Bitcoin is facing renewed pressure from the derivatives market, even as some analysts argue that the broader monthly structure still points to a much larger move ahead.

Key Takeaways

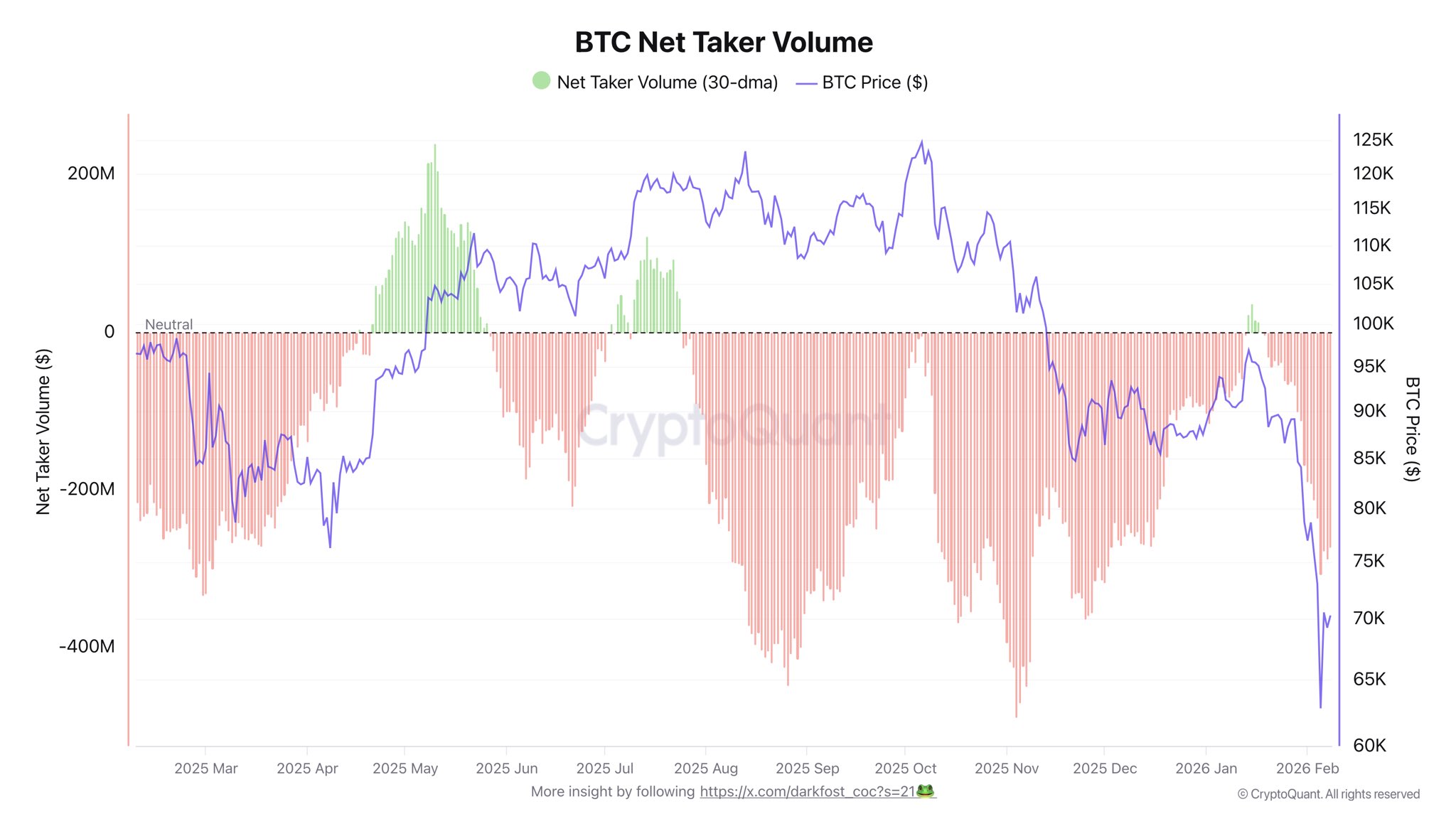

Bitcoin is facing renewed selling pressure from the derivatives market as Net Taker Volume turns negative again.

Seller dominance has intensified, with taker flows dropping to around -$272 million and Binance ratios slipping below 1.

Futures trading continues to outweigh spot demand, making the recent price rebound look fragile despite a bullish long-term chart setup.

Recent data shows that sellers are once again firmly in control, raising questions about whether the latest rebound can hold in the near term.

Derivatives selling regains control

On a monthly average basis, Bitcoin’s Net Taker Volume has flipped back into negative territory, signaling that aggressive sellers are dominating futures markets. After a relatively calm stretch between November and January, when buyers briefly pushed net taker flow to around $36 million, the balance has now swung sharply the other way. Current readings show selling pressure near $272 million, a clear shift back toward risk-off positioning.

This trend is also visible on Binance, the exchange that concentrates a large share of global derivatives volume. Over the same period, the taker buy-sell ratio slipped from 1.00 to 0.97, reinforcing the picture of growing sell-side dominance. More concerning for bulls is the pace of change: the selling pressure is not just persistent, but accelerating, which increases the burden on spot buyers to absorb futures-driven weakness.

Spot demand lags futures activity

Despite periodic ETF inflows and moments of spot buying, futures volumes continue to dictate short-term price action. The gap between derivatives activity and spot demand remains wide, suggesting that leveraged positioning is still the main driver of Bitcoin’s swings. In this environment, even modest macro shocks can amplify moves, especially if forced liquidations reappear.

With key macro data such as US CPI and unemployment figures approaching, traders are increasingly cautious. The recent bounce in price is widely seen as fragile, vulnerable to renewed downside if macro conditions or risk sentiment deteriorate.

A conflicting bullish signal on the bigger picture

Adding complexity to the outlook, analyst Merlijn The Trader points to a very different signal on the monthly chart. According to his analysis, Bitcoin is forming a textbook cup-and-handle pattern, a structure typically associated with powerful continuation moves. He argues that such patterns rarely resolve quietly and tend to reprice the asset decisively once the breakout occurs.

BITCOIN MONTHLY:

This is a textbook cup & handle.

These patterns don’t resolve quietly.

When they break, they reprice the asset.Will it happen?

That’s the risk we take.In this business, you don’t hide.

You take the trade. pic.twitter.com/g5Pcp2AQIw— Merlijn The Trader (@MerlijnTrader) February 9, 2026

At the time of writing, Bitcoin is trading near $68,945, sitting uncomfortably between short-term derivative pressure and a potentially bullish long-term setup. For now, the tension between these two forces defines the market: heavy selling in futures is capping upside, while longer-term chart structures keep the bullish narrative alive.

Until spot demand meaningfully overtakes derivatives activity, caution is likely to remain the dominant theme, even for traders who believe the bigger breakout is still ahead.