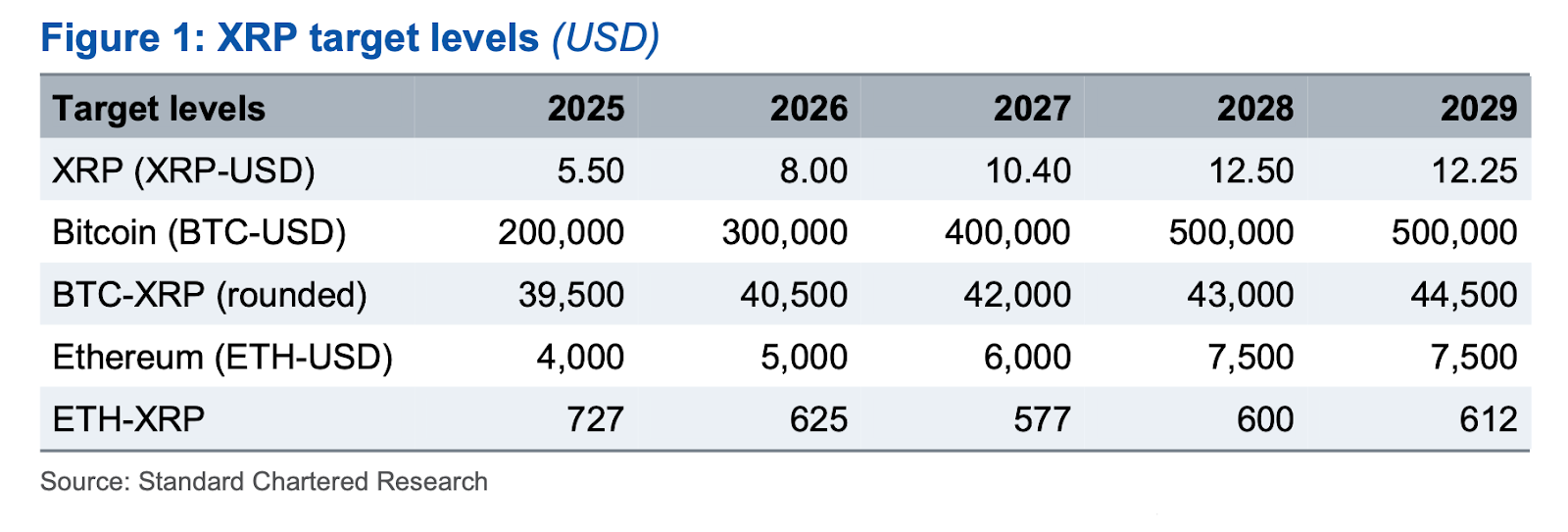

Standard Chartered has issued a forecast for XRP, projecting the asset could surge to $12.50 by the end of 2028. This target implies a potential 500% upside from its current trading level around $2.12. The bank’s analysis points to the recent resolution of regulatory hurdles and the maturing XRP ETF market as primary drivers for this valuation. While institutional coverage of XRP has been historically cautious, this latest roadmap outlines a significant shift in banking sentiment.

Why Standard Chartered’s XRP Target Matters

Institutional price targets for XRP have been scarce due to the lengthy and uncertain SEC v. Ripple legal battle. With that case fully resolved as of August 2025—marked by the SEC dropping its appeal and Ripple paying a settlement without admitting wrongdoing—major financial institutions are revisiting the asset. Standard Chartered’s coverage signals this transition of XRP from a regulatory outlier to a recognized financial instrument. This institutional validation is critical as XRP defends key support levels and seeks to decouple from broader market volatility.

ETF Prospects and Cross-Border Payment Expansion

Geoffrey Kendrick, Standard Chartered’s global head of digital assets research, outlines a path where XRP benefits significantly from the spot ETFs that began trading in late 2025. While early net inflows have reached approximately $1.18 billion, the bank anticipates this figure could scale to $4-8 billion annually as institutional confidence solidifies. Standard Chartered believes these inflows will act as a sustained buy-side pressure, distinct from retail speculation.

Beyond investment vehicles, the report highlights the XRP Ledger’s (XRPL) utility in cross-border payments. The analysis cites Ripple’s RLUSD stablecoin and the favorable environment created by the recently passed GENIUS Act as catalysts for transaction volume growth. Kendrick’s roadmap projects aggressive milestones, targeting $8.00 in 2026 and $10.40 in 2027. Investors tracking these targets should note that while fundamentals align, market price action can often lag behind theoretical valuation models.

What This Means for Institutional Positioning

Standard Chartered’s thesis suggests XRP could outperform broader crypto markets, potentially overtaking Ethereum in market capitalization (excluding stablecoins) by 2028. This projection is underpinned by a broader bullish outlook that sees Bitcoin reaching $260,000 by 2029. For investors, the combination of aligning technical indicators and this high-profile banking endorsement presents a compelling long-term thesis, though it relies heavily on the sustained adoption of tokenized assets by traditional finance.

Investors should watch quarterly ETF inflow reports and Ripple’s stablecoin volume metrics. These real-world adoption markers will be crucial in validating whether XRP can track Standard Chartered’s $12.50 roadmap through 2028.

Bitcoin Hyper: Next Bitcoin Alternative?

Following analysis of XRP’s price prediction by Standard Chartered, attention has also turned to infrastructure efforts focused on expanding Bitcoin’s functionality within decentralized finance. Bitcoin Hyper (HYPER) is one such initiative, positioning itself as a Solana-based Layer-2 that enables smart contract execution and higher-throughput applications, while settling transactions back to the Bitcoin network.

The project aligns with the broader BTCFi narrative, which explores extending Bitcoin’s utility beyond value transfer without altering its base protocol. At the current rate of $0.013675 per $HYPER, the token offers both pricing clarity and deflationary incentives, two things XRP lacks in its current setup.