A US Republican lawmaker has introduced legislation to permanently embed President Donald Trump’s executive order on retirement investments.

This move could expand Americans’ access to crypto-exposed products in 401(k) plans. The bill aims to transform a temporary policy directive into a binding federal law.

Republican House Pushes to Codify Executive Order

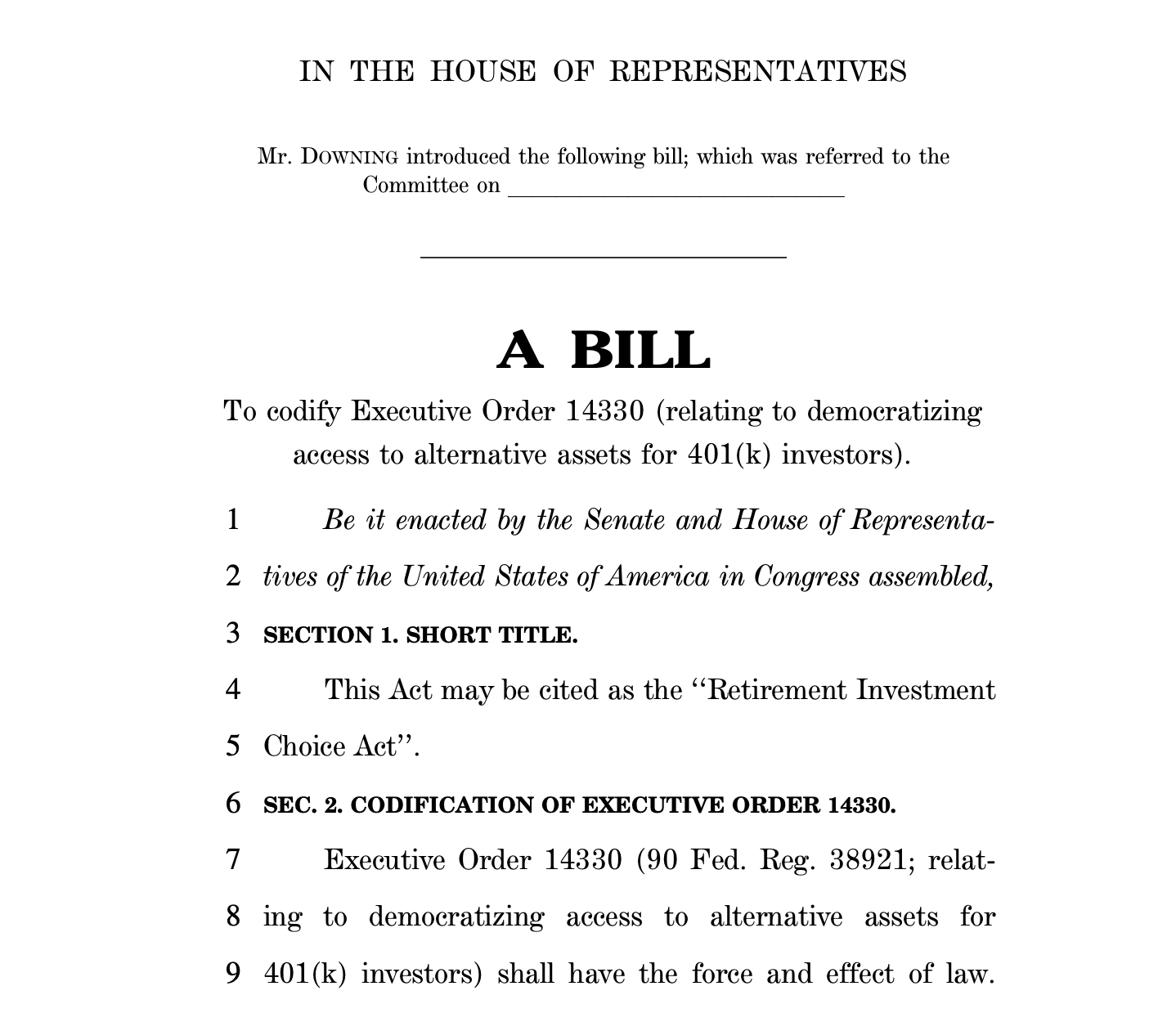

On Tuesday, Representative Troy Downing (R-Mont.) introduced the Retirement Investment Choice Act. The one-page bill grants Executive Order 14330—Trump’s directive allowing crypto in retirement accounts—“the force and effect of law.”

The initiative follows Trump’s August executive order instructing the Labor Department to permit “alternative assets,” including digital assets, when deemed appropriate by plan fiduciaries. The proposal could reshape the $25 trillion US retirement market by opening a new channel for Bitcoin-linked investment vehicles if enacted.

Executive orders can guide policy but lack statutory permanence. Future administrations or courts can reverse them. Downing’s bill aims to fix that gap by legally binding the directive.

“Alternative investments hold the transformative potential to supercharge Americans’ financial security,” Downing said. “I applaud President Trump for his leadership to democratize finance.”

The Retirement Investment Choice Act, introduced in Congress / Source: downing.house.gov

Meanwhile, the Department of Labor has 180 days to propose rule changes enabling plan sponsors to include such assets. However, the ongoing government shutdown could delay progress.

About a month after Trump’s order in September, nine lawmakers urged SEC Chair Paul Atkins to accelerate implementation. They argued that 90 million Americans excluded from alternative assets deserve a stable, dignified retirement.

Industry groups, including the American Retirement Association, back the bill. They say fiduciaries—not regulators—should decide suitable investment options.

New Flows Could Reshape Crypto Markets

If the bill becomes law, 401(k) providers may offer crypto funds in addition to traditional assets. This could become Washington’s most consequential move for digital-asset markets seeking long-term capital. Analysts estimate that even a 1% allocation from US accounts could add tens of billions of dollars to crypto markets.

According to Bitwise, a 1% allocation of US 401(k) assets would channel $122 billion into crypto, while a 3% share could drive nearly $360 billion. Global crypto ETFs confirm the demand: by Oct. 4, 2025, funds saw record inflows of $5.95 billion, with the US making up $5 billion.

Bitcoin and Ethereum ETFs have already been approved, and several altcoin-based ETFs now await SEC review. While the bill’s passage remains uncertain, its arrival shows clear political momentum to normalize crypto within retirement portfolios.