Ethereum’s on-chain activity is surging to levels never seen before, even as its market price remains far below previous highs.

Key Takeaways

Ethereum mainnet transactions have reached a new all-time high of about 70.4 million monthly.

ETH remains roughly 60% below its previous peak despite accelerating network usage.

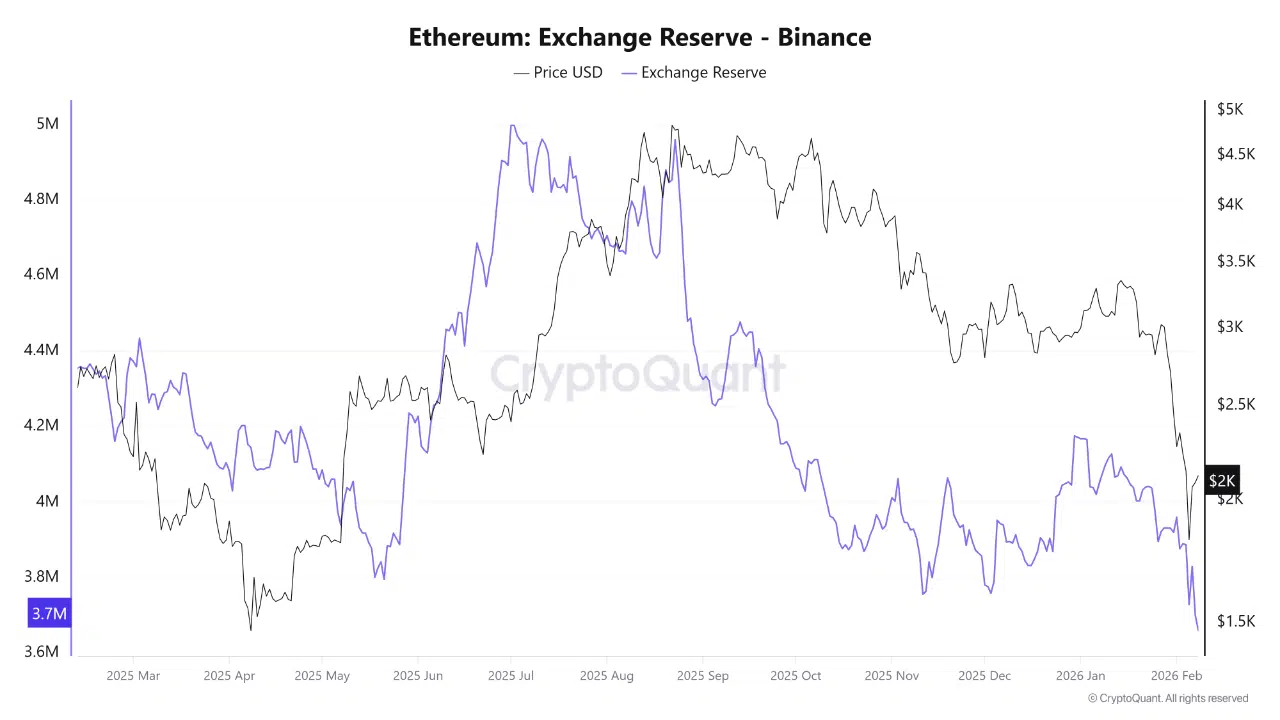

Binance ETH reserves have fallen to their lowest level since 2024, reducing available sell-side supply.

Traders increasingly view current price action as base-building, with $4,000 as a key confirmation level.

New data shows a growing disconnect between network usage, exchange supply, and price action – a combination that analysts say often appears during long base-building phases rather than market tops.

Record activity on Ethereum mainnet

Ethereum has quietly set a new benchmark for network usage. Monthly transactions on the mainnet have climbed to roughly 70.4 million, marking an all-time high. Activity has accelerated sharply, with transactions up around 36% over the past month, 46% over six months, and nearly 90% compared to the same period last year.

The rise reflects steady growth in users, applications, and demand for block space, rather than a short-lived spike. Analysts tracking on-chain metrics note that this type of expansion usually signals deeper network adoption, even when price action lags behind fundamentals.

Despite this explosion in activity, ETH is still trading roughly 60% below its all-time high, reinforcing the idea that the market has yet to fully reprice Ethereum’s underlying usage.

Price structure points to base formation

From a technical perspective, traders are increasingly framing Ethereum’s current range as accumulation rather than distribution. According to market commentary from Merlijn The Trader, ETH has successfully held the $1,500-$2,200 zone as demand, while recent sell-offs appear to have flushed out weaker hands.

ETHEREUM IS BUILDING A BASE, NOT A TOP.

$1.5K–$2.2K held as demand.

Liquidity got swept.

Weak hands flushed.Now the only thing that matters:

Get back above $4K.That’s when the real trend shows up. pic.twitter.com/0ZaBjukQN7

— Merlijn The Trader (@MerlijnTrader) February 8, 2026

Liquidity sweeps below key levels have so far failed to trigger sustained downside follow-through. The next critical test sits near the $4,000 mark, which traders view as the level that would confirm a broader trend reversal. Until then, price consolidation remains consistent with a prolonged base-building phase.

Exchange reserves keep falling

On the supply side, exchange data adds another layer to the story. According to CryptoQuant, Ethereum reserves on Binance have declined to around 3.7 million ETH, the lowest level since 2024. Importantly, the drawdown has been gradual rather than sudden, suggesting intentional repositioning rather than panic withdrawals.

Exchange reserves represent ETH readily available for spot selling. When balances trend lower over time, it often signals reduced immediate sell pressure, as more coins move into long-term storage, staking, or DeFi usage.

Historically, similar reserve declines have preceded periods of tighter supply, especially when paired with rising on-chain activity.

Fundamentals strengthening beneath the surface

Taken together, Ethereum’s rising transaction counts, declining exchange balances, and stable price structure paint a picture of strengthening fundamentals that are not yet reflected in market valuation. While short-term price volatility remains possible, the underlying data suggests Ethereum is consolidating rather than topping out.

For long-term observers, the gap between usage growth and price performance may be one of the most notable developments in the current cycle.