Binance has purchased another $300 million worth of Bitcoin for its Secure Asset Fund for Users — or SAFU fund.

And the industry’s top crypto exchange by volume, isn’t done buying yet, despite owning $740 million in Bitcoin.

“We’re continuing to acquire Bitcoin for the SAFU fund, aiming to complete conversion of the fund within 30 days of our original announcement,” Binance announced in a post on X on Monday.

Established by Binance in 2018, SAFU is an emergency cushion used to protect clients’ assets in the event of a catastrophic security breach or platform failure.

The nine-digit haul comes after Bitcoin’s price has suffered major volatility in recent weeks, driven by selloffs from long-term whales and a lack of buyers.

Bitcoin has crashed 23% over the past month, despite favourable economic conditions that propelled the broader asset market to fresh highs.

On Friday, the top crypto dipped to as low as $60,000 — over 50% below its all-time high set in October 2025 — before bouncing back to $70,000.

The intense volatility comes as the crypto industry is reeling from a $2 trillion drawdown.

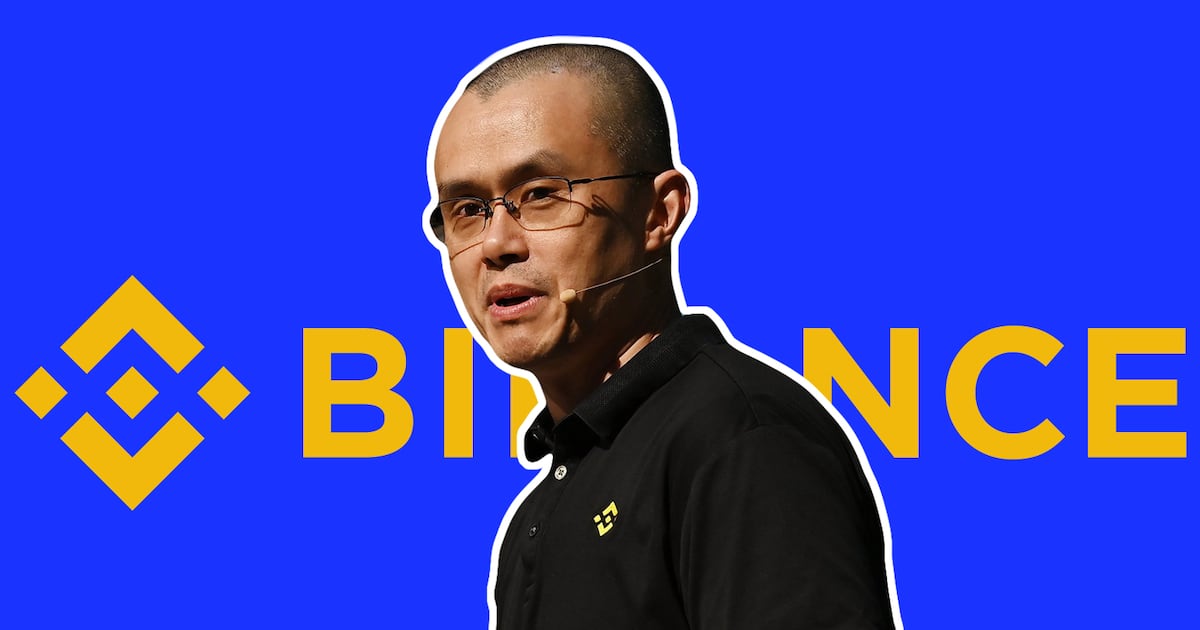

On Sunday, Binance co-founder Changpeng Zhao dismissed fears of a market meltdown and posted a video of himself snowboarding with Kyrgyz President Sadyr Zhaparov.

Binance isn’t alone either.

Strategy’s executive chairman, Michael Saylor, hinted hours earlier that his firm is also buying the dip.

“Orange Dots Matter,” he said on X on Sunday, with a chart hinting that Strategy has purchased more Bitcoin.

Strategy’s fourth-quarter earnings call was attended by a record 200,000 people, despite Bitcoin’s volatile price action, the firm said on X.

Bitcoin SAFU?

The term SAFU — and its link to Zhao — is legendary in the crypto community.

In 2018, a YouTuber by the name of Bizonacci made a video titled “Funds Are Safu” amid security concerns about the exchange’s crypto holdings.

After spreading like wildfire, with Zhao commonly using the phrase after big market or security scares, the term has been enshrined in crypto culture.

As of February 2026, the SAFU fund wallet holds approximately $1 billion in cryptocurrencies.

Today, a portion of these funds is held as capital reserves under Binance’s regulatory obligations in Abu Dhabi, where the firm’s headquarters were moved in 2025.