the decline may not be over, saying bitcoin shows “fingerprints of campaign selling” with limited dip-buying.