Ripple and XRP are entering mid-February 2026 with a rare convergence of regulatory progress, institutional adoption, and renewed market focus.

Key Takeaways

Ripple’s valuation and IPO prospects are strengthening as institutional interest accelerates.

Regulatory changes could unlock derivatives-market access for Ripple’s RLUSD stablecoin.

XRPL adoption is rising fast, driven by real-world assets and stablecoin growth.

XRP’s price rebound is losing momentum, pointing to short-term consolidation.

While price action remains choppy in the short term, developments around Ripple’s business, the XRP Ledger, and regulatory positioning are strengthening the long-term narrative.

Ripple Emerges as a Top Global IPO Candidate

Over the past 48 hours, Ripple has gained fresh attention after being ranked as the 9th-largest global IPO candidate. Current estimates place the company’s valuation near $50 billion, representing an increase of roughly 25% compared to late 2025. This re-rating reflects growing confidence that Ripple’s regulatory battles are largely behind it and that its infrastructure is increasingly relevant to traditional finance.

The IPO discussion is also feeding into broader institutional interest in XRP, as investors assess Ripple not just as a crypto-native firm, but as a regulated financial infrastructure provider.

CFTC Decision Opens a New Institutional Door

A major regulatory milestone was reached on February 7, when the Commodity Futures Trading Commission updated its collateral guidance for derivatives markets. The revised framework now allows stablecoins issued by state-supervised banks to be used as eligible collateral.

Ripple’s RLUSD stablecoin meets these criteria, potentially positioning it for use in institutional clearing and settlement across futures and options markets. If adoption follows, this could expose Ripple’s ecosystem to derivatives markets measured in the trillions of dollars, a scale few blockchain projects can realistically access.

XRPL Sees Surge in Real-World Assets and Stablecoins

On-chain data shows accelerating adoption on the XRP Ledger itself. Over the past 30 days, the value of real-world assets issued on XRPL jumped 265%, reaching approximately $1.4 billion. At the same time, the number of unique organizational holders rose by 69%, signaling growing enterprise participation rather than retail-only activity.

Stablecoin usage on XRPL is also expanding. Total stablecoin market capitalization increased 18% month over month to $416 million, while transfer volumes climbed 45%. Together, these trends point to rising utility in payments, tokenization, and enterprise settlement.

Community and Institutional Engagement Intensifies

Ripple has confirmed that XRP Community Day 2026 will take place globally on February 11–12. The event is expected to feature updates from Brad Garlinghouse and Monica Long, with discussions centered on XRP ETFs, new partnerships, and institutional use cases.

In parallel, Evernorth announced plans to go public via a SPAC merger, aiming to raise more than $1 billion to build what it describes as the world’s largest public XRP treasury. If realized, the move would mark one of the most aggressive corporate treasury strategies focused specifically on XRP.

Upcoming XRPL Network Upgrade

Developers are now preparing for a major XRPL amendment scheduled for activation on February 12. The upgrade introduces features such as permissioned domains, designed to support compliance-driven environments, along with early infrastructure for institutional DeFi, including single-asset vaults and regulated lending frameworks.

Ripple has encouraged developers to test projects ahead of the upgrade to avoid potential disruptions once the amendment is live.

XRP Market Context and Supply Dynamics

XRP is currently trading in the mid-$1.40 range after rebounding from a sharp early-February selloff. The recovery followed Ripple’s routine release of 1 billion XRP from escrow on February 1, part of its long-standing and predictable supply schedule.

While escrow releases often draw attention, the market reaction this time suggests traders are more focused on broader macro and regulatory factors than on supply mechanics alone.

Technical Analysis: Momentum Fades After Sharp Rebound

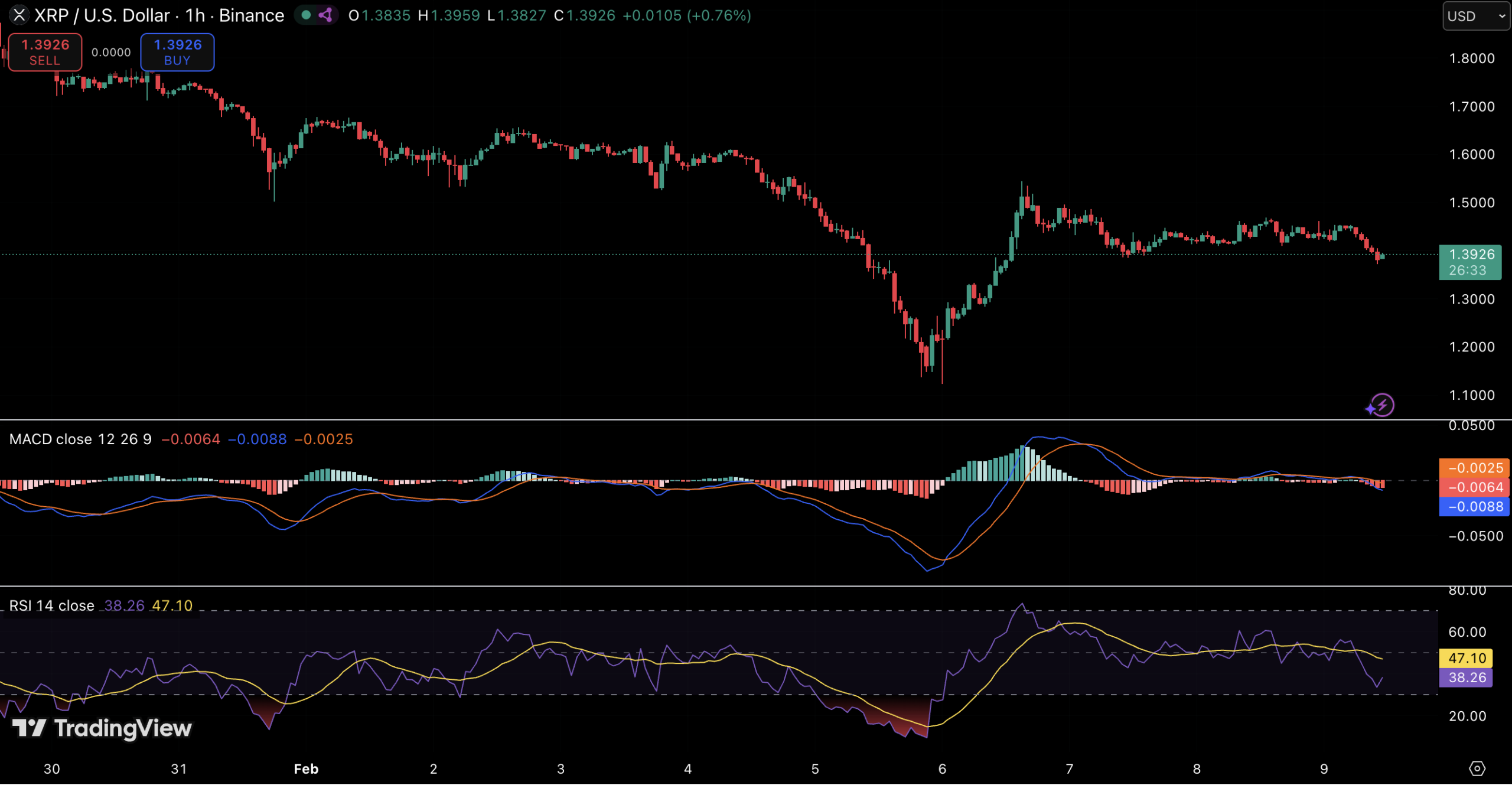

The 1-hour XRP/USD chart shows a strong rebound from the $1.20 area, followed by a loss of momentum near $1.45. After briefly escaping oversold territory, the RSI has slipped back into the high-30s to mid-40s range, indicating weakening bullish strength.

MACD signals reinforce this view. The indicator has rolled over near the zero line, with histogram bars turning negative, suggesting fading upside momentum. Price action has shifted into a sideways consolidation, with XRP struggling to reclaim resistance around $1.48–$1.50.

If the current range breaks lower, traders are likely to watch the $1.30–$1.32 zone as near-term support. On the upside, a decisive move above $1.50 would be needed to restore bullish momentum and reopen the path toward recent highs.

Outlook: Strong Fundamentals, Cautious Price Action

Ripple’s expanding regulatory clarity, institutional traction, and on-chain growth present one of the strongest fundamental setups XRP has seen in years. However, the technical picture suggests the market may need additional time to consolidate before committing to the next directional move.

For now, XRP sits at a crossroads, supported by improving fundamentals but constrained by short-term momentum signals that remain fragile.