Ethereum is sending a powerful signal beneath the surface. While price action remains under pressure and ETH trades below the $2,000 mark, staking activity is accelerating at a pace rarely seen before.

Key Takeaways

30% of Ethereum’s supply is locked in staking, tightening liquid supply.

4.1M ETH is waiting to be staked, while exits remain minimal.

Yield is modest at 2.83% APR, yet demand keeps rising.

Large wallets are reducing share, smaller holders are accumulating.

One more dip may come before a potential rebound.

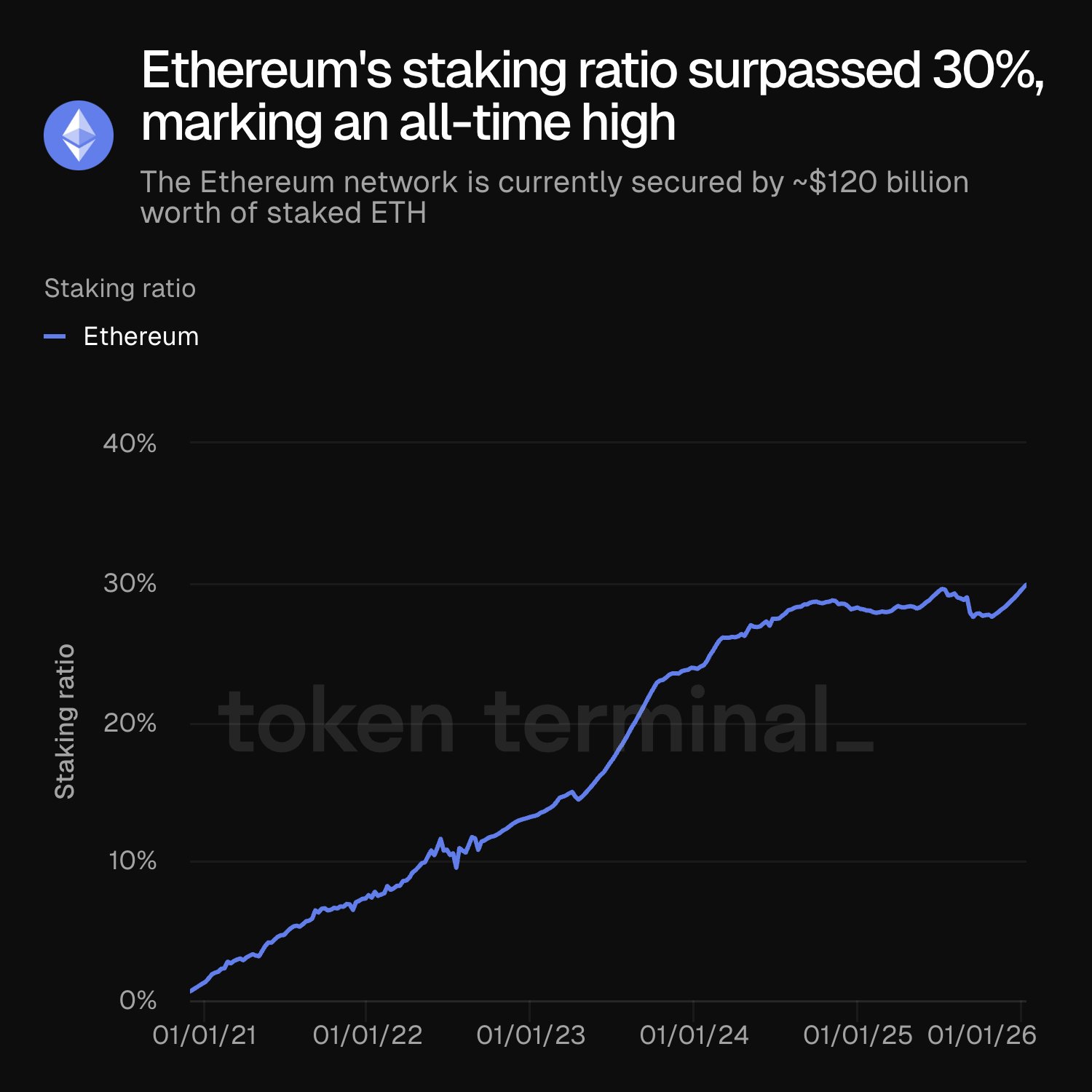

Roughly 30% of Ethereum’s total supply – about 36.8 million ETH worth approximately $72 billion at current prices – is now locked in staking contracts. Nearly one million validators are actively securing the network, reinforcing Ethereum’s transition into a yield-generating, security-focused asset.

This dynamic is creating a significant supply restriction at a time when market sentiment remains cautious.

Queue Explodes as Investors Lock Up ETH

The most striking data point is the staking queue. Around 4.1 million ETH is currently waiting to be staked, highlighting record demand to enter validator positions. Meanwhile, exit activity is minimal by comparison, with just 75,872 ETH queued for withdrawal.

About one-third of staked ETH is now considered illiquid, earning a modest 2.83% APR. By traditional crypto standards, that yield is not particularly attractive. Yet investors continue to lock up capital aggressively.

This behavior stands in contrast to short-term yield farming strategies. Instead, it signals long-term conviction. Locking up tens of billions of dollars during a price downturn suggests participants are positioning for future appreciation rather than chasing quick returns.

On-Chain Shifts: Whales Reduce, Smaller Wallets Accumulate

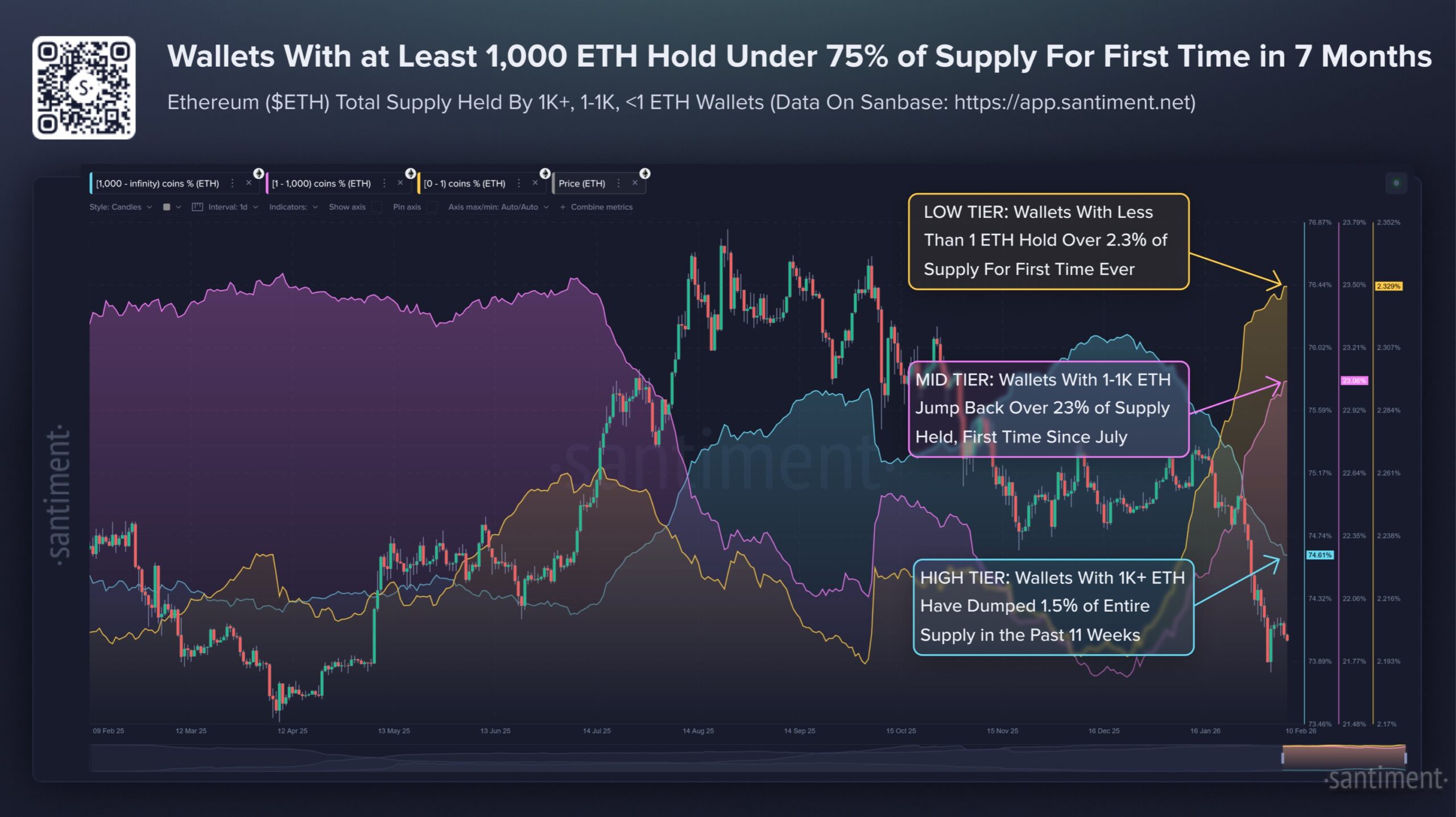

Fresh data from Santiment shows a structural shift in Ethereum’s holder distribution. Wallets holding at least 1,000 ETH now control less than 75% of total supply for the first time in seven months, after shedding roughly 1.5% of supply since Christmas.

s

s

At the same time, smaller wallets – particularly those holding less than 1 ETH – now control their highest percentage of supply ever, at 2.3%.

This rotation hints that larger holders may be reallocating into staking, while smaller participants steadily accumulate. The result is a broader distribution of supply alongside rising validator participation.

Technical Outlook: One More Dip Before a Bounce?

From a technical perspective, analyst Michaël van de Poppe believes Ethereum’s broader structure remains intact. He suggests another move lower toward higher timeframe support could occur before a stronger rebound.

The chart surrounding $ETH hasn't changed.

I think that we'll have another drop downwards, to the higher timeframe support zone.

That should provide enough level of support for a bounce upwards, or even a higher low before we continue to move in the uptrend.

Still expecting… pic.twitter.com/TmbLd7n1Wn

— Michaël van de Poppe (@CryptoMichNL) February 11, 2026

According to his view, that support zone may provide the foundation for a higher low and a renewed uptrend. He still expects this month to mark the bottom for the broader market, followed by a rally lasting two to three months.

If that scenario plays out, Ethereum’s tightening liquid supply could amplify any upside move.

Supply Restriction Meets Macro Sensitivity

Crypto markets are no longer moving in isolation. Ethereum, like Bitcoin, increasingly trades as a high-beta risk asset tied to macroeconomic conditions. Inflation data, labor market trends, and broader liquidity flows remain key drivers.

However, beneath the volatility, Ethereum’s fundamentals appear to be strengthening. With billions of dollars locked, minimal exits, and staking demand at record levels, the network is quietly reducing available supply while expanding validator security.

When investors line up to lock $74 billion during a price dip, it rarely reflects speculation alone. It suggests belief in what comes next.