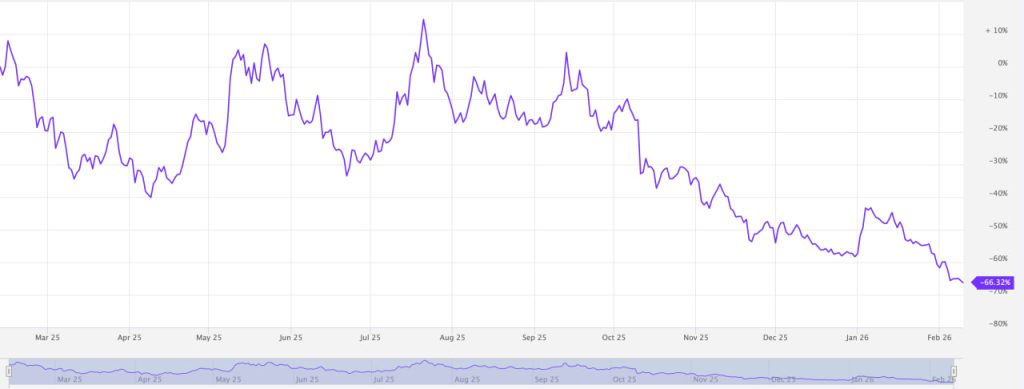

Meme coins price are still getting cooked this week, with DOGE, SHIB, and PEPE all sliding as hype and liquidity dry up fast.

DOGE, the OG meme, is down over 5% in the last 24 hours and looks tired, struggling to keep any bullish momentum alive during the broader market pullback. That price weakness is a clear sign traders are backing off risk and pulling money out of the usual speculative plays.

(Source: Memecoins Market Index / MarketVector)

Overall meme coin market cap is shrinking, volume is thinning, and the aggressive buy pressure from recent months is basically gone.

Right now, traders seem split between rotating into utility alts or quietly hunting for the next low cap meme that has not run yet.

Dogecoin Price Prediction: Where It Could Go Next?

Dogecoin charts are starting to look shaky as price keeps pressing against the lower range. DOGE has slipped below its 50 day EMA, which usually signals the trend is losing strength, not gaining it.

There is a falling wedge showing on the 4 hour chart, which is normally bullish, but volume is weak and not backing up any breakout idea yet. RSI is sitting around 38, close to oversold, but still not flashing a clear bounce signal.

If DOGE fails to reclaim $0.12, things could get uncomfortable fast. Losing that level opens the door for a move toward $0.10, a psychological zone that has acted as strong support in the past.

Shiba Inu is not looking much better either. Price is stuck below local resistance, tightening up, and sellers still have control of the short term trend.

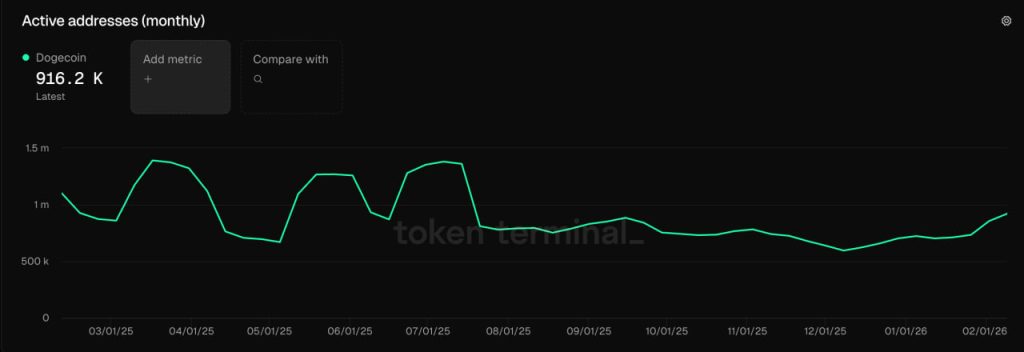

On-Chain Metrics Confirm Weakening Momentum

On chain data is backing up what price is already telling us. Activity across top meme coins has cooled off, with active addresses on DOGE and PEPE trending lower, a sign retail traders are stepping aside instead of buying dips.

(Source: TokenTerminal)

When network activity slows like this, it usually leads to chop or more downside, not an instant bounce. Things just feel quieter across the board.

Whales are sending mixed signals. Large transactions are down, but it does not look like panic selling either. Instead, it feels more like redistribution, with smart money waiting patiently for deeper liquidity zones.

Until those big wallets start accumulating aggressively again, upside for meme coins stays limited and capped.

Market Analysts Weigh In on Memecoins Sector Rotation

The meme coin slide is not happening on its own. The space is straight up overcrowded, with liquidity spread thin across thousands of tokens fighting for the same attention and capital.

As analysis from Tap points out, meme coins grew from simple jokes into a massive market, but hype alone does not hold value for long. Every new meme launch pulls liquidity away, and that slowly drains legacy names like DOGE and SHIB.

Is anyone still buying meme coins anymore?

— NotEzzAI (@NotEzzAI) February 11, 2026

Zooming out, the broader market is not helping either. Bitcoin volatility has traders in a risk off mood, pushing money toward safer setups or undervalued layer 1 plays instead of pure speculation.

Right now, chasing meme coins on the way down feels more like catching falling knives, yet believers chose to believe. Nobody knows what will happen and memecoins always can rally out of nowhere.