While much of the crypto market has struggled with volatility and declining prices, one segment continues to expand at an extraordinary pace - stablecoins.

Key Takeaways

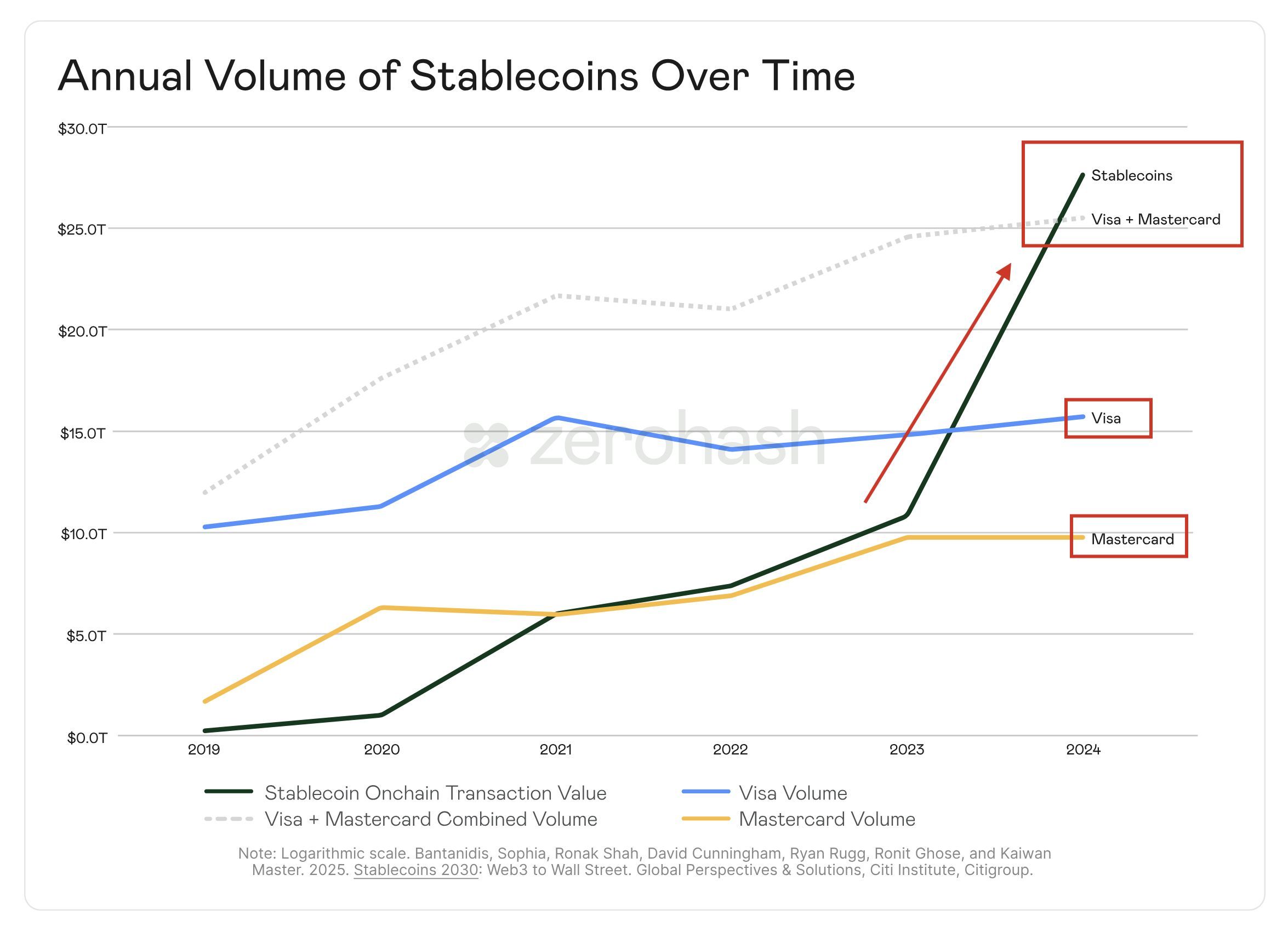

Annual stablecoin transaction volume reached roughly $33 trillion in 2025

Scale now rivals or exceeds Visa and Mastercard combined

Growth continues despite weaker speculative crypto activity

Rising transaction sizes indicate institutional and operational adoption

Tether’s market cap nears Ethereum’s, signaling shifting capital dynamics

New data shows that annual onchain stablecoin transaction volume reached approximately $33 trillion in 2025, placing the sector at or even above the scale of global payment giants like Visa and Mastercard.

The milestone highlights a growing divergence within digital assets. Speculative trading activity in cryptocurrencies such as Bitcoin and Ethereum has cooled, but stablecoin usage continues to accelerate, driven by real-world financial applications rather than market hype.

Stablecoins Reach Payment Network Scale

Transaction data indicates that stablecoins are now operating at a scale comparable to traditional payment rails. The $33 trillion annual figure underscores how deeply integrated dollar-pegged tokens have become in global finance.

Unlike previous cycles dominated by leverage and speculation, this expansion appears to be fueled by practical use cases. Stablecoins are increasingly used for cross-border payments, institutional settlements, treasury management, brokerage funding, and onchain liquidity provisioning.

The steady rise in transaction volumes also comes alongside increasing average transaction sizes. That trend suggests not just retail activity, but growing institutional participation and operational adoption.

Cooling Prices, Expanding Utility

Recent market data shows that Bitcoin is trading near $67,000, Ethereum around $1,950, and broader crypto indices remain under pressure on a weekly basis. Yet stablecoin market capitalization remains elevated, with Tether’s USDT alone holding roughly $184 billion in market value.

Bloomberg Intelligence analyst Mike McGlone recently argued that Tether is on track to surpass Ethereum in market capitalization, pointing to the structural strength of stablecoin demand even as Ether struggles below key technical levels.

Tether on Track to Flippen Ether, Around $1,500 –

The most enduring trend in cryptos is Tether flippening everything. There are only two left: Bitcoin and Ether. Tether is on track to surpass the market cap of the current #2 crypto at about $1,500 — Ether's next key support… pic.twitter.com/pUqOdTfd6z— Mike McGlone (@mikemcglone11) February 11, 2026

The contrast is becoming clearer: while Bitcoin and Ethereum behave as risk-on assets sensitive to macroeconomic shifts, stablecoins are increasingly functioning as digital dollars embedded in global payment flows.

A Structural Shift in Crypto

The rise of stablecoins reflects a broader transformation within the digital asset ecosystem. Crypto is no longer moving independently from traditional markets and is increasingly treated as a high-beta risk asset. However, stablecoins are carving out a separate narrative – one tied to efficiency, settlement speed, and financial infrastructure.

Importantly, stablecoin growth has continued even as speculative activity cooled in 2025. This suggests the foundation of the sector may be strengthening beneath the surface, independent of price momentum in major tokens.

If current trends persist, stablecoins could become one of the most important pillars of digital finance – operating quietly in the background while headlines remain focused on Bitcoin’s volatility and Ethereum’s price swings.