Ethereum pushed back above the $2,000 level after a sharp recovery across the crypto market, following Bitcoin’s surge toward the $70,000 area.

Key Takeaways

Ethereum moved back above $2,000 as Bitcoin rebounded toward $70,000.

Heavy liquidations cleared leveraged positions, with ETH seeing over $400 million wiped out.

On-chain activity hit a new all-time high, signaling strong network usage despite volatility.

The rebound came after a volatile sell-off that briefly dragged Bitcoin down to around $60,000, triggering panic across derivatives markets and sending sentiment into extreme fear territory.

Volatility Spike Follows Heavy Market Liquidations

The move higher came after a significant liquidation event. Total crypto liquidations over the past 24 hours approached $2 billion, with long positions taking the brunt of the damage.

Ethereum alone accounted for more than $418 million in liquidations, including roughly $287 million from longs, suggesting that excessive leverage was flushed out during the downturn.

Ethereum Price Stabilizes After Steep Weekly Decline

Despite the bounce, Ethereum remains under pressure on a weekly basis. ETH is up about 1.8% on the day and nearly 2% over 24 hours, but still down roughly 26% over the past seven days.

Its market capitalization stands near $243 billion, while 24-hour trading volume has climbed above $72 billion, reflecting elevated trading activity as investors reposition.

From a technical perspective, momentum indicators are beginning to improve. Ethereum’s RSI has rebounded toward the high-50s, moving away from oversold conditions, while the MACD has turned upward on lower timeframes. Price action shows ETH reclaiming the $2,000 psychological level after finding demand near the $1,900 zone.

On-Chain Data Shows Record Network Activity

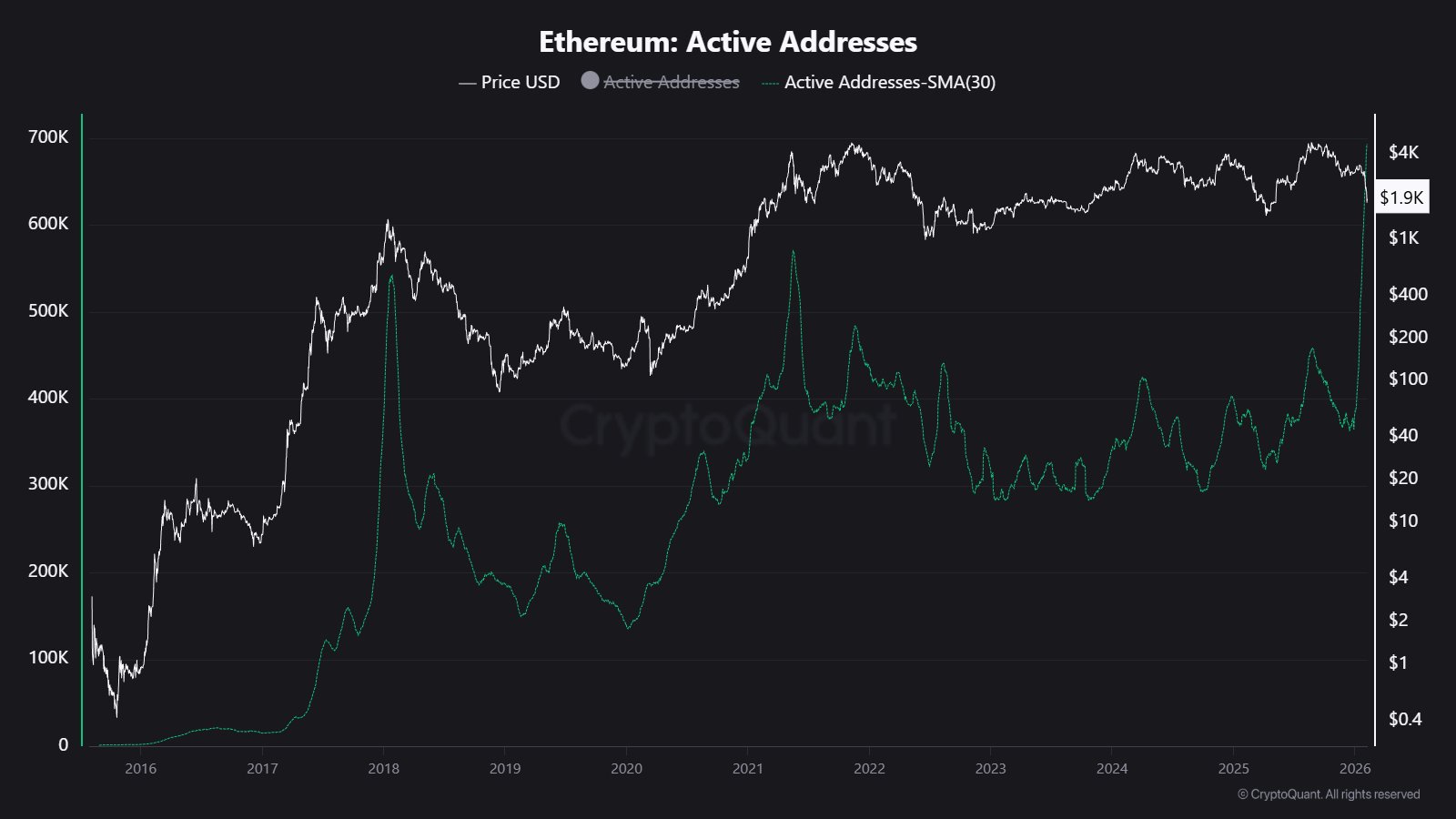

On-chain metrics add a constructive backdrop to the recovery. Ethereum recently recorded a new all-time high in active addresses, with the 30-day moving average rising to around 693,000. Historically, periods where network activity expands during price weakness have often aligned with stronger medium-term recoveries.

Ethereum’s ability to hold above $2,000 now depends heavily on Bitcoin maintaining strength near the $70,000 level. A sustained consolidation above former resistance could allow ETH to target higher levels, although volatility is likely to remain elevated as the market digests the recent liquidation-driven reset.